Tesla shares: Is it a good time to buy?

>

Tesla became one of the most popular stocks among everyday investors after the pandemic wave of home trading, but its fortunes have recently taken a drastic turn.

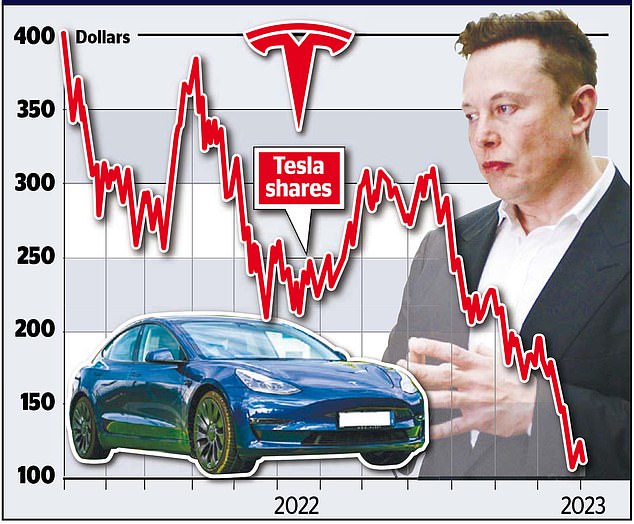

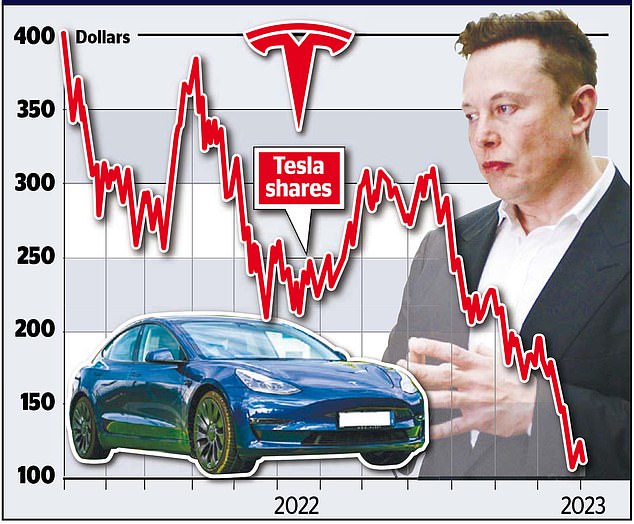

Shares are in freefall and losses have only widened since Elon Musk’s takeover of Twitter, while the electric vehicle giant is also grappling with declining demand and ongoing supply chain issues.

Tesla shares are now threatening to drop below $100 for the first time since mid-2020, after falling nearly 70 percent since the beginning of last year.

It has prompted the most fervent cheerleaders to insist that Tesla is undervalued, while others suggest that Tesla could fall even further this year.

So is this now an opportunity to buy Tesla cheap, or could the stock fall even further?

Life on the slow track: Musk

Why have the shares fallen so much?

After soaring during the pandemic to a peak of $400 in November 2021, Tesla is now entering more than $100. It’s a spectacular fall from grace for what was once the darling of the electric vehicle world.

A surge in DIY investors during the pandemic helped propel Tesla to dizzying heights, and its inclusion in the S&P 500 in late 2020 helped sustain the rally.

Since then, several issues have weighed on Tesla, and Musk himself, with the Christmas sale amid concerns about declining demand for electric cars.

Investors are also concerned that Musk has been distracted by the Twitter acquisition.

The deal has become a sad story for Musk. He tried to go back on his original offer before being forced by the SEC to honor it, eventually selling Tesla stock to fund the purchase and free up liquidity.

Since the deal went through, he’s spent his time recovering banned accounts, playing with subscriptions, battling advertisers, and forcing employees to return to the office full-time.

As he did so, Tesla investors became increasingly unnerved by Twitter’s distractions as the electric vehicle maker’s troubles mount.

Tesla is dealing with the impact of a broader sell-off in the technology sector amid a looming recession, high inflation and rising interest rates. Supply chains have also experienced significant disruption due to the ongoing pandemic in China.

Musk himself last month warned of “stormy weather ahead” as interest rates weighed on demand for electric vehicles.

Quarterly deliveries released this week missed market estimates, which Tesla blamed on ongoing logistical problems and growing demand concerns.

The company delivered 405,278 vehicles in the fourth quarter, down from estimates of 431,117, according to Refinitiv.

By 2022, shipments were up 40 percent, falling short of Musk’s annual target of 50 percent.

However, Tesla is not the only car group struggling with declining demand. Volkswagen is down 33 percent over the same period, while Ford and General Motors are down 50 and 44 percent respectively.

Wedbush analyst Daniel Ives said all this had resulted in a “perfect storm.”

He added: “This is a split in the year ahead for Tesla, which will either lay the groundwork for its next chapter of growth or continue its descent from the top of the perch with Musk leading the way down. ‘

Is Tesla overvalued?

