Should you invest in Next shares? We look at the profit machine stock

Fashion-conscious: Nowadays Next not only sells its own brand, but also many others

The story of Next, the £12.5 billion retail giant, began 160 years ago in Leeds. The company, then known as Hepworth, was the first High Street chain to provide bespoke and turnkey tailoring.

Next’s transformation into a 21st century apparel and homewares powerhouse is an example of how to survive and thrive amid radical shifts in an industry.

The company, which is number one in the UK clothing market, is a leader in the shopping center – and also on the internet.

Today, Next sells not only its own brand, but also many others, including Gap, Laura Ashley, New Balance, Victoria’s Secret and The White Company.

The retailer maintains its tradition of tailoring and also owns 72 percent of Reiss, the luxury chain renowned for its chic suits.

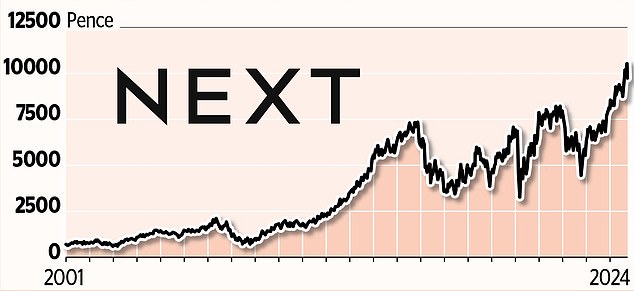

No wonder Next shareswhich are up 33 percent this year, are seen as one of the stocks to own if you want to back major British companies that are also poised to become global stars.

Last month the company reported a 14 percent increase in half-year sales to £2.86 billion. Richard Hunter of Interactive Investor called the figures ‘next-level figures’. He says Next, under its cerebral CEO Simon Wolfson, has “unrivaled insight into the market in which it operates and its ability to capitalize on new opportunities”.

Some of these opportunities will happen right here at home. In recent days, Next has acquired a 16 percent stake in homeware brand Rockett St George.

But other opportunities may lie abroad, given the increasing demand from abroad for Next Fashion. A spokesperson for the retailer says that thanks to the influence of Netflix shows, the tastes of different countries are coming together.

Next also predicts it would make £1 billion in profits for the year, even in a tough economic climate. This prediction was not seen as hype, as Next has a tendency to under-promise and over-deliver.

Will McIntosh-Whyte, of Rathbones Asset Management, is optimistic about the prospects. He says: ‘The company is well positioned to benefit from a recovering British consumer – if the new government doesn’t destroy consumer confidence with their ominous narrative.’

Ben Preston, of the Orbis Global Equity fund, is also optimistic about Next’s prospects. He says: ‘Strong companies can often use difficult times to their advantage, and that is exactly what Next has been able to do.’

This ability to adapt to circumstances began to become apparent in 1987 when Hepworth changed its name to Next. This move recognized that the future was not in scruffy formal wear, but in the Next fashion stores founded in 1982.

These stores, aimed at younger women looking for glamorous costumes, were the creation of George Davis, a major retail personality of the 1980s.

Davis, who went on to launch Per Una at Marks and Spencer and George at Asda, was CEO of Next between 1984 and 1988. Although this was a turbulent period, this pioneering retailer ushered in a new era.

This pattern of disruption resumed under 56-year-old Wolfson, who took over in 2001 after a stint working on the Next floor after law school in Cambridge. He has deftly handled the subsequent retail war of attrition, which has claimed victims such as Debenhams.

Rivals may have closed their stores, but Next has 460 stores and will open more. It also has a sophisticated online offering built on the infrastructure of its mail-order business Next Directory.

Founded in 2023, Next’s Total Platform provides distribution, warehousing, website and other services to other retailers for a fee.

The investments in logistics, IT systems and software to accommodate Total Platform and the online shopping revolution are so significant that Next now employs more people in technology than in its product divisions. As Wolfson puts it, “History has been given a boost, and now that it has moved forward, it seems unlikely that it will return.”

Aruna Karunathilake, portfolio manager of the Fidelity UK Select Fund, a long-time investor in Next, underlines the scale of the move to online. He says: ‘Most people think of Next as a physical retailer given its presence on our high streets, but in reality the retail store now makes up less than 10 per cent of profits.’

This radical change in the nature of the company explains the general approval of Next – and the respect for its position, even when it comes to controversial issues.

More stores: Next has 460 stores and will open more

Last month the company said it could close stores if it lost its appeal against a long-running equal pay claim. But this did not slow the rise in the share price. The assumption seemed to be that Next would follow its usual policy of closing stores with lower profitability, rather than punishing employees.

Russ Mold of AJ Bell describes the company’s management as ‘an example of how to run a publicly traded company’. He emphasizes the ‘detailed guidance’ that Next offers. The report and accounts outline the reasoning behind its strategy, detailing mistakes made in acquisitions, for example, but also how others were avoided.

Next regularly steps in to snap up struggling names like FatFace and Made.com, the furniture company. Still, Wolfson argues that this doesn’t mean Next is a conglomerate, suggesting it is more akin to a venture capitalist group.

In the ‘Big Picture’ report and accounts, Wolfson sets out the tasks ahead. These pages give a hint at his thinking: his public statements are relatively rare – and to the point.

It is this candor that investors appreciate in Wolfson, who sits in the House of Lords as Baron Wolfson of Aspley Guise. As the son of a former Next chairman – Lord Wolfson of Sunningdale – he could be seen as a beneficiary of nepotism, but it is difficult to find anyone who takes this view.

There is respect for his expertise – and also for his quiet lifestyle. In his spare time, Wolfson, a father of three, enjoys gardening. He also sponsors the £250,000 Wolfson Economics Prize.

His wife, Eleanor Shawcross, was an adviser to Rishi Sunak as Prime Minister and to George Osborne during his time as Chancellor. Wolfson is unlikely to emerge anytime soon, despite being the FTSE 100’s longest-serving CEO. He loves his job and investors hope that will continue.

A long-term basis for future growth

If you’re considering adding Next to your portfolio, don’t look for a quick kill. This is a bet on economic recovery in Britain – and elsewhere.

Next shares have risen 50 per cent in the past five years to 9742p. Following this rise, 13 teams of brokerage analysts covering the stock rate it as a hold and four as a buy.

Rathbones’ McIntosh-Whyte is among those who argue that valuations may be stretched, albeit in the short term.

Others have more self-confidence. Fidelity’s Karunathilake says Next is undervalued by the market, given its good return on capital and cash flow.

The shares are valued at 15 times earnings, in line with other retailers. But Karunathilake says this undervalues Next’s online capabilities. This will be the engine of its expansion in Britain and beyond.

DIY INVESTMENT PLATFORMS

A. J. Bell

A. J. Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund trading and investment ideas

interactive investor

interactive investor

Invest for a fixed amount from € 4.99 per month

Sax

Sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals have been chosen by our editors because we believe they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.