Student debt exposed: Nearly 2 million people now owe £50,000 or more

- According to the Students Loan Company, the highest debt is £252,000

- The average ex-student has debts of just £50,000 when they start repaying

- Nearly three million former students have paid off a loan in the past year

New data shows that almost 2 million people have student debt of between £50,000 and £100,000.

Meanwhile, 49 people who took out student finance have debts of more than £200,000.

According to a Freedom of Information Act request made by the BBC to the Student Loan Company, as many as 61,000 people have loans of between £100,000 and £200,000.

The highest debt recorded by the Student Loans Company is £252,000, up from £231,000 just three months ago. It is not clear whether this is the same debt.

Stacking: The government currently owes more than £230 billion in student loans

According to figures from the Department for Education, loan holders owe an average of £48,470 when they start repaying, up 9.1 per cent from £45,000 last year.

For students who follow multiple or longer courses, the student debt can be considerably higher.

Currently, students start paying back once they earn more than £27,295 on Plan 2 if they start their studies after 2012.

People who started before 2021 will have to start paying back after they earn £24,990, while people who started after 2021 will have to earn over £25,000.

Scottish students start paying back above £31,395.

Students pay 9 per cent of their earnings above the threshold and 6 per cent of their earnings above the £21,000 threshold towards loans for postgraduate study.

For postgraduate courses you will pay around £11,000 per year in tuition fees. The government offers loans of up to £11,295 to cover the cost of postgraduate education.

This loan is available for the first two years of postgraduate study.

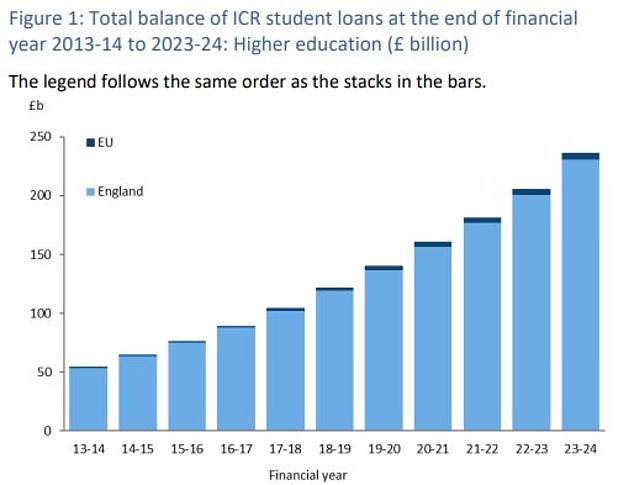

Blowing up: Total student debt stands at £236.2bn compared to £54.4bn in 2013/14

In total, the government has now lent £236.2 billion to people who have completed or are still studying in higher education by the end of the 2024 financial year. In the UK, 2.8 million people repaid their student loans in the financial year.

This figure is up almost 15 per cent from £205.6 billion the previous year and from just £54.4 billion in the 2014 budget year.

The government predicts that this figure will rise to £460 billion by the mid-2040s.

Of this £236.2 billion, almost 75 percent must be repaid. This means that borrowers earn more than the income limit and have exceeded the statutory repayment period.

In 2012, tuition fees were increased to £9,000 per year. In 2017, further reforms saw this increase to £9,250.

Previously, tuition fees cost just over £3,000 per year.

Students can also borrow up to £9,978 as a maintenance loan, or even £13,022 if studying in London.

Currently, Plan 1 student loans are forgiven once the borrower reaches age 65. Plans 2 and 4 have a 30-year repayment period, and Plan 5 has a 40-year repayment period.

The Department for Education reported that £50.8m had been written off in 2024, but most of this was for ‘Access to Higher Education’ courses. The debt for this is written off after someone with an Advanced Learner Loan completes a higher education course.