Sydney, Melbourne, Brisbane, Perth house prices: Real reason why they are soaring

House prices in Australian cities are rising by double digits in less than a year, despite a dozen interest rate hikes.

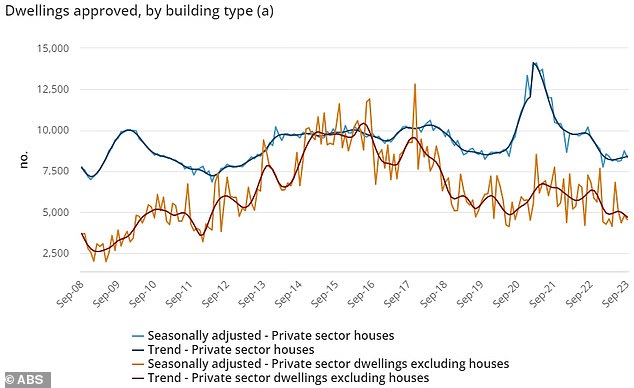

This comes as record high immigration coincides with a 40 percent drop in building permits in just over two years, while construction companies collapse.

Sydney, the recipient of much of the overseas migration, saw its average house price rise 10 percent to $1.397 million in the year to October.

The CoreLogic data also showed a 12.1 percent increase since January, highlighting how the market bottomed out early this year and has since turbocharged, rising for nine months in a row.

House prices in Australian cities are rising by double digits in less than a year, despite a dozen rate hikes (pictured is an auction in Sydney)

Brisbane has seen its average house price rise 10.3 per cent since the start of 2023 to $860,465, putting it further out of the reach of those on average incomes.

Perth, Australia’s most affordable state capital market, saw the average house price rise 11.1 per cent since January to $660,069.

Melbourne, another major recipient of foreign immigration, has seen a more moderate increase of 4.1 percent since January, bringing the average house price to $937,736.

But double-digit house price increases since early 2023 in Sydney, Brisbane and Perth have occurred despite the Reserve Bank of Australia raising interest rates 12 times since May 2022.

Another rate hike is expected on Melbourne Cup Day next week, which would take the cash rate to a 12-year high of 4.35 percent, with September’s 5.4 percent inflation rate still well above the RBA’s target from 2 to 3 percent.

Real estate values are rising despite the sharp increase in monthly mortgage payments over the past eighteen months.

AMP chief economist Shane Oliver said house prices were rising because the supply of new homes could not keep pace with rapid population growth.

“Australia house prices rose again in October, thanks to the supply shortage caused by record immigration,” he said.

‘The recovery in prices reflects a much worse than expected shortage of supply relative to underlying housing demand, as immigration recovered to drive the fastest population growth since the 1950s, while the supply of new homes fell.

“This accentuated already tight rental markets, driving up rents and encouraging tenants to buy.”

In the year to August, 413,530 permanent and long-term migrants arrived in Australia.

These net inflows, including skilled migrants and international students, appear to exceed the Treasury’s forecast of 315,000 for 2023-2024 made in the May budget.

Only 168,231 private homes were built during the last financial year, of which 27,213 were completed by June 2023, down 11 percent from 30,685 in March 2022.

At an average of 2.5 people per home in Australia, the 420,578 people they would theoretically house were well below the annual population growth of 563,200 in March, which included both net overseas migration and births minus deaths.

The housing shortage is expected to continue, with 8,338 new homes approved in September, a sharp drop of 39 percent from 13,717 in May 2021, when Australia was still closed to foreigners.

The slowdown in the number of new homes, both under construction and completion, is also happening because higher construction costs are pushing the construction company out of business.

CoreLogic research director Tim Lawless said while prices in Sydney reflected the surge in overseas migration, house prices in smaller capital cities rose due to interstate migration.

In the year to August, 413,530 permanent and long-term migrants arrived in Australia. This influx, including skilled migrants and international students, looks set to exceed the Treasury’s 2023-2024 forecast of 315,000 made in the May budget (pictured is Sydney’s Wynyard train station)

Rapid population growth has also coincided with a decline in new home completions and building permits (pictured are houses under construction in Oran Park in Sydney’s far south west)

The housing shortage is expected to continue, with 8,338 new homes approved in September, a sharp drop of 39 percent from 13,717 in May 2021, when Australia was still closed to foreigners.

“In addition, Perth and Brisbane have the benefit of positive interstate migration which is likely to support purchasing demand more directly than overseas migration,” he said.

Sydney residents are moving to smaller capital cities and regional areas to escape the traffic jams caused by rapid population growth.

The Regional Australia Institute revealed that in the year to September, 80 percent of Australians who left a major city for a regional area were from Sydney. The data is based on Commonwealth Bank customer accounts.

The group’s chief executive Liz Ritchie said this showed people were moving for lifestyle reasons.

“It suggests that the bigger our cities become, the stronger the pull on our beautiful regions becomes,” she said.