Should Keystone Positive Change investors sell at a discount now or wait for a merger?

The decision point for Keystone Positive Change investors is approaching: will they embrace Baillie Gifford’s shake-up, or take the hit and cash out at a discount now?

Keystone Positive Change investment trust will merge with the Baillie Gifford Positive Change fund if investors support the resolutions at its general meetings on January 27 and February 7 next year.

The portfolios are very similar, with virtually identical exposure, but the Positive Change fund is an open-ended fund that is not listed on a stock exchange – and investors will be locked into a small position in the portfolio of unlisted companies of the trust.

Complicating matters further, Keystone is one of seven investment funds that activist Saba Capital wants to suspend.

The trust’s board fought back yesterday, with Keystone chairman Karen Brade saying she was ‘shocked’ by Saba’s ‘actions and behaviour’.

She added: ‘We believe that the proposed resolutions would be highly damaging to the interests of all other shareholders.

Keystone Positive Change Investment Trust invests in companies that it believes help improve the world, including language app Duolingo

What happens with Keystone Positive Change?

Keystone, which invests in a portfolio of companies that have a positive social or environmental impact, has struggled to grow its assets following a difficult period for ESG investing.

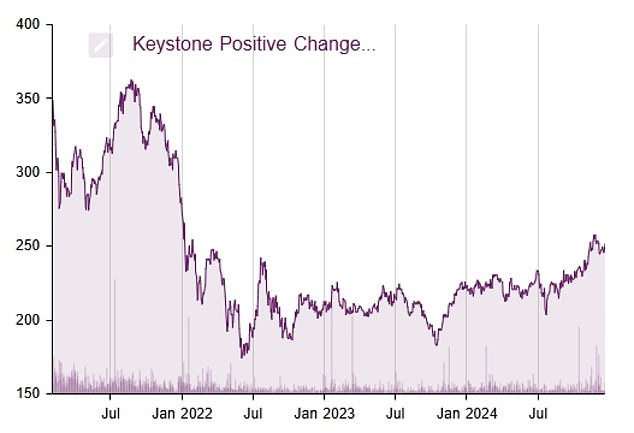

The company’s shares have remained illiquid in recent years, trading at a discount to net asset value.

According to AIC data, the discount has narrowed significantly, from about 16 percent at the beginning of last year to 5.6 percent now.

Should the resolutions be passed, shareholders who do not wish to invest in the open-ended Positive Change fund will be able to sell their shares at a 1 percent discount to net asset value. That means that in theory they would be higher than where they are now.

Investors will no longer be able to trade shares after January 27, or trade in the OEIC until February 10. For those who prefer to exit, the money will not be paid out until February 17, but there will be no exit fee on the OEIC.

But the issue is complicated by Keystone’s unlisted assets.

The trust recently told investors that it still has four unlisted investments, representing 2.6 percent of net assets, that cannot be included in the open-end fund after the merger.

This means that investors are left with a vehicle that houses these companies, while the rest of their money flows into the fund or is redeemed and waits for them to be sold.

Keystone’s remaining holdings include now-bankrupt battery manufacturer Northvolt, which the trust’s board recently had to write off, as well as biotechnology company Spiber, quantum computing specialist PsiQuantum and carbon removal group Climeworks.

The trust said on December 6: ‘All net proceeds from the sale of the illiquid investments during the liquidation period would be returned to ordinary shareholders in due course.

‘However, no assurance can be given as to the possible value and/or timing of distribution(s) that may result from the realization of the Company’s remaining illiquid investments.

‘Both factors will depend, among other things, on the prevailing market conditions.’

Baillie Gifford will waive all management fees until February 7 as it seeks to extract value from private assets.

Should investors sell or choose the fund?

James Carthew, head of investment companies at QuotedData, said: ‘We are unsure why the 1 per cent exit charge is being imposed on shareholders who would rather take cash than enter the open-end fund and would have preferred the board not to have done. go down this route.

“I don’t think that’s a fair way to approach this. I really think that the cash exit should take place at the intrinsic value.’

Instead, Carthew suggests that investors looking to cash out should consider switching to the open-ended fund and “then redeem your units immediately.” This means they walk away with a little more than just taking the money.

Whether they will ultimately make more profits than if they sold out at a greater discount now depends on market movements over the next few weeks.

If Keystone’s positions gain traction, investors will miss out by selling now and get a bigger discount, but if they make a mistake they can get more now.

Carthew explains how it works for those switching to the fund: ‘You should get the NAV minus the estimated cost of liquidating the portfolio to get your money back, which we think is around a NAV of -0.15 percent is.

‘I’m not a shareholder, but if I were, the pedant in me would be redeeming units rather than checking out the till, even with the hassle of extra paperwork. But that means you remain open to market movements a little longer.’

