Reserve Bank boss Michele Bullock’s worrying hint that another rate hike is on the way as she puts mortgage payments on hold this month

Michele Bullock has strongly hinted at her first historic board meeting as Reserve Bank governor that interest rates could rise again in the coming months.

Interest rates remained unchanged on Tuesday at an eleven-year high of 4.1 percent.

But Ms Bullock has suggested the pain is far from over, with inflation rising to 5.2 per cent in August from July’s level of 4.9 per cent.

This pushed the consumer price index further above the Reserve Bank’s target of two to three percent, while petrol prices rose 14 percent over the year.

“Inflation in Australia has peaked, but is still too high and will remain so for some time,” Bullock said.

‘There are significant uncertainties surrounding the prospects.

Michele Bullock has strongly hinted that interest rates could rise again during her first board meeting as Reserve Bank governor

“Service price inflation has been surprisingly persistent overseas and the same could happen in Australia.”

Ms Bullock strongly hinted that another rate hike could be possible to get inflation back to target by June 2025, as Australians struggle with a 13 per cent increase in electricity and gas bills and double-digit price increases for bread and dairy products.

“Further monetary policy tightening may be necessary to ensure inflation returns to target within a reasonable timeframe, but this will remain dependent on the data and evolving risk assessment,” she said.

“Returning inflation to target within a reasonable time frame remains the administration’s priority.

‘High inflation makes life difficult for everyone and harms the functioning of the economy.’

The rise in the CPI in August marked the first monthly deterioration in headline annual inflation since April – with the cost of living worsening for the second time since hitting a 32-year peak of 8.4 percent in December last year.

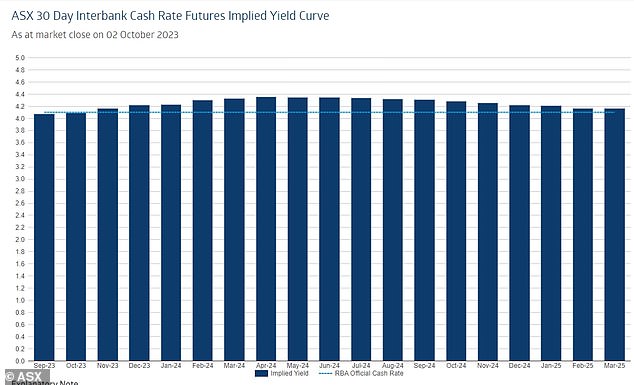

The futures market is also concerned. Investors betting on monetary policy now expect a rate hike in early 2024 instead of a rate cut as recently expected.

National Australia Bank expects a rate hike in November following the release of September quarter inflation data, making it the only one of the Big Four banks to forecast another rate hike (for now).

Ms Bullock has hinted that excessive wage prices, in an era of declining productivity and a low unemployment rate of 3.7 per cent, could increase inflationary pressures until unemployment rises to 4.5 per cent by the end of 2024.

“There are also uncertainties about the lags in the impact of monetary policy and how firms’ pricing decisions and wages respond to the slower growth of the economy at a time when the labor market remains tight,” she said.

“Wage growth has picked up over the past year, but is still in line with the inflation target, provided productivity growth picks up.”

Shortly before the RBA rate decision, new housing finance data from the Australian Bureau of Statistics showed a 2.2 per cent increase in August, with home loan values rising 2.6 per cent.

Ms Bullock replaced Philip Lowe as Australia’s most powerful central banker last month, following anger over the RBA’s rate hikes in just over a year, with the last hike coming in June.

This marked the most aggressive pace of monetary policy tightening since 1989, pushing monthly mortgage payments up 63 percent since spot rates rose from a record low of 0.1 percent.

Tuesday’s board meeting was the first ever to be chaired by a woman since the Reserve Bank was founded in 1960.

Interest rates were unchanged at an 11-year high of 4.1 percent on Tuesday (stock photo shown)

The futures market is concerned as investors betting on monetary policy now expect a rate hike in early 2024

Ms Bullock replaced Philip Lowe on September 18 after his suggestion in 2021 that rates would remain in place until 2024 “at the earliest” led to Treasurer Jim Chalmers refusing to extend his term to 10 years.

From next year, a specialist monetary board will set interest rates, with six of the nine members being part-timers outside the Reserve Bank.

Former RBA governor Ian Macfarlane is concerned that Ms Bullock could be in the minority, leading to her defending a rate hike she may not agree with.