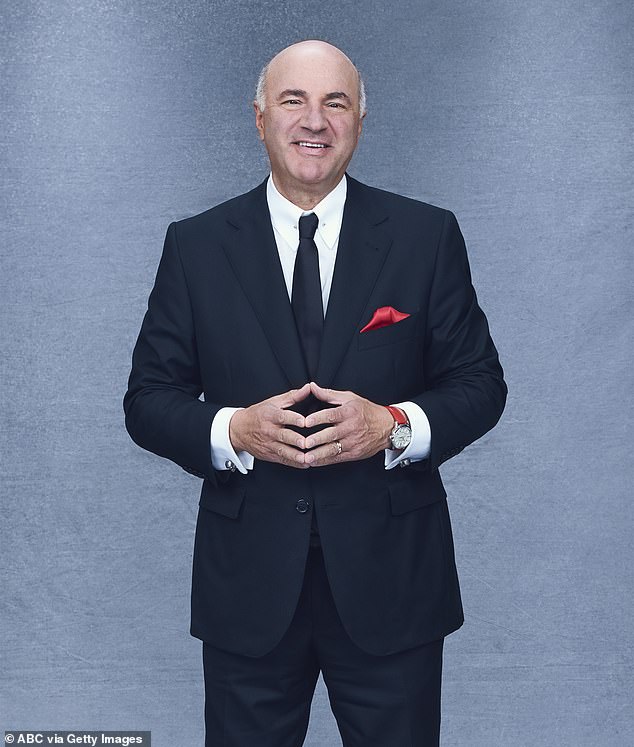

Shark Tank’s Kevin O’Leary gives surprising warning about why workers should NOT retire early: ‘Not just about money’

Shark Tank’s Kevin O’Leary has made the surprising suggestion that retirement might not be as great as it seems. He believes that people with jobs should stay in the workforce for as long as possible.

O’Leary, 70, initially retired at age 36 but found the work unfulfilling and returned to the workforce.

“Work is not just about money. People often don’t understand this until they stop working. Work defines who you are,” the Canadian businessman said in an interview with CNBC.

Many Americans aspire to join the FIRE (Financial Independence, Retire Early) movement – for many, retiring early is a stated goal.

Shark Tank’s Kevin O’Leary, 70, has made a surprising suggestion that retirement might not be as great as it seems and believes people with jobs should keep working

For most Americans, 67 is the age at which many retire. A significant number of people retire at 65 or even before they are 62.

The coronavirus pandemic has only accelerated the retirement of many Americans, giving those affected time to reassess their priorities in life.

“I don’t know where I’m going to go when I die, but I’ll be there working,” said O’Leary, who added that he has no plans to retire.

O’Leary has achieved financial success, but he still works hard. He runs the O’Leary Financial Group, O’Leary Fine Wines and appears on Shark Tank.

“I was retired for three years. I was bored to death. Work gives you a place where you’re social with people, it gives you interaction with people all day long in an interesting way. It actually helps you live longer and is very, very good for your brain health.”

O’Leary, who is nicknamed Mr. Wonderful on the hit TV series that has been running for 15 seasons, says that continuing to work has many benefits, including financial gain. But he also says that money isn’t everything.

“I don’t need extra money,” O’Leary adds. “I just want to do the things in my life that I want to do, and money allows me to do that. I tell every entrepreneur, ‘Don’t focus on the money. It’s not about greed. It’s about personal freedom.'”

Delaying retirement can also lead to higher Social Security benefits, while continuing to work can also provide much-needed social interaction, which can boost mental health.

Delaying retirement can increase Social Security benefits, while continuing to work can also provide much-needed social interaction, which can boost one’s mental health (file photo)

“You’re interacting with people all day long in interesting ways,” O’Leary said.

Yet, despite his insistence on retaining the workforce, statistics show that most Americans retire between the ages of 61 and 64. The number of people who want to retire at a younger age is growing.

The percentage of U.S. workers who plan to work past age 62 fell to 45.8 percent in March, the lowest level in a decade, according to researchers at the New York Fed. That continues a downward trend that began during the pandemic.

Among younger generations, Millennials and Gen Z are planning to retire earlier and aim to retire at age 60 or earlier.

Despite the fact that many people aspire to retire early, many still believe that the ideal retirement age is between 68 and 70.

O’Leary, 70, originally retired at age 36 but found it unfulfilling, so the Canadian businessman kept working and never looked back

Among younger generations, Millennials and Gen Z are planning to retire earlier, with ambitions to retire at age 60 or younger (archive photo)

Today, men typically retire from careers around age 65, while women retire around age 63.

The researchers found that the number of years Americans expect to work has fallen by 9.5 percent since March 2020, when the pandemic began.

Of course, economic circumstances and personal preferences also play a major role in when you retire.

However, researchers found that the decline in the number of years Americans plan to work is consistent across demographic groups, suggesting a widespread shift in retirement intentions.