Smith & Nephew sparks biggest investor uprising over executive pay

- Texas-based Nath, who earns £3.8million, could receive up to £9.3million this year

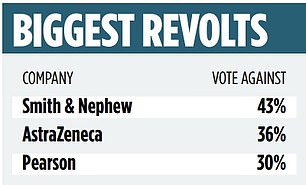

Nearly half of Smith & Nephew shareholders voted against plans to give CEO Deepak Nath a huge pay rise

The largest uprising against high salaries took place at a medical device company Smith and Cousin where nearly half of shareholders voted against the plan to give CEO Deepak Nath a huge pay rise.

Texas-based Nath earns £3.8million, but if he hits all his targets he could earn up to £9.3million this year.

Education firm Pearson has been named for the second year in a row on the ‘list of shame’ for companies where more than one in five investors protest over bosses’ pay. It is the only FTSE 100 company to receive the dubious distinction.

The company’s boss, Andy Bird, saw his salary rise by almost two-thirds last year to £11.3m – including a £16,000 monthly allowance to rent a New York apartment.

Nearly a third of investors voted against Pearson’s compensation report, down from 46 percent who opposed the policy the year before.

There is a major investor revolt underway at rental company Ashtead over plans to almost double the salary of chief executive Brendan Horgan, who earned £5.8m last year.

Shareholder advisory group Glass Lewis criticised the proposals as “excessive”. This comes after a third of Ashtead’s investors voted against the remuneration report in 2022.

Ashtead, which has significant operations in the US, is considering moving its listing from London to New York.

But the number of major shareholder revolts over executive pay has declined, despite the seemingly inevitable rise in executive pay.

Only three companies made the list of shame this year, with an uprising of more than 20 percent.

Salary matters: Pharmaceutical giant AstraZeneca has faced a major pay revolt over the generous rewards given to its boss, Pascal Soriot

By comparison, the year before, eleven top companies were accused by name of boardroom greed.

Annual votes on executive salaries are not binding, so companies can ignore them and simply continue with their own policies.

However, this can damage a company’s image. The rules came into force in 2017, when then-Prime Minister Theresa May drew up a list of companies that were dishing out fat pay. At the time, more than a fifth of FTSE-listed companies were on the register, which was kept by trade body the Investment Association (IA).

May described the offenders as “damaging to society” because they overpay top executives.

Pharmaceutical giant AstraZeneca also saw a major salary revolt over the generous pay for its boss, Pascal Soriot, who was the driving force behind the company’s stellar performance.

The three companies subject to the IA’s “naughty step” have large operations in the US, where higher executive salaries are tolerated and executives at competing companies typically earn more.

Housebuilder Berkeley has seen the size of its pay revolt fall from 40 per cent to 14 per cent, with boss Rob Perrins having raked in more than £100m since taking charge. His pay packet was unchanged at £8m last year.

But he fell from 11th to 16th place on the list of highest-paid CEOs as other bosses overtook him.

DIY INVESTMENT PLATFORMS

AJ-Bel

AJ-Bel

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive investor

interactive investor

Fixed investment costs from £4.99 per month

Saxo

Saxo

Get £200 back on trading fees

Trading 212

Trading 212

Free trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals are chosen by our editorial team because we think they are worth highlighting. This does not affect our editorial independence.