How Anthony Albanese told Aussies he had no intention to change the tax cuts at the same time plans were being drawn to dump them

Senior officials were working on plans to dump the phase three tax cuts, even as Anthony Albanese told Aussies he had “no plans” to change them.

Prime Minister and Treasurer Jim Chalmers have repeatedly said there will be no changes to the tax cuts originally secured by the previous coalition government – to the point where they announced drastic changes in January.

But on Monday, Canberra bureaucrats confirmed at a Senate inquiry that they were working on plans to ditch the Coalition version for an updated Labor version before Christmas.

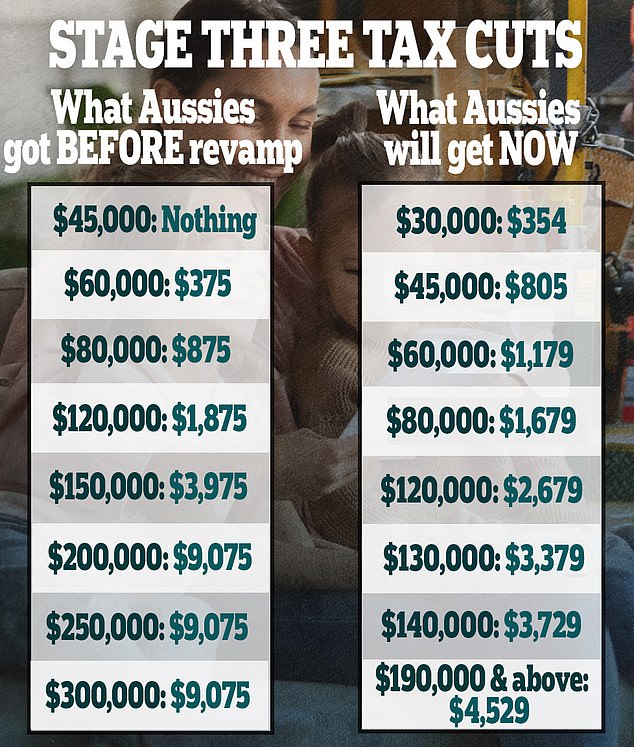

More than 11.5 million taxpayers are expected to be better off under Labour’s changes, but an estimated 1.1 million people earning more than $150,000 will receive only half the tax cut they would have received if the coalition was still in power.

Liberal Senator Jane Hume asked Treasury and Treasury officials: “How many Australians will pay more tax as a result of this decision?”

Senior officials worked on the government’s ‘broken promise’, the third phase of tax cuts, in December, while Anthony Albanese (pictured with his partner Jodie Haydone) said he had ‘no plans’ to make changes

The officials said they had to answer the question in advance, meaning they would answer it later, most likely in a written response.

Ms Hume wasn’t happy about that and demanded to be told: ‘How can you not know how many more people will pay more tax in the medium term, when the Government will raise another $28 billion?’

She put it to officials that “when the Prime Minister said on December 21, ‘we are not reconsidering our position’, you were actually reconsidering it.”

But they said they were not “complicit in a lie” in doing so.

Anna Harmer from the Treasury said it was not clear until January that the government was about to make changes to the phase three tax cuts.

Despite breaking repeated promises to press ahead with the coalition’s version of tax changes, Albanese insisted on Sunday he was not being deceitful.

‘I am an honest person. I’m honest,” he told ABC’s Insiders programme.

“What I’ve done here is be very, very clear. And I’ve listened to people all say to me, “What are you doing about the cost of living? What are the steps you can take?”

About 85 percent of taxpayers earning between $50,000 and $130,000 will receive $804 more than previously promised.

Those who have the most to lose if Labour’s changes reach the Senate with cross-bench support are those earning more than $190,000, who will see their tax savings halved from $9,075 to $4,529.

Labor’s revisions will mean incomes between $18,200 and $45,000 will be taxed at a lower rate of 16 percent.

The 30 percent bracket will be expanded to include incomes between $45,000 and $135,000, and the 37 percent bracket will continue to apply to incomes between $135,000 and $190,000. Above that, a rate of 45 percent applies.

The latest Newspoll conducted by The Australian found that 62 percent of voters believe Mr. Albanese did the right thing by reworking the statutory tax cuts.

But the prime minister’s personal approval ratings have not improved following the decision.

Labour’s primary vote has fallen by one point, but the two-party contest between Labor and the Coalition is unchanged from the previous poll six weeks ago: 52-48 in Labour’s favour.

The head-to-head between Albanese and opposition leader Peter Dutton remains 56-35 in Albanese’s favor.

More than 11.5 million taxpayers are expected to be better off under Labour’s changes. A female tradie is depicted

Parliament resumes on Tuesday, with the government planning to introduce legislation to replace the phase three tax cuts with the new model.

Passing it in the House of Commons, where Labor has the majority, will not be a problem, but the government will need cross-bench support to pass it in the Senate if the coalition does not support it or abstains.

The Reserve Bank of Australia will also meet on Tuesday, with interest rates likely to remain unchanged.

About 18 percent of voters surveyed in the Newspoll thought they would be worse off as a result of Albanese’s broken election promise.

The poll also found that female voters (65 percent) were significantly more likely to support the tax cuts, while those aged 50 to 64 were the most supportive of the change.

The 18-34 age group was the least in favor of the changed tax cuts.

Nicholas Barry, a politics lecturer at La Trobe University, said Albanese’s broken promise was unlikely to lead to an early election.

About 85 percent of taxpayers earning between $50,000 and $130,000 will receive $804 more than previously promised. The photo shows a female carpenter using power tools

Liberal Senator Jane Hume (pictured) asked Treasury and Treasury officials: “How many Australians will pay more tax as a result of this decision?”

“While Peter Dutton is putting pressure on the government to call an election because of the recent tax cuts, as things stand I don’t see us going to the polls in 2024,” Dr Barry told Daily Mail Australia.

‘Having been out of power for nine years, it is unlikely that Labor would want to take the risk of such a snap election.

“Governments will generally only do this if they have high confidence in an overwhelming victory.”

He added that “reducing the tax cut that the highest income earners receive makes sense as a policy because it funds a larger tax cut for low- and middle-income earners who need it more.”