First Stage Three tax cuts… then Stage Four and Five? Shock theory about Anthony Albanese’s tax plan as PM gives MPs dramatic five-word directive

Prime Minister Anthony Albanese has reportedly told Labor MPs to answer questions about the phase three tax cuts, saying ‘we have not changed our position’.

It comes amid growing speculation that the Prime Minister will announce a radical policy change this week, with senior opposition figures warning that tweaking tax cuts would be the ‘mother of all broken promises’.

Radio 2GB claimed on Monday that Mr Albanese plans to reduce the amount of tax relief given to Australians earning more than $180,000 in favor of support for lower- and middle-income Australians.

The rumor mill is running at full speed in the run-up to a cabinet meeting on Tuesday evening. Meanwhile, Labor MPs have been summoned to Canberra for an unusual caucus meeting outside Parliament House.

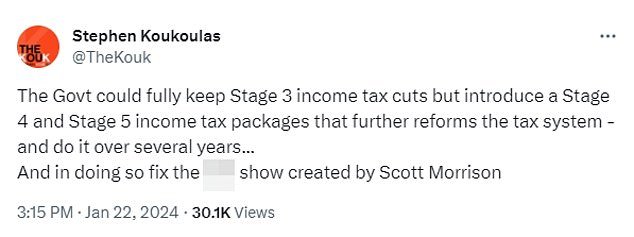

Stephen Koukoulas – a Labor political pundit and former economic adviser to Julia Gillard – last night put forward a radical theory about what Mr Albanese and Treasurer Jim Chalmers could announce.

“The government could keep the Phase 3 income tax cuts in full, but introduce a Phase 4 and Phase 5 income tax package that further reforms the tax system,” Mr Koukoulas wrote on X.

He also suggested the government “could do it over several years… and fix Scott Morrison’s damn show.” Such a move would allow Labor to dodge accusations that it was breaching its pledge to fully implement phase three cuts.

Prime Minister Anthony Albanese (pictured with his partner Jodie Haydon) has reportedly given Labor MPs a five-word sentence on the tax cuts in phase three, while a high-profile economist suggests a radical plan that would cut taxes for everyone.

Stephen Koukoulas, former economic adviser to Julia Gillard when she was Prime Minister, proposed a radical way forward for taxation (pictured)

On Monday afternoon, a radio presenter claimed that Labor is considering a major overhaul of the promised tax cuts in phase three.

Albanese called an emergency meeting of the Labor caucus in Canberra this week to discuss a new cost of living package.

Radio 2GBChris O’Keefe claimed Mr Albanese will announce a review of his tax plans at the meeting.

Under the new phase three proposal, “all taxpayers will still receive a tax cut,” O’Keefe claimed.

Many lower- and middle-income voters would be better off under the reported change.

But Australians earning more than $180,000 would be the biggest losers if their tax cuts are cut.

These claims come despite years of assurances – some as recently as last week – that Mr Albanese’s position on the tax cuts had “not changed” since he vowed to fully enforce them.

The Liberal Party is already benefiting from the prospect of the Prime Minister breaking an election promise to fully implement tax cuts.

In an email sent from the Liberal Party’s headquarters to all its followers on Tuesday morning, voters were warned that any change would be “a huge broken promise from Albanians.”

“If you can’t trust the Albanian to keep that promise, how can you ever trust anything he says?” reads the email.

“Changes to the third phase of the tax cuts would represent a clear breakdown of trust among the Australian people.”

The Albanian government has long been warned that this would result from any changes in policy.

Treasurer Jim Chalmers has reportedly ‘tested the waters’ on the implications of changing the phase three tax cuts due to start this year

Meanwhile, the opposition knows it can benefit from Labour’s breaking election promises if even the slightest change in policy is made.

A government spokesperson reiterated to Daily Mail Australia on Monday afternoon that its position “has not changed”.

But O’Keefe argued that the government’s “position” was about “cutting taxes” – rather than specifically maintaining the third stage cuts.

Under the new plans, lower-income people would instead get more relief in an effort to ease cost-of-living pressure on people who feel the pain most directly, O’Keefe said.

Under the existing Phase Three proposal first introduced by the Coalition, Australians earning more than $200,000 would receive the most tax relief: $9,075 per year. That amount would be reduced.

The tax cuts in their current form would cost the government more than $300 billion over the next decade. But the Morrison-era policies have not been without controversy.

Left-wing politicians and voters have demanded the government restructure tax cuts to help middle and low-income earners.

Deputy Nationals leader Perin Davey confirmed this on Monday afternoon, telling Sky News: “If that is what the Prime Minister is doing, he is breaking an election promise.”

Former Deloitte economist Chris Richardson weighed in on the likelihood of changes on Monday afternoon, saying: “Phase 3… Canberra has suddenly gone very quiet and my spider senses are tingling.”

Although the Prime Minister has repeatedly said his position on tax cuts has not changed, he has come under increasing scrutiny in recent months as speculation mounted that change was afoot.

Last week, Mr Albanese called out an ABC presenter for playing “word games” with him.

“Nothing has changed, nothing has changed,” he said. ‘We are in favor of tax cuts.’

He told an Adelaide radio station last week: “Tax cuts will happen in July. That’s what we’re committed to… we haven’t changed our position.

But at the same time, a report surfaced from Capital Brief showing that Treasurer Jim Chalmers’ staff had at least “tested the waters” on making changes to the policy.

The publication reported that the Ministry of Finance had rejected a Freedom of Information Act request seeking “modelling, analysis, estimates or correspondence between the Ministry and the (Albanian) Government regarding the impact of the change of phase three on tax revenues or the budget’.

Two separate government documents, prepared between October 2022 and October 2023, were reportedly identified as relevant to the freedom of information quest.

But the request to release them was rejected due to potential ‘damage to the effectiveness of the Treasurer’s decision-making and consultation processes’.

While these documents do not indicate that the government is currently considering changes to tax policy, they do suggest that the government has at some point considered what adjusting tax cuts might look like.

A spokesperson for the Treasurer told Daily Mail Australia it was standard practice for the Minister to be briefed on all aspects of the budget and future changes.

“It is not unusual or controversial for the treasurer to be kept informed of the costs of upcoming changes to the budget,” the spokesperson said.