Terry Smith: Tech must stop behaving as if money is free

>

Manager of the £23 billion Equity fund Fundsmith Terry Smith has urged his tech companies to stop “behaving like money is free” by 2023 as the global economy weakens.

Fundsmith’s CEO said in his annual investor letter on Tuesday that the tech sector is facing “fundamental headwinds” amid rising interest rates and slowing revenue growth, and should abandon “less promising” projects outside of their core business.

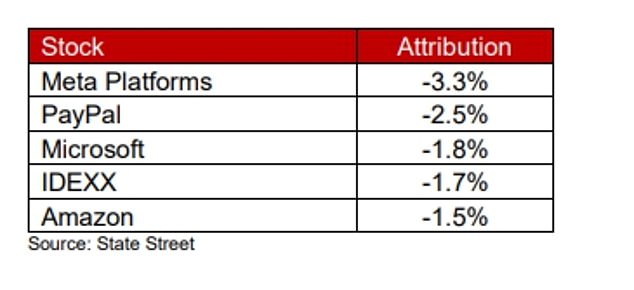

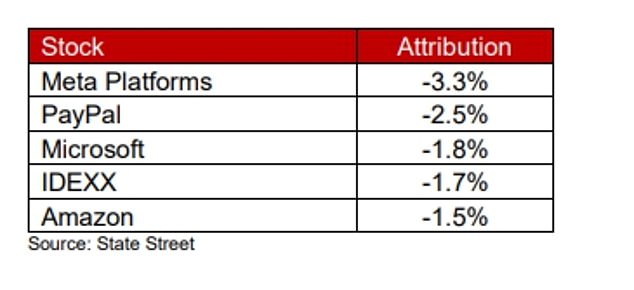

Like many major fund managers, Smith endured a torrid 2022 in which portfolio holdings such as Meta, Amazon and Microsoft contributed to his strategy underperforming relative to the broader market.

He highlighted Meta – the tech star formerly known as Facebook – and its expensive foray into the metaverse, along with Google parent Alphabet’s big bets on new ventures, but said it was clear that some of these big money lenders were the kept things in check.

Fundsmith CEO Terry Smith blames a bad 2022 on the end of the ‘easy money’ environment of the post-2008 era

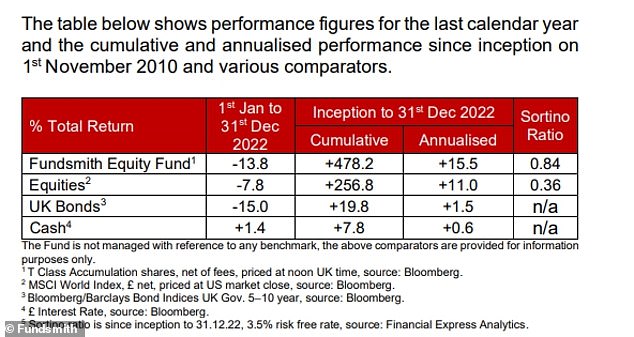

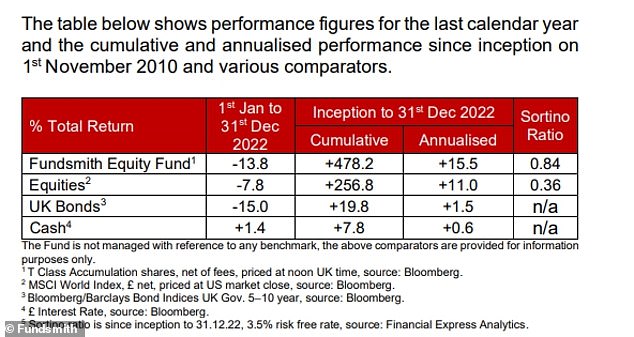

Fundsmith Equity fell 13.8% in 2022, but long-term returns are strong

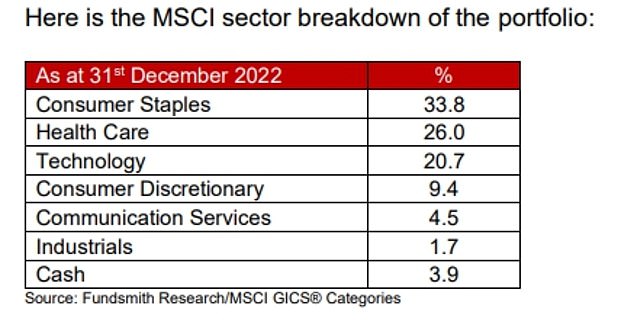

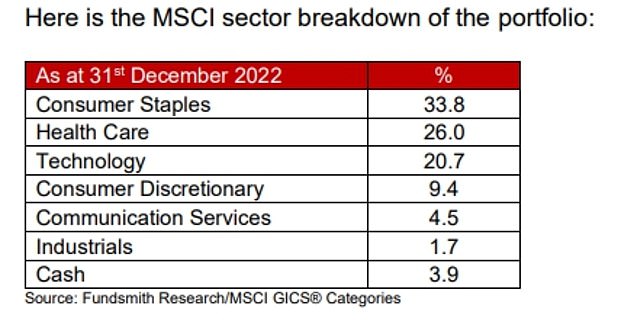

Fundsmith Equity, which invests 20.7 percent of its portfolio in stocks classified as technology, lost 13.8 percent in 2022 compared to a 7.8 percent drop for the MSCI World index.

