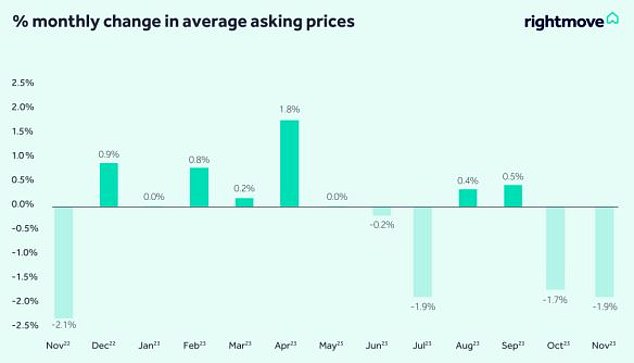

The average asking price of a house has fallen £13,000 since October, says Rightmove

According to Rightmove, asking prices for new homes have fallen by 1.9 percent this month, following a 1.7 percent fall in November.

The fall represents an average fall of £6,996 in the price of newly listed homes in December compared to November and a fall of £13,054 compared to October.

The average asking price for a newly listed house in December is £355,177.

Reality check for sellers: asking prices for newly listed homes have fallen by 1.9 percent this month, according to Rightmove, after a fall of 1.7% in November

According to the property website, asking prices tend to fall at this time of year as serious sellers price more competitively to attract distracted buyers in the run-up to Christmas.

Yet Rightmove says the decline this month is greater than the previous 20-year average of 1.5 percent.

The larger-than-normal decline is partly driven by new sellers trying to lower their prices below the competition as the pendulum has swung toward a buyers' market.

Higher mortgage rates have been a major challenge for movers and starters this year, and affordability remains under pressure.

Tim Bannister, director at Rightmove, said: 'Further price falls outside the usual seasonal trends we would expect at this time of year are a sign that some new sellers are continuing to act on advice from estate agents to price competitively.

'We entered this year under a cloud of uncertainty as the effects of the mini-autumn budget trickled down to lower activity levels.

“High mortgage rates, which have contributed to already limited affordability for buyers, have been a challenge in 2023 and are likely to continue next year.”

There are other signs that homeowners are struggling to find buyers at current prices.

The average time it takes a seller to find a buyer has increased by three weeks, according to Rightmove, from 45 days this time last year to 66 days now.

It also says price cuts have also become more widespread this year, with 39 percent of properties now seeing their price reduced during marketing, compared to 29 percent last year.

Last month, the other major property portal, Zoopla, revealed that one in four sales are agreed at 10 per cent or more below asking price.

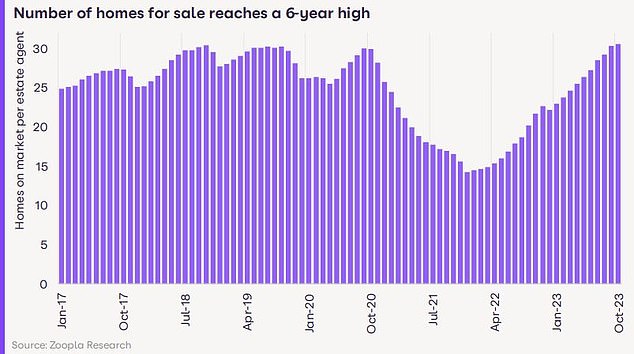

Zoopla also said the number of homes for sale has reached a six-year high, with 34 percent more homes for sale than a year ago.

This increased supply increases choice for buyers, but is likely to keep prices under downward pressure as price-sensitive buyers continue to negotiate.

Market stand-off: The average time it takes a seller to find a buyer has risen by three weeks, from 45 days this time last year to 66 days now, according to Rightmove

Supply surplus: The number of homes for sale has reached a six-year high, with 34% more homes for sale compared to a year ago, according to Zoopla

Are sellers setting overly optimistic asking prices?

While asking prices may have fallen sharply over the past two months, average asking prices for the year are only 1.1 percent lower than a year ago.

In seven of the eleven regions, prices are marginally higher than a year ago. The North West of England is leading the way, with an increase of 1.5 percent compared to last year.

Rightmove says sellers still need to price more aggressively than their local competition to land a buyer, especially those with an urgent need to sell.

Mortgage interest rates are likely to remain high next year, putting pressure on affordability for buyers.

This pressure on affordability is reflected in lower transaction levels.

According to Rightmove, year-to-date sales agreed in 2023 are 13 percent lower than the same period in 2022.

Consecutive falls: New listed homes fell by an average of £6,996 in December compared to November and are £13,054 lower than in October

Tomer Aboody, director of property provider MT Finance, said: 'Market activity was at a lower level than last year, with a lower number of property transactions as interest rates continued to rise and buyers found it difficult to budget.

“As many buyers sit idle and wait for the right opportunities, sellers eager to sell have had to lower their prices in many cases.”

Rightmove predicts that national average asking prices will fall by an average of 1 percent by 2024.

Tim Bannister says: 'Our research and feedback from agents is that the best strategy for selling in today's market is to price enticingly at the start of marketing, rather than testing it out with a higher price .

'This will hopefully avoid the need to lower your asking price later, and pique the interest of that early bird buyer for the new year, while also avoiding the stress of delaying the sales process and risking the for sale sign is still open at Easter. .'

Mortgage interest rates are falling

Mortgage rates have fallen in recent months, with the best available rates now almost 1 percentage point lower than the Bank of England's base rate of 5.25 percent.

Last week, Nationwide Building Society caused further ripples in the mortgage market after announcing its eleventh consecutive round of rate cuts in four months. The cheapest deal on the market is now 4.29 percent.

According to Rightmove's own analysis, the average mortgage rate has now fallen for 19 weeks in a row. The average five-year fixed mortgage rate is now 5.11 percent, up from 6.11 percent in July.

With mortgage rates no longer skyrocketing and many analysts predicting rates will fall next year, Rightmove says this could mean that homebuyers and movers who have been putting off this year may be more tempted to take action next year.

The company says it is seeing early signs of increased activity in the family mover market, with demand in the mid-market sector (three- and four-bed homes) up 9 percent compared to today's post-mini-Budget period . last year.

Although new listed asking prices may have fallen sharply in the past two months, average asking prices at the end of the year are only 1.1 percent lower than a year ago

“There appears to be more peace and certainty heading into 2024,” adds Rightmove's Tim Bannister.

'The annual decline in asking prices of 1.1 percent underlines the much better-than-predicted resilience of the market this year.

“With mortgage rates more stable and on a slow downward trend, potential movers who have been biding their time and waiting for calmer market conditions may decide to act early next year.

'Indeed, there is always a big upturn in Rightmove traffic after Christmas, with early bird buyers starting their search on Boxing Day.

'This year's revival is being eagerly anticipated by those keen to sell, especially by family movers who are considering having an estate agent sign put up when the Christmas tree falls.'

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.