S&P raises expectations for the British economy

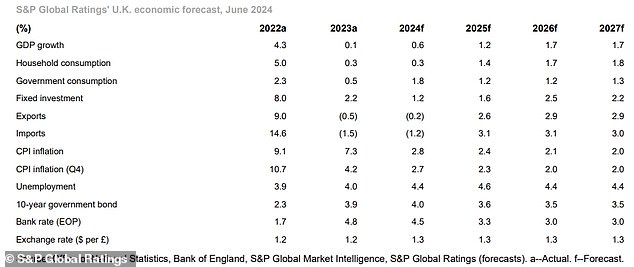

- The ratings agency now says UK GDP will grow by 0.6% this year, up from 0.3%

- S&P expects the Bank of England to cut its base rate to 4.5% by the end of 2024

S&P Global Ratings has upgraded its forecast for UK economic growth after a better-than-expected start to the year and ahead of a boost from looming interest rate cuts.

The ratings agency on Monday raised its forecast for UK economic growth for 2024 to 0.6 percent, from just 0.3 percent previously, on the basis that inflationary pressures will continue to ease and the country will also benefit from “improvement in trading conditions ‘. .

Data from the Office for National Statistics will show later this week how the UK economy fared in May, after leveling off in April due to a decline in manufacturing and construction output. British GDP is expected to be slightly higher again this month.

On the positive side, S&P Global Ratings has upgraded its forecast for UK economic growth

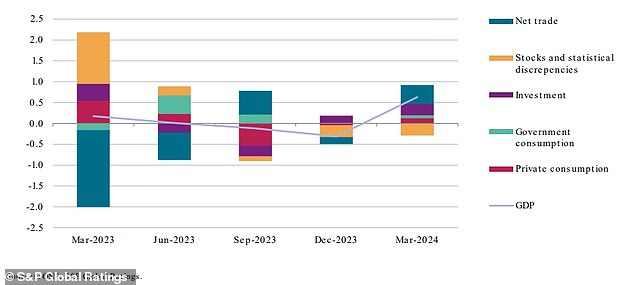

S&P said 2024 had “started strongly for the UK economy”, after growing 0.6 percent in the first quarter, which “more than offset” the contraction in the second half of last year.

It added: ‘Improving trading conditions will help, with net trade making the largest contribution to GDP growth as imports shrank more than exports.

“Investment was also strong, accounting for almost half of the increase in activity, suggesting that the effects of past rate hikes are starting to fade. This was especially visible in the construction sector.’

Economic activity has recovered due to improved trade and investment

British consumers are also showing signs of strength, with retail sales exceeding expectations last month as inflation finally returned to the Bank of England’s target of 2 percent.

S&P said this decline is “primarily related to declining energy bills and less dynamic prices for food and non-energy goods,” noting that services inflation remains at 5.7 percent, largely due to wage growth.

It added: ‘As a result, we expect inflation to be slightly higher in 2024 (2.8 per cent), before falling to 2.4 per cent in 2025.’

S&P said that while “it is still too early for the BoE to claim victory,” a looming slowdown in employment figures and still subdued consumer demand will provide the framework for the first rate cut in August.

The BoE opted last week to keep the key interest rate at 5.25 percent, with members of the Monetary Policy Committee expressing concern about high inflation in the services sector.

S&P expects the BoE to cut by 25 basis points to 5 percent in August, and cut by another 50 basis points later this year to bring the base rate to 4.5 percent by the end of 2024.

The ratings agency said: ‘Falling inflation, monetary policy easing and improving trading conditions should help the UK economy rebalance and return to potential growth over the next two years, absent other shocks.

‘Consumers are expected to return to stores as their purchasing power recovers and businesses will continue to ramp up investment, supported by falling input and financing costs.

‘In addition, a clearer policy path in Britain could provide a more business-friendly environment than in the years following the Brexit referendum, especially in light of high policy uncertainty in other advanced economies.

‘The BoE will also have to take into account the 12 to 18 month gap between any rate cuts and their effects on the economy, when rates start to ease.

“Overall, we believe that a gradual approach to rate cuts is most likely, especially given uncertainty about both persistent supply shocks to past inflation and the prospects for long-term economic developments.”

How S&P expects the UK economy to perform over the next four years