Shark Tank’s Barbara Corcoran explains why house prices are set to go ‘through the roof’

Shark Tank star Barbara Corcoran has revealed when house prices will go ‘through the roof’.

The self-made real estate millionaire said a drop in interest rates is essential – to lower the cost of borrowing and attract buyers who will drive up prices.

The ‘magic number’ is a drop of 1 percent to bring mortgage rates below 6 percent.

“If interest rates fall another percentage point, prices will skyrocket,” Corcoran said in a speech Fox Business job interview Wednesday.

‘Everyone will come and buy. There are probably 10 buyers on the sidelines (for every home on the market) waiting for interest rates to drop,” she continued. “So everyone is going to tax the market.”

According to the latest data from government-backed lender Freddie Mac on March 21, the average 30-year mortgage rate is 6.87 percent.

That’s down from 8 percent in October last year, but still double the historically low figures of around 3 percent during the pandemic.

What will it take to get mortgage rates below the 6 percent that Corcoran sees as “the magic number that makes people juicy”?

Although the Federal Reserve does not directly set mortgage rates, the benchmark interest rate it sets does indirectly affect the amount Americans pay on a loan to buy a home.

Mortgage rates follow the pattern of 10-year Treasury yields, which are determined by a range of factors, including inflation, economic growth and the Fed’s benchmark interest rate.

The Federal Reserve left interest rates unchanged for the fifth time in a row earlier this month, leaving interest costs at a 23-year high of between 5.25 and 5.5 percent.

The Fed’s series of aggressive rate hikes were aimed at putting cold water on rampant inflation, which peaked at 9.1 percent in June 2022.

At its latest meeting, Fed policymakers had targeted a three-quarter percentage point cut by the end of the year, but did not promise a date for when rates could start falling.

If interest rates fall, this will affect the mortgage interest rate.

But Corcoran warned Americans that instead of getting a cheaper deal when rates fall, the housing market could actually heat up.

Corcoran warned Americans that if interest rates fall, it means home prices will rise even further as the demand to buy suddenly skyrockets

According to the latest data from government-backed lender Freddie Mac as of March 21, the average 30-year mortgage rate is 6.87 percent

“If you wait for interest rates to drop another point, I don’t think you’ll make a profit. I think you’ll end up paying more because I wouldn’t be surprised if real estate went up another 8 or 10. percent if interest rates fall one more point,” she said.

Higher mortgage rates and a historic shortage of homes for sale have already pushed home prices high, pushing many Americans out of the market.

In 2023 alone, the US housing market gained $2 trillion in value.

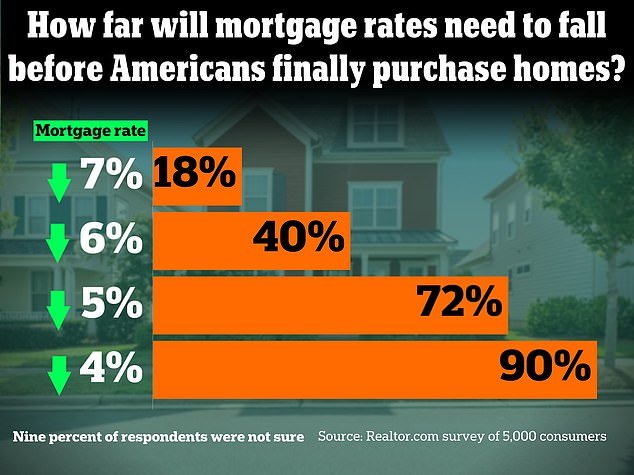

Corcoran’s comments come after a survey by real estate company Realtor.com found that the majority of homebuyers would need mortgage rates to drop to 5 percent before making a purchase.

About 72 percent of potential homebuyers said pulling the trigger would be feasible if mortgage rates fell below 5 percent

According to the survey of 5,000 U.S. consumers, conducted in the first week of November, when interest rates were at their highest, about 18 percent of Americans said they were waiting for interest rates to fall below 7 percent.

If they fell below 6 percent, another 22 percent of respondents said they would buy a home.

But the vast majority (about 72 percent) said interest rates would have to fall below the “magic” mortgage rate of 5 percent before they would sign on the dotted line for a house.