Tesla reports its worst earnings since 2012 – but promise of cheap EVs sees share price jump almost 10 percent

Tesla reported first-quarter profit that was even lower than expected, but its commitment to developing affordable cars boosted its stock price by almost 10 percent after markets closed.

First-quarter revenue was $21.3 billion, lower than Wall Street estimates of $22.3 billion, and down 9 percent from the $23.3 billion the company earned in the same quarter last year, the company reported Tuesday afternoon .

It was the sharpest annual decline since 2012.

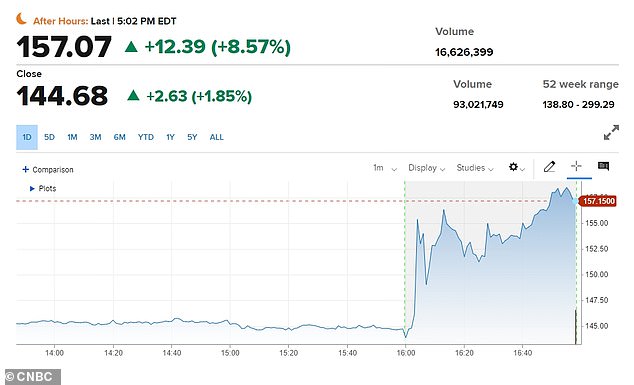

Nevertheless, Tesla’s stock price rose more than 9 percent to about $158 an hour after the results were released. The closing price was about $145.

In other good news, the company produced 1,000 Cybertrucks in one week in April, a sign that it can ramp up production to meet demand.

Tesla reported a profit for the first quarter that was even lower than expected. Pictured is the new Cybertruck in January

In after-hours trading, Tesla’s share price rose nearly 10 percent after the company made guarantees of affordable cars in the near future

It also said it would promote production of more affordable cars, which is crucial if the company wants to capture a lucrative slice of the mass market.

“We have updated our future vehicle range to accelerate the launch of new models ahead of our previously communicated start of production in the second half of 2025,” the report said.

“These new vehicles, including more affordable models, will utilize aspects of the next-generation platform as well as aspects of our current platforms, and will be able to be produced on the same production lines as our current vehicle lineup.”

Musk also shared on X that he sees automated self-driving taxis, or robotaxis, as a crucial market for Tesla. Earlier this month, it announced an August 8 unveiling.

The EV maker’s stock price was down about 40 percent this year, making it one of the worst performers in the S&P 500.

Adding to investor concerns, the company had reportedly canceled its project to build the ‘Model 2’. The car was rumored to cost around $25,000 and to many analysts was an essential product for Tesla to crack the mass market.

Earlier this month, the company also reported delivery figures for the quarter, which fell well short of expectations and suggested sales would not be strong.

In the first three months of the year, 386,810 vehicles were delivered, down 20 percent from the previous quarter and almost 9 percent from the same period in 2023.

Wedbush analyst Dan Ives described it as “a train wreck against a brick wall for Musk.”

A source of additional headaches for Tesla this quarter comes from Chinese competition. During the development of the Cybertruck, companies such as BYD, Li Auto and Nio focused on affordable electric vehicles for the mass market.

They now produce cars for as little as $10,000 – about a third of the price of the cheapest electric car available in the US.

An hour after the results were released, Tesla’s stock price rose more than 9 percent to about $158

Chinese EV maker BYD recently released the Seagull, which costs $9,700 in China. Tesla recently scrapped its plans to make a cheap ‘Model 2’ car for the mass market

In an effort to compete, Tesla began cutting the price of its cars around the world this weekend.

Tesla cut the starting price of the Model 3 in China by 14,000 yuan, or $1,900, to 231,900 yuan, or $32,000, its official website showed Sunday.

In Germany, the price of the Model 3 with rear-wheel drive was reduced by 2,000 euros to 40,990 euros, or about $43,600. There were also price cuts in many other countries in Europe, the Middle East and Africa, a Tesla spokesman told Reuters.

The Cybertruck is also causing concern among investors. The unconventional vehicle has little in common with typical cars and features many costly gimmicks, such as the stainless steel body panels.

Last week, the automaker recalled nearly 4,000 Cybertrucks to fix an issue with the accelerator pedal that could prevent the EV from accelerating to top speed.