Retailers are suffering from a disappointing start to the ‘golden quarter’, as turnover lags behind Budget

- The lead in sales of clothing and shoes is diminishing as shoppers take control

British retailers had a disappointing start to the sector’s key ‘golden quarter’ as pre-Autumn Budget jitters caused consumers to hold back on spending.

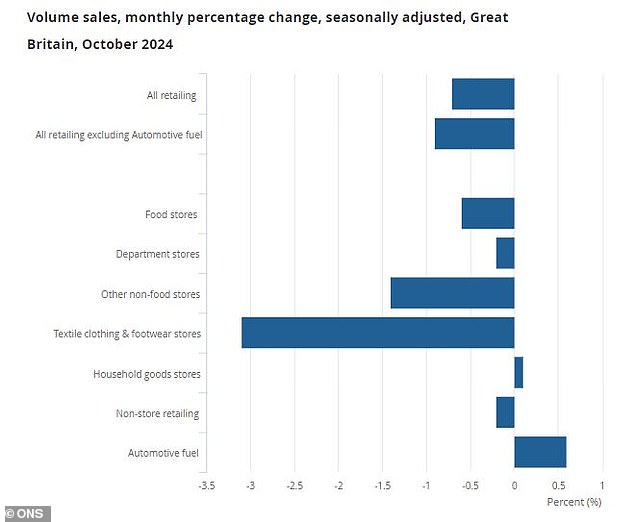

Retail sales followed a 0.1 percent rise in September and a 0.7 percent decline in October, driven by a 3.1 percent decline in clothing and shoes, and a 0.4 percent fall in food, it shows from data from the Office for National Statistics. Friday.

Sales volumes rose 2.4 percent year-on-year this month, but remain 1.5 percent below pre-corona levels in February 2020.

Silvia Rindone, EY’s retail leader in Britain and Ireland, put the October decline down to weak consumer confidence, driven by “uncertainty around the autumn statement, rising energy bills and the approaching cost of Christmas”.

She added: ‘The coming months are a critical time for many retailers. The retail sector faces significant headwinds from the upcoming National Insurance changes and minimum wage increases.”

Many retail businesses have already warned that the impact of higher labor costs, which come into effect in April 2025, will lead to higher prices and possible job losses.

Retailers are hoping for a recovery ahead of the main festive trading period

They’re hoping for a recovery as Black Friday and the crucial festive shopping season loom.

Danni Hewson, head of financial analysis at AJ Bell, said: ‘It could be that people were just keeping their powder dry, saving their pennies for the late half term or to indulge in Christmas.

‘It may also be that the unusually mild weather has simply delayed the purchase of winter woolen clothing, which was needed over the past week.

“But with retailers like JD Sports scaling back sales expectations for this year, the next crucial few months could be incredibly difficult for the sector.”

Sales of clothing and shoes led to the decline, while gasoline appeared to be the only outlier

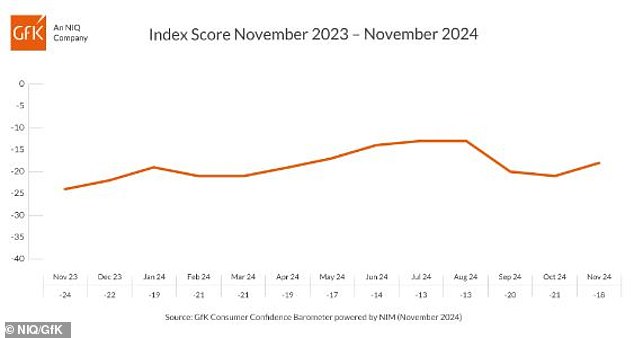

Separate data from Friday could be a bright spot for retailers, with indications that consumer pessimism is waning.

The GfK Consumer Confidence Index rose to -18 for November, up from -21 in October and well ahead of economists’ forecasts of a deterioration to -22.

Economists consulted by Reuters had expected a deterioration in the confidence indicator to -22.

Retail sales remain low

Thomas Pugh, economist at RSM UK, said: ‘Looking ahead, retail sales should grow until 2025 as higher consumer incomes and rising consumer confidence feed through to higher spending volumes.

‘While headline inflation rose from 1.7 percent in September to 2.2 percent in October, retail prices fell at an accelerated pace.

“Indeed, retail inflation fell from -1.3 to -1.6 percent, meaning lower prices will help an increase in spending feed through into bigger increases in sales volumes.”

Consumer confidence improved this month

DIY INVESTMENT PLATFORMS

A. J. Bell

A. J. Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund trading and investment ideas

interactive investor

interactive investor

Invest for a fixed amount from € 4.99 per month

Sax

Sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals have been chosen by our editors because we believe they are worth highlighting. This does not affect our editorial independence.