Keystone Positive Change’s achievements in recent years (Source: AIC until January 3, 2025)

What impact will a potentially protracted sale of private assets have on investors?

Thomas McMahon, head of investment companies research at Kepler Partners, said: ‘The fundamental way the deal works is that the private investments have to be sold, and that will take time, so whether you invest in the OE fund or take cash, you have to wait until that happens before we can get anything out of it.

‘The discount has now been increased to 5.5 percent. The unlisted allocation is approximately 2.6 percent, and the deal will incur fees of approximately 0.5 percent. 1 percent of the cash pool is deducted from the NAV.

“So there’s not really a value angle, you just have to decide whether you want to have about 95 percent of your money in cash or a little more in units in the OE fund.”

Should you support new management – or opt for something new?

Investors switching from the trust to the fund will support the same strategy.

According to the latest figures from Baillie Gifford, the Positive Change fund returned 14.4 per cent in the 12 months to the end of November. In three years it fell by 4.7 percent, but in five years it fell by 13.4 percent.

It focuses on the performance of the MSCI AC World Index, in sterling, plus a minimum of 2 percent per annum over rolling five-year periods. The benchmark has risen 28.7 percent in the past year, with gains of 11.9 and 14.5 percent over three and five years respectively.

McMahon said: ‘The strategy has performed poorly in recent years, but you need to consider what you think it will deliver in the future and whether you think there are better options.

‘The positive change approach is distinctive and can appeal to many people.

‘On the other hand, if you want global equity exposure with a growth strategy, you can get Scottish Mortgage at a 13 percent discount, or choose a very different value approach AVI Global at an 8 percent discount.

“So you could convert the money into a ‘cheaper’ investment trust, hoping to make a profit from that discount in the future.”

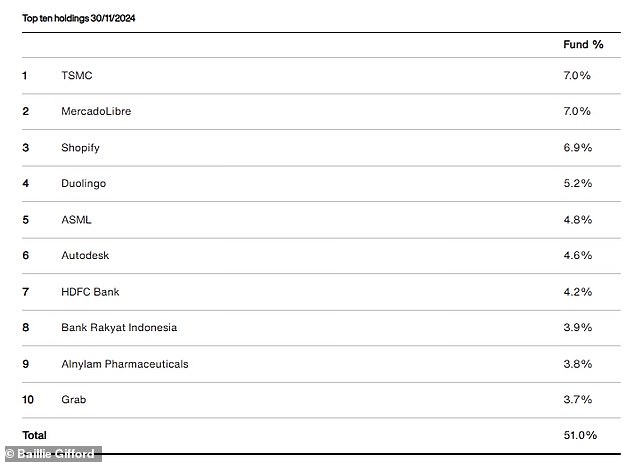

The top 10 companies of BG Positive Change range from chip companies to language app Duolingo

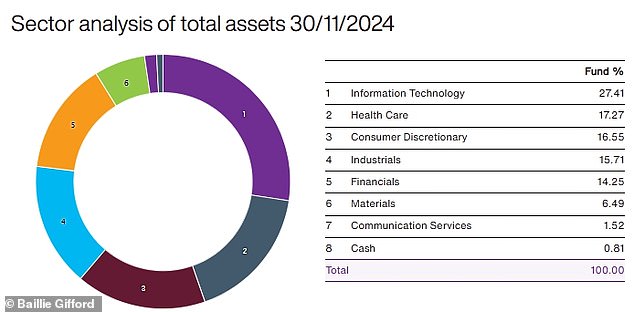

BG Positive Change invests more than a quarter of its portfolio in technology stocks

How does Saba’s intervention change the picture?

On December 18, activist investor Saba Capital targeted Keystone and six other trusts in an attempt to overhaul governance and management.

Saba wants shareholders to have a vote on dismissing the trust’s board and replacing its members with “new, highly qualified candidates” – including the hedge fund’s own directors.

The renewed boards would then try to appoint Saba as the investment manager of the trusts.

Keystone has opposed this, with Keystone chairman Karen Brade defending his plan. She said: ‘Be under no illusions: we believe this US hedge fund manager is acting opportunistically and attempting to take control of the board without a controlling shareholding in order to pursue his own agenda.’

Kepler’s McMahon said Saba’s intervention “changed the picture somewhat.”

He added: They want shareholders to vote for a new board and therefore appear to be offering a cash exit or a rollover to a Saba-managed portfolio of trusts or ex-trusts.

‘How the timetable would work, given that the current proposals are scheduled for a shareholder vote on January 27, remains unclear at this time.’

DIY INVESTMENT PLATFORMS

A. J. Bell

A. J. Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund trading and investment ideas

interactive investor

interactive investor

Invest for a fixed amount from € 4.99 per month

Sax

Sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals have been chosen by our editors because we believe they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.