Santander increases mortgage rates just FIVE days after cutting them

Santander has announced it will increase interest rates on some of its fixed-rate mortgage deals, just days after cutting them.

From tomorrow, the bank will increase all fixed interest rates for home buyers and people who refinance.

It is also withdrawing all its exclusive fixed-rate deals for first-time buyers, as well as a three-year fixed-rate product for homebuyers with a 10 percent down payment.

Changing course: Santander has announced it will increase interest rates on some of its fixed-rate mortgage deals, just days after cutting them

Santander’s interest rate increases will be relatively small, ranging between 0.05 and 0.2 percentage points.

Last week, Santander cut interest rates on some of its fixed rate deals. It cut its lowest two-year fixed rate from 4.55 percent to 4.1 percent, immediately becoming a best buy.

Today’s announcement marks a shift from the mortgage price war of recent weeks, with more than fifty lenders cutting home interest rates since January 1.

> What are the cheapest mortgage rates today? Find out with our tool

Ben Perks, managing director at Orchard Financial Advisers, said: ‘The steady rate cut announcements we enjoyed were destined to come to an end at some point.

‘Hopefully this is just Santander ‘turning off the tap’ as they were priced so competitively last week and have seen an influx of inquiries.

“We’ll see some ups and downs in the coming weeks, so borrowers shouldn’t worry too much.”

Why is Santander increasing rates?

As of Wednesday last week, experts began warning that mortgage rates were about to stop falling, following the surprise rise in inflation.

Inflation of 4 percent for December was slightly higher than the 3.8 percent that markets had forecast.

This led the financial markets to slightly reduce their expectations for base rate cuts this year.

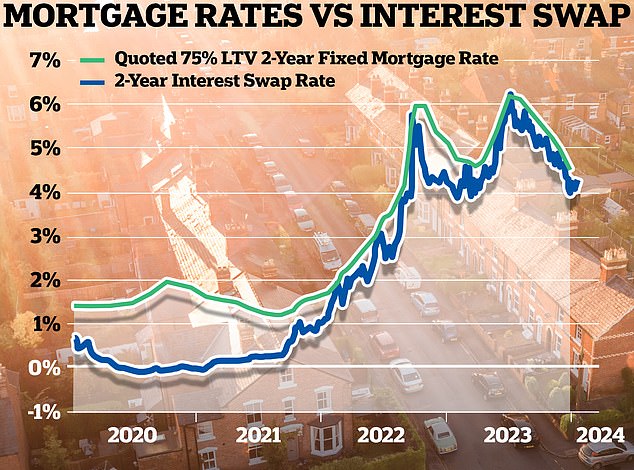

As for fixed rate mortgages, market expectations are generally reflected in the Sonia swap rate.

These swap rates show what banks and building societies think the future holds in terms of interest rates and help guide their fixed interest rates.

Rare: Many of the cheapest mortgage rates are very close to swap rates, indicating they are about to rise

Will there be more mortgage interest rate increases?

Five-year swaps are currently 3.69 percent and two-year swaps are 4.25 percent – both well below the current base rate. This is an increase compared to 3.4 percent and 4.04 percent at the beginning of the year.

Mortgage adviser Chris Sykes of Private Finance told This is Money last week that it is very rare for the lowest priced mortgage rate to fall below the swap rate.

In Santander’s case it did just that. The two-year best-buy fix of 4.1 percent was cheaper than the two-year swap rate of 4.25 percent.

Justin Moy, director of EHF Mortgages, said: ‘The recent rises in swap rates have led to a number of lenders raising rates in the past week.

‘Meanwhile, others are still launching cheaper deals, but they may limit availability for a few days as borrowers and brokers look for alternative deals.

“I suspect the general trend of rate cuts will continue as predicted, but a few bumps along the way are inevitable.

‘This highlights the need to work with mortgage brokers who can continue to source the best deals in a changing market, and potential borrowers should have their documents ready for any application to avoid disappointment.’

Some mortgage brokers also believe that the rate hikes have more to do with Santander struggling to cope with a large influx of customers, rather than any sign that mortgage rates will rise again across the board.

David Sharpstone, director of CIS Mortgage Advice, added: ‘Santander has long suffered from inconsistent service levels, and once they turn on the tap, the flow of applications increases, and the time to bid decreases.

“I suspect this is more of an application management response than something of market-wide concern.”