The leadership of Tesla and Musk has become polarizing. Even after taking a hit in 2022, everyday investors still flocked to the electric vehicle maker and Tesla remained the top holding company across multiple retail trading platforms.

Fans of the company insist Tesla will recover this year. They believe that Tesla remains the standout electric vehicle producer and claim that the production line has matured.

Famed tech-focused investor Cathie Wood has doubled her investment in Tesla, even as the shares are in free fall.

ETFs backed by Wood’s Ark Investment Management have bought just over 445,000 Tesla shares since Oct. 3, according to data compiled by Bloomberg.

Even with stocks struggling, Bestinvest CEO Jason Hollands cautioned that the stock isn’t necessarily “cheap.”

Tesla’s stock price has been hammered since the start of last year as demand slows down

He said: “Fans should avoid becoming entrenched in their thinking when the market environment has clearly and fundamentally changed since 2021.

“Last year it was perhaps the most overvalued major company in history, given its actual profitability and the lack of a dividend. By most stock valuation measures, it can now hardly be described as a bargain, despite the decline in the share price and the company’s fundamentals also face challenges.”

Stephen Yiu, chief manager of the LF Blue Whale Growth Fund, has long warned that Tesla had the potential to become a bubble ready to burst.

He said: “While Tesla is undoubtedly an interesting company, with an even more interesting figure at the helm, the price increase in 2020 and 2021 has been pure exuberance.

Most of the investors who bought the stock supported Elon Musk as the next Steve Jobs, rather than Tesla’s fundamentals. It was pure speculation – which paid off until it didn’t!

“The important question we need to ask at Tesla is, ‘Will we see the share price return to 2021 levels?’

“Now if the stock price more closely reflected its fundamental value, I’d say we wouldn’t — in fact, we’re likely to see further declines.”

While Musk may be making headlines, declining demand should worry investors.

AllianceBernstein analyst Toni Sacconaghi said, “We believe Tesla is facing a significant demand problem…many investors are underestimating the magnitude of the demand challenges facing Tesla.”

Tesla benefited from the DIY investment boom during the pandemic, reaching a high of $400 in 2021 before falling rapidly in 2022

The risk of a recession will further weigh on the company as consumers postpone non-urgent purchases and ongoing supply chain issues will further squeeze margins.

Ives said Tesla’s 2022 delivery numbers were “nothing to write home about” and raised questions about how the company would perform amid a “very cloudy” economic outlook.

Analysts from Mizuho Securities have also said they see “potential weakness in Tesla sales as macroeconomic headwinds and weaker consumer could reduce demand for more expensive EVs.”

But the company pointed to Tesla’s new factories as a benefit and tax credits for electric vehicles in the US that could help bolster declining demand.

Others are much more optimistic about Tesla’s 2023 outlook.

Long-term Tesla bull Ives said, “We don’t believe now is the time to give up on the stock and see it as a way to oversell on fear of the unknown.”

Wedbush, which maintained its outperform rating and price target of $175, added: “Musk determines the fate of Tesla, this is a moment of truth for Musk to navigate damage control now… or the relentless pain will persist.’

Investors may also be relieved to learn that Tesla number two Tom Zhu has taken charge of the group’s U.S. assembly plants, as well as sales operations in North America and Europe, Reuters said.

This could allay some of the concerns shared by investors who think Musk has his fingers in too many pies.

What should investors do?

The coming year looks set to be a tough one for Tesla. A slowing global economic situation coupled with higher interest rates will not dampen investors’ nerves.

“A world of higher yields is a headwind for growth stocks like Tesla, which do not pay dividends and whose valuations are heavily driven by estimates of future cash flows discounted to today’s money,” said Bestinvest’s Hollands.

Analysts disagree on the outlook for Tesla this year with two different camps.

This is a stock that tends to elicit strong opinions from one group of loyal bullish followers against another group with a diametrically opposed bearish view. Wall Street analysts are mixed on the stock with 14 buy recommendations versus 13 hold and 4 sell,” said Victoria Scholar, chief investment officer at interactive investor.

“But there have been a number of downward revisions to the stock’s price target recently by the analyst community, including from JP Morgan, Deutsche Bank and RBC, suggesting it could be a bumpy road.”

Fund managers are also divided. Tesla remains in the top 10 of 23 active UK-domiciled equity funds, including Scottish Mortgage and JPMorgan American Investment Trust.

Of these, six have reduced their exposure to the company, including T Rowe Price Global Technology and BNY Mellon US Opportunities Fund, according to Morningstar Direct.

The pain for Tesla is likely to last well into 2023.

Whether Musk, who is also facing a lawsuit over claims he received funding to go private this year, can turn it around remains to be seen.

Hollands added: “Tesla is clearly an innovative company, with well-designed products, but in addition to short-term headwinds, traditional automakers, with higher profitability and more attractive valuations, are busy developing their range of electric vehicles. vehicles against pace, so I would remain cautious about buying the stock at this time.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and use it for free. We do not write articles to promote products. We do not allow any commercial relationship to compromise our editorial independence.