THE BANKERS INVESTMENT TRUST: Banking on growing dividends

>

THE BANKERS INVESTMENT TRUST: £1.3bn fund banking on 57 years of growing dividends

Investment trust The Bankers is designed to represent the best of asset manager Janus Henderson – and from an income perspective it ticks all the boxes.

The 135-year-old publicly traded fund has an annual dividend growth record stretching back 56 years – only one rival investment fund (The City of London) has matched this feat.

And it seems that in all hell or high tide, the board of this £1.3bn trust is determined to extend the record well into the future.

For the record, The City of London is also run by Janus Henderson.

Earlier this month, when announcing the trust’s results for the fiscal year ending November 30, 2022, the board said dividend growth for the coming year would be at least five percent.

Alex Crooke, the manager of the trust, said: ‘Last year the target for dividend growth was 3%, but we achieved 7%. Five percent, which represents an annual dividend of 2.44 pence, is a good starting point for the current financial year. We could be in a position to pay more.’

The fund pays quarterly dividends. Changes to the trust’s portfolio should help boost dividend growth as the fund shifts from a heavy focus on growth stocks (especially U.S. technology companies) to a broader portfolio that includes growth stocks as well as more defensive stocks, such as banks that now pay dividends.

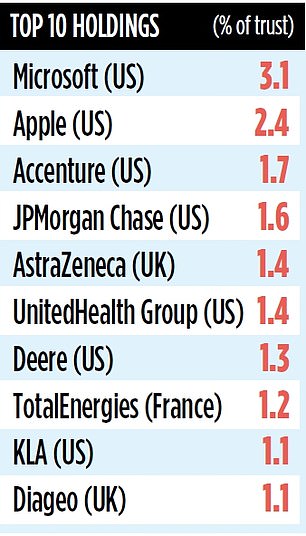

“We are slowly shifting the focus of our exposure to financials,” says Crooke. “Previously it was heavily built around financial companies that specialize in transactional matters, such as Mastercard. Now we like the big US banks like JP Morgan Chase and Co – and in the UK Lloyds is a favourite.

Higher interest means higher interest margins [the difference between savings and mortgage rates] and the potential to increase profits and pay shareholder dividends.”

Although Crooke oversees the trust’s assets, he is more of a conductor than a hands-on manager.

The fund’s portfolio is divided into six geographies and is managed by six Janus Henderson investment teams located around the world.

Crooke’s role is to ensure that the asset allocation is perfect. His broad view is that the trust should have about a third of its assets in the world’s three largest economic regions: Europe (including the UK), North America and Asia.

It means his performance is different from the FTSE World Index he aims to outperform, which is heavily concentrated around North American stocks.

Over the past five years, the trust has underperformed the index – mainly due to its underweight position in the United States – although in its defense it has delivered better overall returns than the average global investment trust (27 percent versus 15 percent).

The total annual cost of the fund is reasonable at 0.48 percent, while some expensive debt (which costs 8 percent per year) will be paid off by the end of the fiscal year. This will eliminate a negative impact on performance while preserving cheaper borrowing.

Crooke says the coming year will have its challenges, with high interest rates and continued inflation weighing on both investment and consumer spending. Profit warnings, he says, will come to the fore. But by the end of the year, the situation will improve as interest rates stabilize. As a result, Crooke thinks there will be opportunities during the year to ‘bottom fish’ – buying good companies at favorable prices.

The stock exchange ID code of the trust is BN4NDR3 and the market ticker is BNKR. The shares are currently trading at just over £1, implying a modest (but growing) annual dividend of 2.2 per cent.