Seattle woman, 25, who earns $100,000 A YEAR says she STILL can’t afford simple luxuries like meals out and the gym – revealing she’s had to ‘downgrade’ her lifestyle to cope with soaring cost of living

A woman who earns $100,000 a year has claimed her salary is still not enough to support her lifestyle. She laments the “downgrades” she’s had to make to her regular expenses, from canceling her gym membership to avoiding eating out.

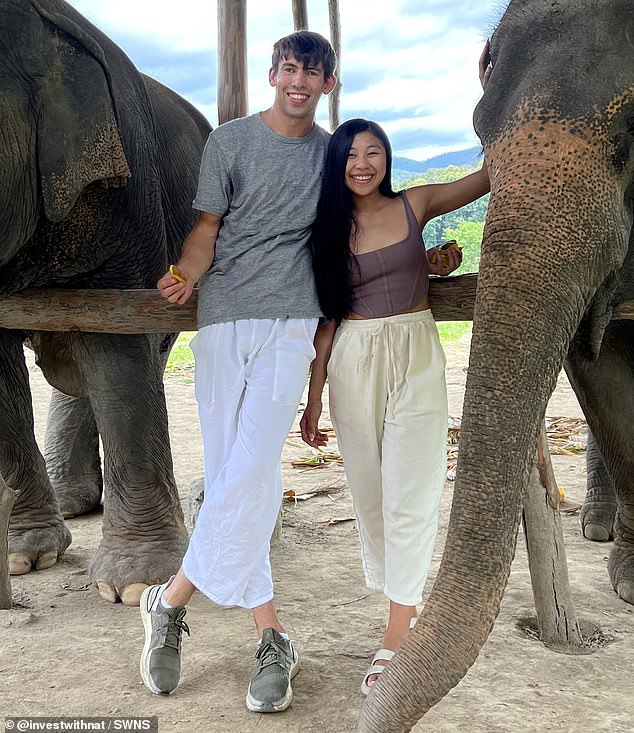

Natalie Fischer, 25, and her husband, Keldon, 30, from Seattle, Washington, both work in the technology industry and bring home a combined salary of $200,000.

As a result of their six-figure salaries, Natalie admits that the couple experienced “lifestyle creep,” which caused them to spend more money because they were taking more money home.

But the pair soon found the money draining away, mainly due to rising inflation and the rising cost of living – forcing them to cut back on the little luxuries they once enjoyed.

Natalie Fischer, 25, and her husband, Keldon, 30, from Seattle, Washington, both work in the technology industry and bring home a combined salary of $200,000

She earns $100,000 a year. It has been revealed that she had to downgrade her lifestyle because she could no longer afford to go to the gym or eat out due to the rising cost of living

And despite both earning six-figure salaries, Natalie claims they experienced ‘lifestyle creep’, causing them to spend more money because they were taking more money home.

Before downsizing, Natalie and Keldon often dined with friends and took luxury trips to Rome, Mexico and Alaska.

The couple spent about $4,000 monthly: $2,738 on their two-bedroom apartment, $1,163 on bills, $200 on groceries and $300 on dining out.

Natalie said: “I consider myself and my husband middle class. We live in the Seattle area and both worked nine to five jobs in the tech industry.

“We both make over $100,000 and as we started making more money, we started treating ourselves a lot more.”

In August 2023, Natalie and Keldon got married after saving $20,000 for their special day, prompting them to spend cautiously in 2024.

In an effort to curb their spending, the couple canceled their $208 gym membership, Natalie stopped treating herself to monthly manicures and pedicures, which cost her $100, and now the lovebirds only go out once a week to eat.

She added: ‘A big reason we decided to downsize our lifestyle is because we didn’t know where our money was going.’

As the couple’s salaries increased, they experienced what they called “lifestyle creep” — where they didn’t think twice about spending more because they could.

But soon the couple found themselves at a loss as to where all their money had gone, so they tried to cope with rising inflation

In an effort to curb their spending, the couple canceled their $208 gym membership. Natalie stopped treating herself to monthly manicures and pedicures, which cost her $100.

Natalie said: “Just five years ago we were broke students. As we started making more money, we treated ourselves more.

“We weren’t too concerned about spending money on going out, getting my hair done or traveling.”

The pair each spent $208 a month on gym memberships and dined out two to three times a week – an average of $60 each time.

Natalie said: ‘Last year was a bit of an anomaly for us – my husband and I got married, which cost a lot of money.

‘We’ve been traveling a lot and doing a lot of general expenses, so we haven’t saved that much.

“We are trying to cut back on these non-essential expenses.”

Natalie and Keldon are now trying to save $200 each and want to use their savings for a travel fund to visit Guam, the Philippines and Japan.

Since early 2024, the couple has ditched eating out in favor of more home-cooked meals.

They’ve also canceled their gym memberships and are working to ditch credit cards with annual fees.

As the couple’s salaries increased, they experienced what they called “lifestyle creep” — where they wouldn’t think twice about spending more because they could

Natalie and Keldon are now trying to save $200 each and want to use their savings for a travel fund to visit Guam, the Philippines and Japan

Natalie said: ‘I noticed it was becoming very difficult to keep track of how much we spent when we went out. I lived beyond my needs.

“I want to massively increase the savings we have and I feel like we’re spending way too much, so I’m trying to balance it out this year.

“I know we’ve been experiencing lifestyle creep — that’s a big reason why I wanted to downgrade my lifestyle and track where every dollar goes.”

In 2023, the couple spent a total of $4,601, now they’ve cut back and shared their new budget goals.

The couple’s monthly expenses are targeted for 2024: Mortgage: $2,378, bills: $753, gym membership: $0, dining: $227, eating out: $0, buying clothes: $10, socializing: $0, savings: $400. Total: $3,368.

According to Pay ratethe cost of living in Seattle is 50 percent higher than most areas.

According to Apartment listthe recommended household income for a two-bedroom apartment is $78,240 per year.

At the end of 2022, the median household income was $105,391, according to the U.S. Census Bureau.

A six-figure salary was once considered the benchmark for a comfortable lifestyle, but new research suggests it depends exactly on where you live.

A report from GoBanking Rates analyzed how far a $100,000 annual wage would reach in America’s fifty largest cities.

According to the study, someone making $100,000 in Seattle would have about $24,330 left after bills.

In 2023, the couple spent a total of $4,601, now they’ve cut back and shared their new budget goals

Due to the rising cost of living, many people across the country are trying to reduce their expenses

Many people have started living in their cars or vans due to inflation.

Due to the rising cost of living, many people across the country are trying to reduce their expenses.

Although inflation has decreased in recent months, it still remains high at 7.1 percent.

According to consumer data company Dunnhumby, a third of households are skipping meals or reducing portion sizes to save money.

Researchers found that 18 percent of the 2,000 study participants noted that they were not getting enough to eat.

Additionally, 31 percent of households have reduced their portion sizes due to empty pantries due to rising supermarket prices.

In addition to food costs, millions of people across the country lack a financial safety net.

According to researchers, 64 percent of participants admitted that they would not be able to raise $400 in an emergency.

Many have suffered from inflation, which has sent prices of basic goods skyrocketing – including meat and poultry prices rising 10.4 percent, grains 15.1 percent and fruit and vegetables 8.1 per cent.

Another point of pressure for many people across the country is gasoline prices, which have risen nearly 60 percent in the past year, while the cost of airline tickets has risen by more than 34 percent and the price of used cars by more than seven percent.

Clothing costs increased 5.2 percent, total shelter costs increased 5.5 percent and delivery services increased 14.4 percent.