Sister reveals how her brother’s ex-girlfriend is getting his $250,000 life insurance payout – in heartbreaking cautionary tale which should serve as a warning to ALL Americans

Last Thanksgiving, Dawn Williams had an informal conversation with her brother Dave about the state of his estate planning.

She had been working on building a trusting relationship and wanted to see what stage he was at. The siblings, both in their early fifties, were the only remaining members of their family, as both parents had passed away.

He was never very good at that kind of thing, but Dave assured his sister that he would pass everything along to her and work on changing the primary beneficiary listed on his $250,000 life insurance policy.

His ex-girlfriend was still on the form despite the fact that the relationship had ended.

But on December 31, Dave died in his sleep after a short illness. He did not have a will and had not gotten around to updating his life insurance policy.

Not long after his death, his ex cashed in on the policy.

Dawn’s brother Dave passed away before updating his life insurance beneficiary

Now, Dawn not only has to deal with the sudden death of her beloved brother, but also struggles with the shock (and anger) she feels over what has happened since.

After Dave’s death, Dawn contacted a lawyer who told her that the insurance company would stick to what was on the paper, and that it would be very difficult to dispute that.

But he suggested that insurance companies have a form that can be filled out by the primary beneficiary so that the payment can actually be sent to another recipient.

“I wrote her a letter expressing that while I know they had a deep love, it was over, and I explained the conversation I had with him on Thanksgiving,” Dawn told DailyMail.com.

‘I asked her to honor his wishes and sign the form. But I never heard anything back. But about a month later I saw that everything had been paid out and closed.’

There were no financial or emotional ties between them to justify this, Dawn said.

“No shared property, assets or financial accounts. They had no children together. Their relationship was over and they both moved on.”

Despite everything, Dawn is not considering legal action.

“If it didn’t go in my favor, I would be missing out on thousands of dollars in attorney fees,” she said.

Dawn’s heartbreaking story serves as a cautionary tale, reminding Americans how much beneficiary forms for life insurance policies, retirement accounts and bank accounts really matter.

The designation can often take precedence over a will, even if it was completed decades earlier.

A beneficiary dispute is also every family’s worst nightmare when dealing with the death of a loved one.

‘You don’t want to have to deal with it. You just want to grieve and figure out how to heal. You don’t want to fight or anything,” Dawn said.

Beneficiary designations can often take precedence over a will, even if it was completed decades ago

Dawn’s experience underlines the need for greater awareness of the risks of outdated or incomplete beneficiary forms.

And the more money there is in an account, the riskier it becomes – which can lead to nasty disputes for families.

In Pennsylvania, a decades-old beneficiary form has sparked a fierce legal battle over a pension fund totaling more than $1 million.

Margaret Losinger, now 68, had a relationship with Jeffrey Rolison in the 1980s, according to court documents obtained by The Wall Street Journal.

Rolison worked at a Procter & Gamble factory and in 1987 named Losinger on a handwritten form as the sole beneficiary of his pension plan.

The couple moved in together, but separated after two years. Rolison never updated the beneficiary designation before he died in 2015 at age 59.

Now Rolison’s two brothers, Richard and Brian, are contesting Losinger’s claim to the fund, which has grown to more than $1.15 million.

Richard told DailyMail.com: ‘The whole thing was overwhelming.’

The brothers have fought Losinger and P&G in court, arguing that the company failed to properly inform Rolison of its beneficiary options.

P&G claims they provided adequate warnings, including online statements and notifications of changes to the service provider.

One such message read: ‘You have no beneficiary designations online. Any previous beneficiary designations registered with the Plan are retained by P&G but are not visible on this site.”

The brothers claim that this message was unclear and could have been misinterpreted by Rolison. They believe the plan should have defaulted to the estate, of which they are co-trustees, if a clear beneficiary had not been designated.

The court ultimately sided with P&G and Losinger, but the brothers appealed the decision.

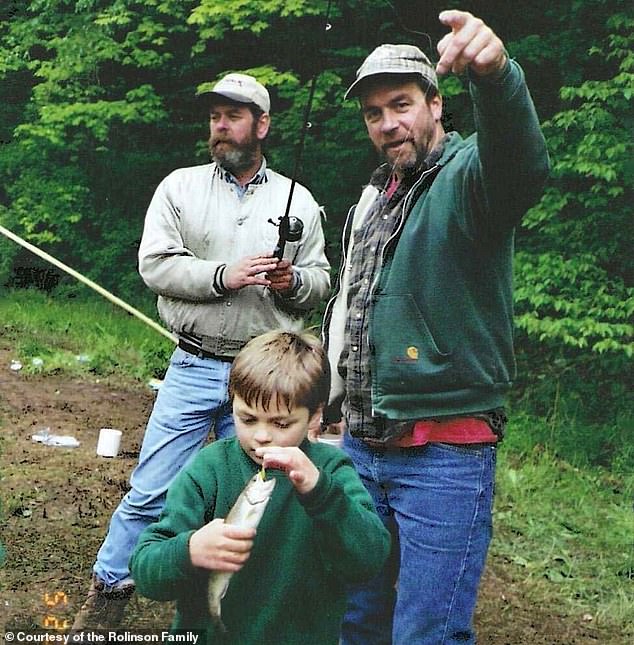

In 1987, Jeffrey Rolison (pictured) named his ex-girlfriend as the sole beneficiary on a handwritten form

Rolison’s brothers take legal action (photo: Jeffrey Rolison, left, Brian Rolison, right, and Brian’s son, Nick, center)

The rules surrounding inheritance of retirement accounts are inherently complex, even if there is no debate about them.

This means it is absolutely crucial that Americans stay on top of their beneficiaries.

Not listing someone as a beneficiary can also cause problems, says Peter Gallagher, director of Unified Retirement Planning Group.

This can cause delays in transferring money or lead to a lengthy probate process for families.

“Name someone as your beneficiary and make sure you change this if your circumstances change,” Gallagher told DailyMail.com.

Dawn hopes her story will serve as a warning to others.

“I can’t dwell on this terrible situation and know I have to let it go or it will eat me up inside,” she said. I’m working on it, but I’m not there yet.

“My heart goes out to anyone who faces controversial situations, especially when grieving a loved one. I can’t express how important it is to make sure your loved ones know they need to get things in order.

‘You never know how much or little time you have left.’