SOMERSET EMERGING MARKETS: Globe-trotting manager finds jewels

SOMERSET EMERGING MARKETS: Itinerant manager finds jewelry

Investment house Somerset Capital Management is a boutique asset manager specialized in emerging markets. Co-founded 16 years ago by Conservative MP Sir Jacob Rees-Mogg, it now has £3.3 billion in funding and offices in Shanghai, Singapore and Britain.

Its investment managers – who manage a mix of global emerging market mandates, Asia-specific and China-only funds – spend a lot of time meeting with companies in a quest to identify winning companies and vet existing ones.

One of the most frequent travelers is Kumar Pandit, co-manager of the firm’s Emerging Markets Dividend Growth fund. In the past year he has been to China, India, Indonesia, South Korea, Taiwan and Vietnam to look for opportunities for the fund.

“Yes, a lot of the financial analysis of investable companies can be done in the office in Britain,” he says, “but meeting companies in person is essential to what we do, whether that’s in their home country or on conferences. in the United Kingdom. We need to understand what management is thinking.”

The fund he manages together with Mark Williams is unusual for an emerging markets investment fund. While it focuses on generating total returns for investors, it has an income bend. “We want to hold companies that generate a lot of cash and use some of it to pass on to shareholders in the form of dividends,” Pandit adds.

It’s an approach that has not been without challenges – particularly the impact on businesses of extended lockdowns due to Covid. But Pandit says the long-term trend among many emerging market companies in countries such as Brazil, South Korea and Taiwan is to pay shareholders a dividend for their support.

Last year, dividends paid to investors totaled around 1.8 pence per unit, compared to 3.3 pence the year before. But it is encouraging that this year’s interim payment was an improvement compared to 2022.

Unlike some other emerging market funds such as Mobius, which are nervous about investing in China for geopolitical reasons, Pandit is cooler. He describes the prospect of an invasion of Taiwan by China as a “high risk, low probability event”, adding that this would be catastrophic for China in terms of its role in the global supply chain. He believes a more likely outcome is unification through the emergence of a government in Taiwan that is more receptive to the idea.

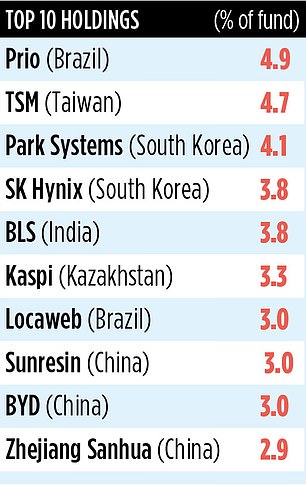

One of the fund’s main holdings in China is electric car manufacturer BYD (Build Your Dreams). “It is the largest electric car manufacturer in the world,” says Pandit. ‘Having honed its craft in its home market, BYD now sells cars across Asia – in countries such as Indonesia and Thailand. I’ve even seen adverts for the cars on London Underground stations.’

What Pandit likes about the company is that it is “vertically integrated,” meaning it makes the lithium batteries that power its cars, rather than relying on a supplier. Dividends are also paid.

The fund’s performance numbers aren’t great, although Pandit and Williams have improved relative performance since their appointment as joint managers in November 2020. Under their management, the fund has generated a 10 per cent return, compared to a zero return versus the average. emerging markets fund.

Pandit believes that many emerging markets are now better positioned than developed markets to offer investors attractive returns – due to stronger economies, lower inflation and falling interest rates. The annual costs of the fund are just over one percent. Williams is also co-manager of Somerset Capital’s Asia Income Fund.