SBF’s victims outrage as he’s sentenced to 25 years – HALF of what he faced – for $8billion crypto fraud

Victims of Sam Bankman-Fried’s FTX fraud have expressed outrage and disappointment at his “lenient” sentence, saying: “25 years is a joke.”

People who lost huge sums of money when the cryptocurrency exchange collapsed in 2022 have flocked to social media forums to share their anger after its disgraced founder was convicted on Thursday.

Judge Lewis Kaplan sentenced Bankman-Fried to 25 years in prison – and recommended a medium-security prison – and ordered him to pay $11 billion for stealing $8 billion from customers in an elaborate scheme.

A member of an FTX creditor group with the username “Bruno Dixon” wrote on the messaging app Telegram minutes after the verdict was handed down: “25 years is a joke.”

Another member of the same Telegram group, named Steven, said the verdict was “laughable for such a serious crime.”

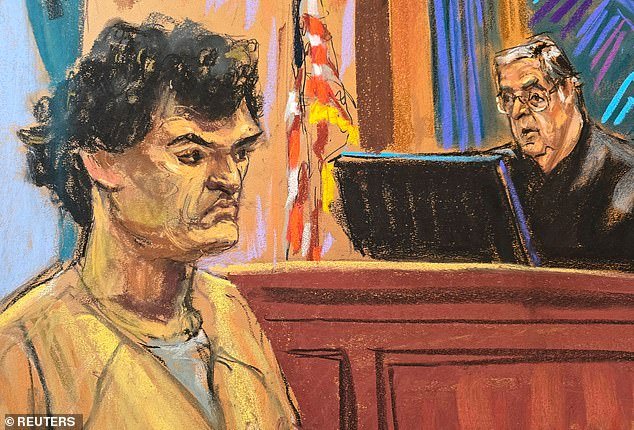

One of the victims Sunil Kavuri testified in court on Thursday ahead of the sentencing for FTX founder Sam Bankman-Fried

Bankman-Fried was sentenced to 25 years behind bars and ordered to forfeit $11 billion for defrauding investors in FTX crypto exchanges

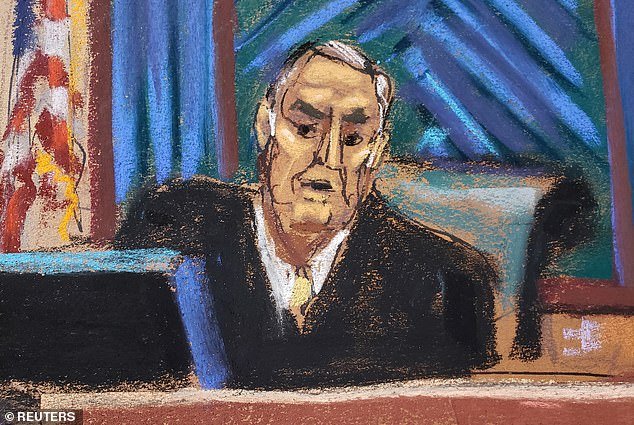

Judge Lewis Kaplan convicted Bankman-Fried and branded him a ‘thief’, but the victims were left dissatisfied

More than 1 million customers face potential losses from the sudden collapse of FTX in November 2022. Victims say they are still owed more than $19 billion based on current crypto prices – although Bankman-Fried pointed out during his sentencing insisting that victims can get their money.

Sunil Kavuri, a London-based technology investor at the Shomei Group, spoke on behalf of 200 victims in court ahead of the sentencing.

He said, ‘I suffered every day. This is an ongoing lie that we are all cured (through bankruptcy payments).”

He added that he had “taken away the money I wanted to spend on a family home.”

Kavuri told the court that he knows other victims who suffer from depression and some have even committed suicide.

A New York jury found Bankman-Fried guilty last year of stealing from unsuspecting customers to support his hedge fund Alameda Research, buy luxury properties and finance political donations.

He was convicted of stealing $8 billion from customers of his international crypto exchange FTX and could have been sentenced to 110 years in prison for these crimes.

Prosecutors have sought a prison sentence of 40 to 50 years for what they say is one of the largest financial frauds in American history.

Bankman-Fried’s defense has argued that less than ten years would be appropriate as clients would likely be cured.

Some victims said Thursday they were satisfied with the punishment, as expected for a corporate fraud.

“White-collar men are treated differently, so 25 is probably as good as it could get,” wrote one of the Telegram group’s administrators, adding that members should focus on getting their assets back.

But other victims compared it unfavorably to the 150 years passed to infamous fraudster Bernie Madoff.

“I thought 30-40 was somewhat fair,” wrote Tristan, another user of the same Telegram group, which has more than 3,000 members who say they have nearly $700 million in combined claims.

Bankman-Fried’s lawyers said the former FTX boss overlooked risk management but did not steal customer money. Bankman-Fried has vowed to appeal his conviction and sentence.

Some clients said they believed 25 years was not enough to justify plea deals that prosecutors struck with other top FTX officials, allowing them to avoid harsh sentences in exchange for serving as witnesses. Many speculated that Bankman-Fried would serve significantly less time after his promised appeal.

Mark Bini, a former federal prosecutor, said the judge’s sentence took into account the magnitude of the crime and the finding that Bankman-Fried lied on the stand.

The NBA’s Miami Heat stadium, which had a 19-year deal with FTX, was left in the lurch after declaring bankruptcy and had to drop the name of their building

A judge quickly dismissed the idea that Bankman-Fried deserves a lighter sentence because FTX customers lost nothing in the fraud

“Although less than prosecutors’ request for 40-50 years, it is a very important sentence and sends the message that people convicted of crimes in the crypto space will face serious consequences,” said Bini, now a partner at the Reed Smith law firm. .

During the trial, prosecutors called FTX customers to testify and submitted dozens of victim impact statements to the court prior to sentencing. Many said they had lost years of savings and had their lives destroyed.

“I lost my happiness, my ability to get out of bed, my desire to stay alive,” wrote one FTX customer who said he had a $4 million claim. Names were redacted.

It wasn’t just individuals who were lost: The NBA’s Miami Heat stadium, which had a 19-year deal with FTX, was left in the lurch after FTX went bankrupt.

They had to drop the name FTX Stadium and had to look for another partner. They eventually teamed up with the security software company Kaseya.

Administrators using FTX now are still recovering assets. They said in January they expect to have $13.7 billion to pay $31.4 billion in legitimate claims, including $9.2 billion from customers.

Customers will be paid “in full” but at November 2022 crypto prices, administrators said, meaning customers will not benefit from a rally in bitcoin and other tokens in recent months. Many FTX customers are fighting that decision.

FTX was one of many crypto company bankruptcies in 2022 caused by a collapse in crypto prices.