Tesla shares fall after Elon Musk’s company made less money than expected at the end of last year – after fierce price war with Chinese rival BYD, which now sells more EVs

Tesla stock prices fell more than 3 percent in after-hours trading as the EV maker’s revenue and profits exceeded expectations.

Price cuts for electric vehicles and slowing sales growth hit profits.

This week it emerged that the value of a used Tesla fell by more than €1,000 on average in the first half of January.

According to data from the used car platform, between January 1 and 18, the average list price of a Tesla fell from $36,410 to $35,370. AutoGurus.

This morning there are plans for a new mass market electric vehicle codenamed ‘Redwood’ in mid-2025, which would start at $25,000, making it the cheapest electric car available.

Tesla sold fewer cars than BYD in the last three months of 2023. But 484,000 cars were still sold, helped by car exchange discounts

Tesla reportedly plans to build a $27,000 electric car as a host of automakers struggle to boost the adoption of eco-friendly vehicles. Pictured: CEO Elon Musk at a conference in Paris, France, in June 2023

Tesla’s net income more than doubled last quarter, but that was thanks to a one-time tax benefit.

The Austin, Texas-based maker of vehicles, solar panels and batteries said its net income for October through December was $7.93 billion, up from $3.69 billion a year earlier.

But excluding one-time items such as the $5.9 billion non-cash tax benefit for deferred tax assets, the company earned $2.49 billion, or 71 cents per share.

That was 39 percent lower than a year ago and lower than analyst estimates. Data provider FactSet said analysts expected earnings of 73 cents per share.

Tesla reported quarterly revenue of $25.17 billion, up 3 percent from a year earlier, but also below analyst estimates of $25.64 billion.

Shares of Tesla fell 3 percent in trading after markets closed on Wednesday.

Earlier this month Tesla has reported this those fourth-quarter sales rose nearly 20 percent, boosted by steep price cuts in the U.S. and globally during the year.

Some cuts amounted to $20,000 on more expensive models.

Tesla’s new reportedly $25,000 car is expected to have a weekly output of 10,000 compact crossovers when production begins in June 2025, according to a new report.

The billionaire promised in 2020 that customers would get a cheaper electric vehicle – and ‘Redwood’ could be part of that plan.

The move could be Musk’s strategy to attract more buyers, as Tesla’s cheapest model – the Model 3 – at $43,900, saw a 15 percent drop in sales last year compared to 2022.

Tesla may have plans for a new mass-market electric vehicle by mid-2025, codenamed “Redwood,” which would start at $25,000, making it the cheapest electric car available. The Model 3 (pictured) is Tesla’s cheapest vehicle at $43,900

Tesla has a reputation for not meeting its launch and pricing targets, and it would take time to build volume as suggested in the supplier notes. Production of Cybertruck (photo) has been delayed and is slowly getting underway

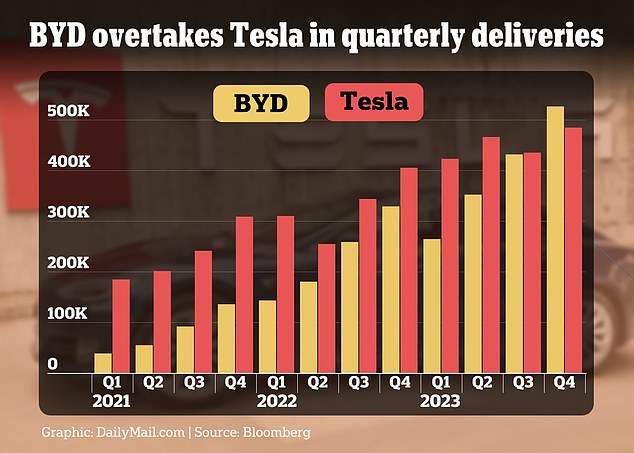

Chinese car manufacturer BYD sold more electric cars than Tesla in the last three months of 2023. Tesla continued to sell more during the year

Fast-growing Chinese powerhouse BYD overtook Tesla as the world’s best-selling electric vehicle company in the fourth quarter.

In its letter to shareholders, released after Wednesday’s closing bell, Tesla warned that sales growth this year could be “significantly lower” than 2023’s growth rate as it works to launch a next-generation car in a factory near Austin, Texas.

The company, the letter said, is between two major waves of growth, one from the global expansion of the Models 3 and Y, and a second coming from next-generation vehicles.

said Tesla Cybertruck deliveries will increase this year. This year too, sales growth from energy storage should surpass the automotive sector, the company said.