Supreme Court denies Biden’s latest ploy to cancel MORE student loan debt

The Biden administration was dealt another major blow by the Supreme Court, which rejected the high court’s request to reinstate a landmark student loan forgiveness plan.

The Supreme Court has refused to allow Biden’s $160 billion Savings on a Valuable Education (SAVE) plan to proceed.

It comes after two federal judges last month sided with several Republican-led states and prevented Biden from moving forward with debt forgiveness.

The plan, announced in June 2023, was intended to lower monthly payments and accelerate loan forgiveness for millions of Americans by tying monthly payments to borrowers’ income and family size.

The government has already forgiven more than $168 billion in debt for some 4.8 million borrowers.

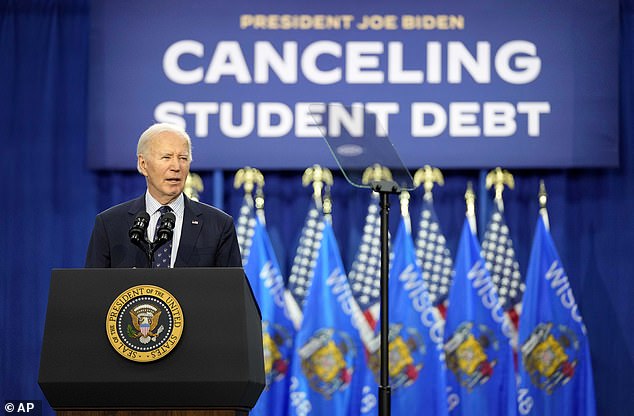

President Biden speaks about efforts to cancel student debt during an event in Madison, Wisconsin on April 8

Additionally, it was reported that more than eight million people have already used the SAVE measure to reduce more than half of their payments to $0.

Last year, the Supreme Court rejected the Democratic president’s first attempt to forgive the loan.

Since then, the Biden administration has pushed new loan forgiveness plans, including SAVE, which they say circumvent court rules.

In late July, the Biden administration announced that it would take the next steps this fall to forgive the student loans of tens of millions of borrowers.

The Department of Education has begun emailing borrowers who have at least one federal student loan with an update on the potential student loan forgiveness available to them under rule changes set to be finalized this fall.

It’s the latest step in a sweeping effort by President Biden to cancel billions of dollars in student loan debt.

If the rules become final, the total number of borrowers eligible for student loan forgiveness will rise to more than 30 million, including those whose debt has already been forgiven since Biden took office.

The Education Department estimated the changes would cost $150 billion, but an estimate from the Committee for a Responsible Federal Budget ranged from $250 billion to $750 billion.

Critics say the administration is unfairly burdening taxpayers with a massive debt transfer, and some Republicans even accuse the president of trying to buy votes before the November election.

Once the rules are finalized, the Department of Education will provide additional information to borrowers. However, this week’s emails state that borrowers have until Aug. 30 to opt out if they do not want the upcoming waiver.

“Today, my administration took another important step to cancel the student debt of approximately 30 million Americans,” Biden said in a statement.

“By providing borrowers with more information about how they can take advantage of our upcoming debt relief programs, borrowers will be better prepared to take advantage of them quickly once the rules are finalized,” he continued.

“Despite attempts by elected Republican representatives to block our efforts, we will not stop fighting to help student loan borrowers, fix the broken student loan system, and help borrowers escape the burden of student debt.”

In April, the Biden administration announced a series of rules giving the Secretary of Education the ability to forgive student debt for tens of millions of borrowers.

It was part of the administration’s continued efforts to use the lengthy regulatory process after the Supreme Court in June 2023 blocked their original $400 billion plan to forgive the debts of some 40 million borrowers.

Protesters outside the U.S. Supreme Court on June 30, 2023. In a 6-3 ruling, the court overturned President Biden’s original plan to forgive up to $20,000 in student debt for millions of borrowers

If the rules become final, they will affect multiple groups of borrowers, including those who now owe more on their loans than when they started paying them back because of extra interest that is piling up. The government estimated that the change would affect nearly 23 million borrowers.

The rules also target borrowers who have been paying for decades. Those who have been paying on undergraduate loans for more than 20 years qualify, as do those with graduate loans that have been paying for at least 25 years.

Different rules apply to borrowers who qualify for loan forgiveness under other plans but have not yet applied, such as the Income Driven Repayment (IDP) plan, and to borrowers who were enrolled in programs deemed of low financial value because they did not meet Department of Education standards.

Borrowers who want to opt out of student loan forgiveness under the rules being finalized should contact their student loan provider. The Department of Education said those borrowers will not be able to reapply.

Biden announced efforts through the regulatory process on August 8, 2024, to cancel the student debt of more than 30 million borrowers

The Biden administration’s latest moves this week come after an appeals court earlier this month blocked implementation of the administration’s separate Savings a Valuable Education (SAVE) Plan.

The 8th Circuit Court of Appeals in Missouri has provisionally blocked all aspects of the plan. It is not yet clear whether the court will issue a final ruling in the case.

The ruling comes in response to one of two lawsuits filed by more than a dozen Republican-led states in response to the Biden administration’s launch of the SAVE plan last summer.

The SAVE plan was expected to reduce payments for millions of borrowers, while those already paying down their loans expected to have their debts forgiven after 10 years.

According to the White House, more than eight million borrowers had signed up for the program. About 400,000 borrowers had already received debt forgiveness under the plan.

Following the ruling, the Department of Education said borrowers enrolled in the SAVE plan would receive an interest-free moratorium on payments until the lawsuit was resolved.