This was a rare period of underperformance for the fund that has delivered investors a cumulative return of 478 percent since its launch in 2010, an average of 15.5 percent annually.

Smith, who added Apple to Fundsmith’s portfolio in November, told investors, “In addition to lower valuations due to higher interest rates, technology stocks are facing some fundamental headwinds.

“A slowdown in technology spending growth is not surprising after the massive growth driven by digitization during the pandemic.

“In addition, the cyclicality of technology spending and online advertising is likely to become apparent as the economy slows and perhaps enters a recession.”

With interest rates yet to spike and the economy set to weaken further, 2023 will be another tough year for the technology industry, which typically thrives in times of strong growth and low interest rates.

Fundsmith’s worst performers in 2022 were led by Meta, formerly known as Facebook

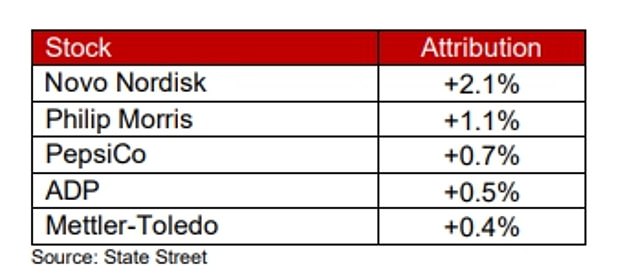

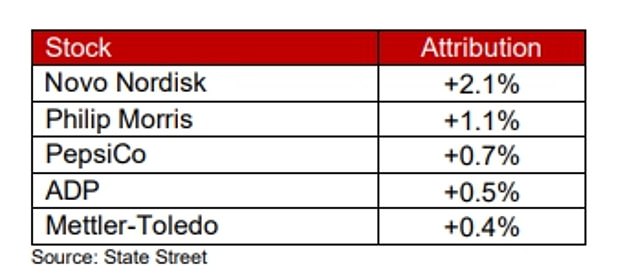

Fundsmith’s top performers in 2022 were led by Novo Nordisk and Philip Morris

Smith is estimated to have pocketed some £190 million last year from his wider investing activities.

He said, “There may be a silver lining to this cloud (no pun intended) though, as this revenue growth pressure may cause some of the tech companies we invest in to stop behaving like money is free and some of the less promising projects outside their core business.’

He highlighted Google owner Alphabet’s “hugely losing other bets” and warned the search engine and advertising-focused group that “the light doesn’t strike twice.”

Smith added, “Amazon…has already withdrawn from supplying food and technical education in India (who knew?). It has a very successful e-commerce and cloud computing business to focus on.

‘Meta [is] quit or cut back on the metaverse. Without those expenses, we would own a leading communications and digital advertising company on a single-digit price-to-earnings basis.”

More broadly, Smith acknowledged his fund’s poor performance in 2022, which he says “gives credibility to those who suffer from triskaidekaphobia” — the fear of the number 13.

But, he added, “unless you limit your equity investments to the energy sector, you would almost certainly have experienced a drop in value.”

Smith blames a bad 2022 on the end of the “easy money” environment of the post-2008 era “of large budget deficits, where government spending significantly exceeds revenues, and low interest rates.”

He said: “Attempting to suppress volatility will only exacerbate it in the long run. If you count current events, we’ve now had three economic and financial crises this century and it’s still in the first quarter.

This latest round of easy money after the pandemic led to all the usual bad investments people make when they assume money is endlessly available and costs nothing to borrow or raise.

“We are seeing the winding down of these ill-advised investments, for example in the collapse of FTX, the cryptocurrency ‘exchange’ (sic) and the collapse of the share prices of those technology companies with no profit, cash flow or even revenue.

Inevitably, when interest rates rise, as they do now to fight inflation, longer-term bonds fall more than short-term bonds. in the future — suffer 5 more from the recession than low-rated or so-called value stocks.

This effect is reflected in the five factors that will negatively impact the fund’s performance in 2022:

Breakdown of Fundsmith Equity’s portfolio by sector

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and use it for free. We do not write articles to promote products. We do not allow any commercial relationship to compromise our editorial independence.