Ruffer will stay defensive ahead of ‘uncomfortable ride’ in 2023

>

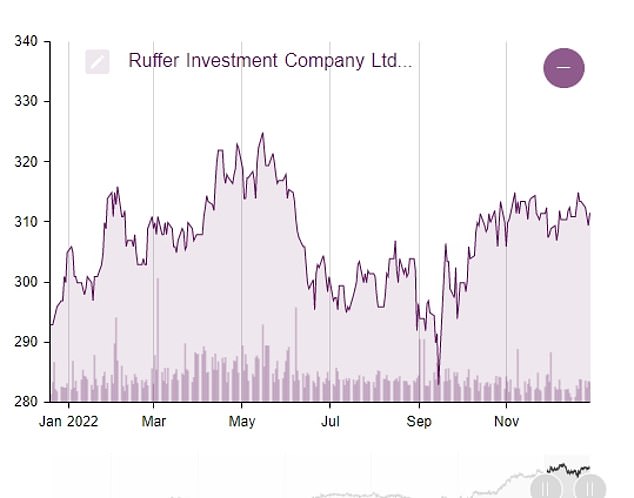

Ruffer defied the investment opportunity to end 2022 up 7% – but confidence will remain defensive pending an expected ‘uncomfortable ride’ in 2023

Ruffer Investment Company investment director Duncan MacInnes

Ruffer Investment Company defied the odds and ended 2022 in positive territory, outperforming the FTSE All Share.

The capital preservation-focused investment trust earned a total NAV return of 4.8 percent in the six months to December 31, bringing its total annual return to 8 percent.

But it said it wasn’t easy to do that in a year when the global stock market fell nearly 20 percent and bonds also took a beating from rising interest rates.

In his year-end report, Ruffer noted that there were few hiding places for investors.

The investment managers’ report, from co-managers Duncan MacInnes and Jasmine Yeo, said: ‘The writer Charles Bukowski said, “The most important thing is how well you go through the fire” – this feels particularly appropriate to describe 2022, in which investors in most asset classes have been burned. Even an investor with perfect foresight might still struggle.

“Imagine if you predicted US interest rates would rise by 400 basis points, not the 80 basis points predicted in January. Or predicted that realized inflation would explode to a 40-year high.

“A traditional inflation hedge portfolio of gold, oil, inflation-linked bonds and real estate would have lost money, and a traditional inflation hedge of gold, oil, inflation-linked bonds and real estate would have lost money.”

Ruffer said it was protected by its “unconventional protective toolkit,” which includes interest rate hedges through payer swaptions, which contributed 7.3 percent to portfolio returns.

In terms of share price, it returned 4.2 percent in the second half of the year and 7.3 percent for the full year, in line with its 7.8 percent annualized return since inception.

At the end of 2022, Ruffer traded at a 1.02 percent premium to NAV, but this has now dropped to 0.54 percent, according to AIC data. Shares in Ruffer were up 0.8 percent by mid-afternoon to 314 pence.

Perhaps unsurprisingly, the biggest negative impact of Ruffer’s performance last year was index-linked government bonds, which shed 5 percent of the portfolio after Kwasi Kwarteng’s disastrous mini-Budget.

“We have long referred to these bonds as the ‘crown jewels’ of our portfolio, as we believed they should provide the best protection in a world of financial repression. We still hold this view,” Ruffer’s executives said.

“That it can be so painful to hold on to a major asset when the overall portfolio performance is positive reflects the impotence of positioning and portfolio construction.”

Energy stocks also helped Ruffer break into positive territory, adding 0.6 percent to portfolio returns.

Confidence has signaled it will remain defensive in 2023 and remain in ‘crouch mode’ as quantitative tightening continues to ‘draw liquidity from financial markets’ [and] high-risk assets appear vulnerable to liquidation.’

“To protect against this, we continue to use credit protections. The protection arsenal is further enhanced by single name and equity index put options.’

Ruffer predicts that we will experience one of the “disinflationary pendulum swings” in the near term, with bond yields falling in response to a “bumpy recession landing for the economy.”

Longer term, “the destination of inflation remains crystal clear,” with the manager now expecting inflation to average between 3 and 4 percent over the next decade “but with much greater volatility.”

“We’re entering the year set up for an awkward ride.”

Ruffer says it enters 2023 with a highly liquid portfolio “ready to take advantage of opportunities the turmoil may create.”

Our assessment is that now is a bad time to take risks. Patience and preparation are our keywords and in the meantime you will receive a decent waiting wage for the first time in 14 years.’