Saga prepares sale of Acromas underwriting business amid £721m debt pile

>

Saga prepares to sell Acromas insurance business as over-50s insurer tackles £721m mountain of debt

- Acromas Insurance underwrites approximately 30% of Saga’s business

- Saga sale would crystallize value and improve long-term returns’

Saga is in talks to sell his insurance company Acromas Insurance, as the over-50s seeks to tackle its £721 million mountain of debt.

The group told investors Monday that the sale is “consistent” with the turnaround strategy and would “crystallize value and improve long-term returns for shareholders.”

Acromas, which underwrites an estimated 25 to 30 percent of Saga’s insurance business, is based in Gibraltar and underwrites a variety of personal policies for businesses, including Saga Services and AA Insurance Services.

Saga plans a sale of the insurance business as it tries to deal with its mountain of debt

Saga launched a turnaround plan in 2019, which aimed to “create a refreshed, contemporary and confident brand with a data and digital approach to improve our customers’ experiences.”

The plan has had mixed results with the group, which also operates a travel business including cruises, which was forced to cut earnings expectations in September due to rising costs of insurance claims.

It said in a statement on Monday: “Saga’s operational and strategic position in the insurance market, in line with its move to a capital-light business model and its stated goal of reducing debt.

“It has concluded that a potential sale of its insurance business is consistent with group strategy and would crystallize value and improve long-term returns to shareholders.”

Saga added that there is no guarantee that a bid for Acroma will be made, but it will notify investors in due course.

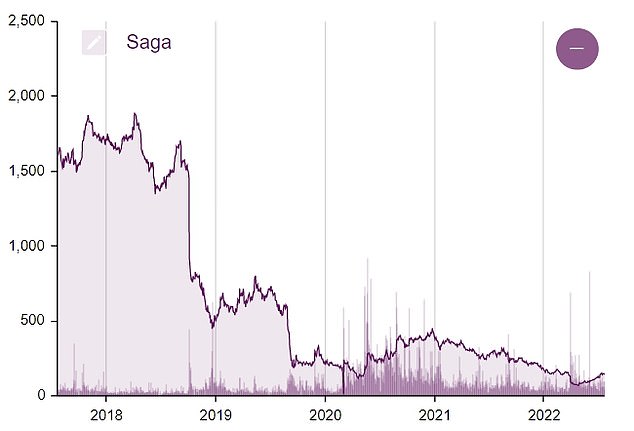

Saga Shares rose 3.5 percent to 155.7 pawns on Monday morning. They have lost about 41 and 90.2 percent of their value in one and five years, respectively.

Saga shares have lost more than 90% of their value in the past five years