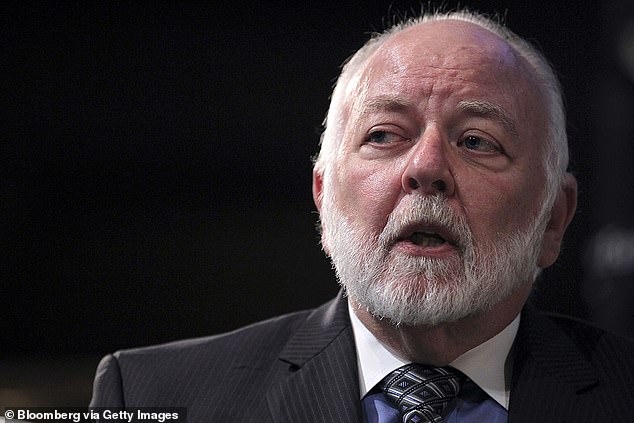

Famed financial analyst Richard X. Bove predicts the fall of the US economy and says China will take over as the money superpower in his final forecast ahead of his retirement: ‘The dollar is finished as the world’s reserve currency’

- The recently retired banking oracle – who predicted the 2008 housing crisis – made the dramatic prediction this week

- Bove, 83, claimed that other analysts will not make the same admission because they are “monks praying for money” and dependent on the mainstream financial system.

- This is despite the collapse of the real estate sector, which accounts for about a quarter of the country’s economy, and US growth

China will soon overtake the US economy and the US dollar will suffer a catastrophic collapse, according to renowned financial analyst Richard X Bove.

In a typically theatrical prediction, the recently retired 83-year-old banking oracle has announced that “the dollar is done as the world’s reserve currency.”

His dire forecast comes despite the collapse of China’s Evergrande, which is impacting the real estate sector, which makes up about a quarter of the country’s economy, and despite the US economy doing better than expected last quarter.

But it is in line with the longer-term outlook, with many analysts predicting that China will take America’s leading position in the world rankings in just over a decade.

In conversation with the New York TimesBove said you won’t hear his latest prediction from any other analyst because they are “monks praying for money” who don’t want to speak out about the mainstream financial system on which their livelihoods depend.

China will soon overtake the US economy amid the catastrophic collapse of the US dollar, according to famed financial analyst Richard X Bove (pictured in 2012).

Evergrande, one of China’s largest real estate companies, has defaulted on a loan for the first time, raising fears of a ripple effect on Chinese and global markets

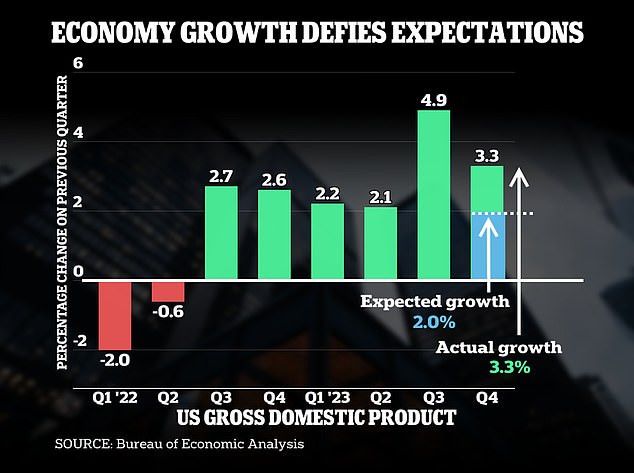

The US economy grew much faster than expected in the final three months of last year, exceeding expectations as consumers and businesses continued to spend

Florida-based Bove worked at 17 brokerage firms during his decades-long career before retiring from boutique brokerage Odeon Capital — and he’s no stranger to the spotlight and making bets that go against the grain.

Not all of his financial predictions have come true, but he is known for predicting the 2008 housing crisis three years before it happened in his 2005 report This Powder Keg Is Going To Blow.

His latest prediction is in line with forecasts based on current growth rates, which show that China’s GDP will be more than double that of the US in just over a decade. World economy.

In the short term, however, the US economy grew much faster than expected in the last three months of last year, while China took a major hit to the real estate sector.

The US easily missed a recession – which many analysts had predicted was inevitable.

Gross domestic product (GDP), a measure of all goods and services produced, rose 3.3 percent annually from October through December, the Commerce Department reported this month.

Analyst consensus was for growth of only 2 percent in the fourth quarter.

The pace was slightly lower than the 4.9 percent in the third quarter from July to September, which was due to a strong increase in consumer spending during the summer months.

But the latest numbers reflect the surprising sustainability of the U.S. economy — and the American consumer’s willingness to spend despite high interest rates and price levels.

It is the sixth consecutive quarter in which GDP has grown by 2 percent or more annually.

Bove (pictured in 2012) said you won’t hear his latest prediction from any other analyst because they are “monks praying for money” who don’t want to speak out about the mainstream financial system on which their livelihoods depend

The latest numbers reflect the surprising sustainability of the US economy – and the US consumer’s willingness to spend despite high interest rates and price levels

At least 10 Chinese real estate companies have gone bankrupt since the government launched a crackdown on the sector earlier this year, with Evergrande the biggest victim.

In addition to better than expected GDP figures, there was also good news about inflation.

A measure favored by the Federal Reserve — core personal consumption spending prices — rose 3.2 percent annually, up from 5.1 percent a year ago.

Meanwhile, China’s economy has taken a hit after real estate giant Evergrande, the world’s most indebted property developer, was ordered into liquidation by a Hong Kong court.

Evergrande Group is one of them dozens of Chinese developers which have collapsed since 2020 under official pressure to rein in rising debt, the ruling Communist Party sees as a threat to China’s slowdown. economic growth.

But the crackdown on excessive lending has plunged the real estate sector into crisis, putting pressure on the economy and throwing financial systems in and out of China into turmoil.

Chinese regulators have said the risks of global shockwaves from Evergrande’s failure can be mitigated.

Court documents seen Monday showed Evergrande owes about $25.4 billion to foreign creditors. Total assets of approximately $240 billion are dwarfed by total liabilities.