Sadiq Khan would introduce a tax of £2 per mile to drive in central London, which could have cost £40 for a return journey

Sadiq Khan planned to charge drivers £2 per mile for driving in central London, leaked proposals reveal.

The plan was almost implemented before September 2026 and would become the main policy of the mayor’s final term.

Had it gone ahead, it would likely have proven to be one of the most controversial automotive builds in recent history.

Sadiq Khan planned to charge drivers £2 per mile for driving in central London from September 2026, leaked proposals reveal.

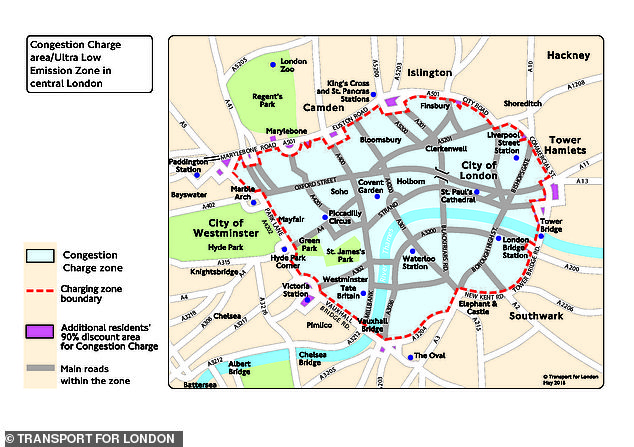

The leaked plans, seen and revealed by London Centric, show that the Mayor of London and TfL had plans to charge motorists up to £2 per mile for driving within the Congestion Charge zone, and provide them with a daily tax of £5.

“Project Gladys,” as it was codenamed internally, modeled how paying per mile would lead to a dramatic reduction in the number of cars on the roads.

Leaked plans reported by London central show that the Mayor of London and TfL had plans to charge motorists up to £2 per mile for driving within the Congestion Charge zone, and provide them with a daily charge of £5.

Under the proposals – in which prices had not yet been finalized – the original Ultra Low Emission Zone, ‘Inner London’, would likely receive a per-mile fee of 60p per mile. For the rest of Greater London there is a charge of 40p per mile.

According to London Centric, the eye-watering amounts motorists had to pay under the ‘Next Generation Charging’ scheme were modeled by TfL.

Driving a ULEZ compliant car through ‘inner London’ on a 30 mile return journey from Highgate to Fulham would have cost the motorist £18 in tax per mile.

Currently it only costs the amount a driver spends on fuel.

A return from Upminster to Oxford Circus would have risen from £15 to as much as £40 under the proposed changes.

The effect on traffic levels in London would have been drastic, with London Centric claiming the modeling showed there would have been 600,000 fewer car journeys, 170,000 extra bus journeys and 210,000 foot journeys.

In September this year, Sadiq Khan categorically ruled out the introduction of a radical tax system

The implementation process was also detailed in the leaked documents, with an initial trial period followed by public consultations throughout 2024.

By 2025, signage in London would be replaced, and the full pay-per-mile system would be enforced by September 2026.

London Centric reported that TfL ‘continued to develop the scheme with the Mayor’s support until the end of 2023, having already invested millions of pounds in the project and the required technology’

But in September, Sadiq Khan categorically ruled out the introduction of the radical tax system.

Speaking to the London Assembly, Mr Khan said: ‘I want to be crystal clear. A pay-per-mile scheme is not on the table and not on my agenda. I will not move the goalposts on ULEZ emissions standards.”

Protesters opposing the expansion of London’s Ultra Low Emissions Zone demonstrate outside BBC Broadcasting House in London on July 22, 2023

According to London Centric, the reason for the multi-million pound turnaround was strong opposition in the run-up to the mayoral election, where Sadiq Khan was accused of creating a ‘war on motorists’.

The unveiling of ‘Project Gladys’ comes after the Chancellor refused to introduce a per-mile tax in the Budget, despite pressure to introduce the new road charging system to replace conventional car taxes across the UK.

The latest recommendations suggest this could generate £30bn of cash flow for the economy and reduce congestion on the busiest routes.

Pay per kilometer: what is that?

As the name suggests, road tax means that drivers pay tax based on the number of kilometers they drive.

The further you drive, the more you pay.

It would replace the current VED system or ‘road tax’, where a vehicle is taxed depending on vehicle type, age, fuel type and – crucially – the measured CO2 emissions. Higher polluting vehicles are taxed with a higher VED rate.

Iceland and New Zealand already have a tax policy based on paying per mile.

How popular or unpopular is the national pay-per-mile?

Go Compare surveyed 2,000 drivers in December 2023, with just over half (53 percent) voting against a pay-per-kilometre tax system.

Unsurprisingly, 52 percent said they opposed the plan because they felt it would be unfair to car owners who are more dependent on their engines, especially those living in rural and remote areas.

Young drivers were the most against it: 60 percent of 18 to 24-year-olds felt this way.

In contrast, the quarter (26 percent) of respondents who would welcome price per kilometer were mainly older drivers aged 55 and over (one third).

Of the 26 percent who said they supported the switch, 76 percent thought it would create a fairer system.

The next most popular reason was the positive impact this would have on minimizing unnecessary car use and reducing congestion and emissions – 59 percent voted for this.

About 44 percent said they were in favor of it because they would pay less tax.

While this may seem fair to some motorists, there are stark warnings about how unfair it will be for rural drivers who have no choice but to drive on.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.