Savers go wild for simple trick for pocketing an extra $5,000 in 2023 and other tips

>

Aussies have gone crazy over a simple budget hack dubbed the ‘$5,000 challenge’ that’s going viral on TikTok, and it’s easy to follow for financial rewards.

The hack was shared on the smart women society budgeting page, where Australian founder and CEO Téa Angelos, 25, said that if you save a different number on each paycheck, you’ll quickly hit $5,000.

“This is the challenge of saving $5,000 in 2023,” Téa said.

scroll down for video

Aussies have gone crazy over a simple budget hack dubbed the ‘$5,000 challenge’ that’s going viral on TikTok, and it’s easy to follow (pictured Smart Women Society CEO Téa Angelos)

The amounts to be saved each month range from $135 in September to $745 in July, but can be changed and adjusted based on outstanding commitments.

‘Comment made when you’ve done your January transfer,’ Téa said.

If the $5,000 amounts were too much for you, the expert said there’s also a $1,000 challenge, where you can save anywhere from $25 to $165.

The amounts to be saved each month range from $135 in September to $745 in July, but can be changed and adjusted based on outstanding commitments.

Other Aussies on Facebook shared their smart saving tips, including the ‘envelope challenge’ or putting all your small change in a Coke bottle until it adds up.

The Envelope Challenge promises to leave you with an additional $5,050 in your lifetime.

All you have to do is start with 100 envelopes and write a number from 1 to 100 on each envelope.

Then he shuffles the envelopes and places them in a bucket or basket.

Every day you take out an envelope and whatever number you take out, you put that amount of cash inside and do so for 100 days until the envelopes are full.

‘I pay my bills online and then I take out the rest. Everything else I pay in cash. What I never use I put in a money box. I glued the lid together and punched a hole in it big enough to pay 50 cents, about $5 and quarters from the last payment,” one woman wrote alongside a photo of the cash box of hers.

‘I’m halfway through a bottle of coke with $2 coins. About $650 last time I counted,’ added another.

A third wrote: ‘Open an account at another bank and hide the card. Deposit $50 a week for the year, $2600. I just finished the whole of last year and I haven’t touched it.’

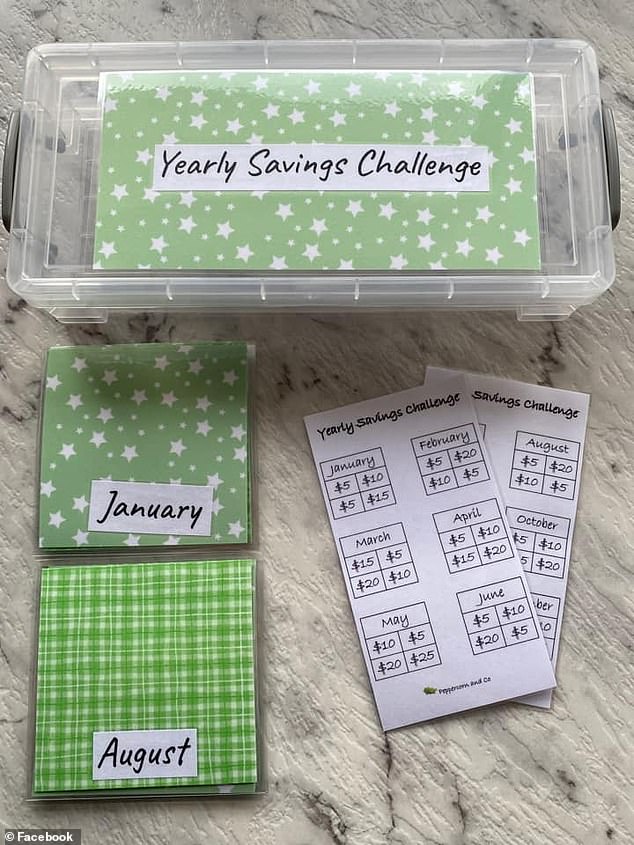

Others said things like the ‘annual savings challenge’ followed, which is essentially a form of financial bingo.

Other Australians shared the savings approaches they will use in 2023 to save money, including the ‘Envelope Challenge’ and the ‘Annual Savings Challenge’ (pictured)

Others said they use Coke bottles or makeshift money boxes (pictured) to put all their spare change, which adds up quickly.

Previously, Téa shared the budgeting approach she swears to be successful by: the 50/30/20 approach.

This means that 50 percent of your budget goes toward necessities, like rent or mortgage, groceries, transportation, and bills.

The next 30 percent goes towards your ‘wants’.

‘Want’ encompasses everything from dining out to a Netflix subscription to new clothes and other items.

Finally, the remaining 20 percent should go into your savings and investments, and if you make sure this happens or even invest more, you’ll likely get rich faster.

He also revealed the three savings accounts that every saver and investor needs.

The first is a high-yield savings account for short-term goals, like going on vacation.

The second is a high-yield savings account for long-term goals, like buying a home.

Finally, he said he needs an emergency fund account for “anything that goes wrong.”

“Keep this one in a separate bank to ensure success,” the 25-year-old said on TikTok.

Ideally, you need to save three to six months of your living expenses in your emergency fund in case something goes wrong.