Stock market headed for extremely rare occurrence as it rallies after Trump’s election

The S&P 500 is on track to post a gain of more than 20 percent for the second year in a row.

If the index pulls it off, it would be only the third time there have been consecutive gains of that magnitude in the past century, according to Deutsche Bank.

The S&P 500 tracks the performance of the 500 largest companies in the US, including major technology companies such as Amazon and Apple, and banks such as JPMorgan Chase and Bank of America.

Since its inception in 1957, the index has typically achieved an average annual return of 10 percent.

But the S&P 500 gained more than 24 percent in 2023 and is now up about 26 percent on the year after last week’s rally following Donald Trump’s victory in the presidential election.

The S&P 500 is on track to post a gain of more than 20 percent for the second year in a row

Rising stock market returns are good news for Americans who have invested in 401(K) and IRA retirement plans, which are typically invested in the major market indexes.

That means when Wall Street makes profits, so do their savings.

The stock market soared on news that Trump had won a second term.

The S&P 500 reached the milestone of 6,000 points on Friday, a record high.

A landslide Trump victory fueled bets on a business-friendly agenda, with expectations of lower corporate taxes and looser regulations.

“Rallies after close elections have been the historical norm, as we have noted before,” Deutsche Bank strategist Parag Thatte said in a note on Friday.

“But the current one is clearly faster than the previous one.”

Thatte said market progress had been “exceptional” even before last week’s surge to record highs. CNBC reported.

The S&P 500 is still within the upward trajectory of the past two years, but is now near the top of that, he said.

According to Dow Jones Market Data, the last time the index gained more than 20 percent in two consecutive years was in 1997 and 1998, in the middle of the dot-com bubble.

More than 20 percent had also been added in 1995 and 1996, a total of four years in a row.

Further back, stocks hadn’t seen such a strong rally for two years in a row since 1955, before the S&P 500 was even introduced. MarketWatch reported.

The stock market soared on news that Trump had won a second term

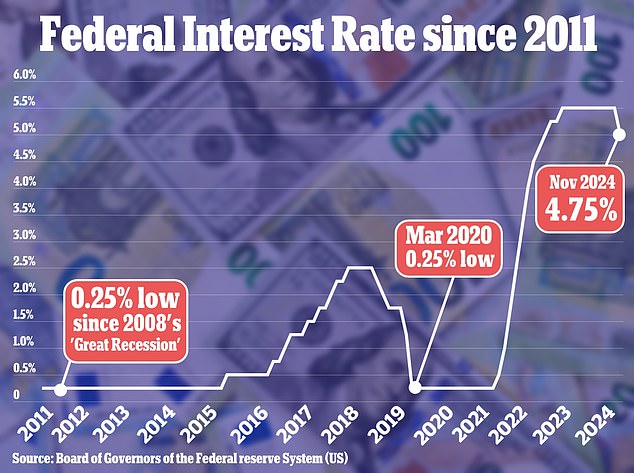

The Federal Reserve also cut interest rates again last week, against the backdrop of a slowing labor market and cooling inflation

The central bank cut rates by 25 basis points on Thursday, bringing yields down between 4.5 percent and 4.75 percent

Historical data also suggests that further growth is in store for the S&P 500 this year.

Wall Street investment bank Oppenheimer looked at the 11 years in which the S&P 500 rose more than 20 percent during its first 217 trading days.

In those years, the smallest additional gain from then to the end of the year was 0.5 percent, CNBC reported.

That means that, if history repeats itself, the S&P 500 should end above 6,000 points in 2024.

The latest rally also came as a rate cut by the Federal Reserve eased pressure on the US economy.

The central bank cut interest rates by 25 basis points on Thursday, in line with economists’ forecasts, bringing interest rates down between 4.5 percent and 4.75 percent.

Thursday’s decision marks the second time the Fed has cut rates this year, against the backdrop of a slowing labor market and cooling inflation.

Policymakers voted in September to cut rates by as much as 50 basis points, pushing borrowing costs down from a 23-year high.