Republicans call Biden forgiving another $1.2 billion in student loans a ‘slap in the face’ and ‘screw you’ to American taxpayers and those who know the ‘real’ cost of college

Republicans are pushing back on Joe Biden’s efforts to cancel student loan debt after the White House announced it has wiped out a total of nearly $138 billion since taking office.

The Biden administration’s aggressive effort to wipe out more than $1.7 trillion in U.S. student debt comes despite the Supreme Court blocking President Biden’s initial $400 billion plan.

On Wednesday, the White House announced that more than 150,000 borrowers have been notified of their debt forgiveness totaling $1.2 billion in the first round of debt forgiveness under the administration’s new SAVE program.

Republican Party lawmakers argue that the administration’s continued efforts place a huge burden on taxpayers, are unfair to the millions of Americans who have not gone to college and are an overreach of Biden’s authority.

“UPDATE: Biden will send a second email to taxpayers and others who didn’t take out loans or work hard to pay them back: ‘Fuck You!’,” Sen. Eric Schmitt, R-MO, responded in a message to .

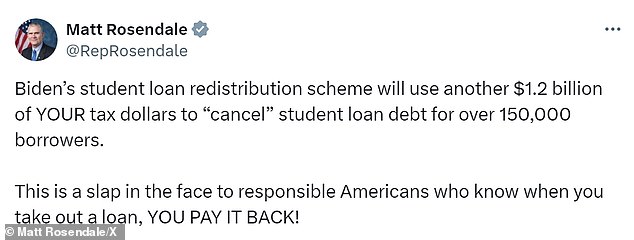

Congressman and Senate candidate Matt Rosendale, R-MT, wrote: “Biden’s student loan redistribution program will use an additional $1.2 billion of YOUR tax dollars to “cancel” the debts of more than 150,000 borrowers. This is a slap in the face to responsible Americans who know that when you take out a loan, YOU PAY IT BACK!”

Sen. Joni Ernst, R-IA, fired at Biden must end his socialist plans and focus on helping families and students understand the true costs of college!”

“There is no such thing as ‘forgiveness’ for student loans,” Sen. Tom Cotton, R-AR, said online. “President Biden is simply transferring the debt so you and your children can pay back the student loans you never took out.”

Republican lawmakers and Biden critics have condemned the administration’s efforts to cancel student loan debt

Multiple Republican lawmakers have rejected the Biden administration’s efforts to cancel student loan debt, saying taxpayers should not have to foot the bill

Wednesday’s announcement by the White House marks the first group of borrowers to be approved for student loan relief under the shortened repayment period of the income-driven Saving on a Valuable Education (SAVE) plan.

The Penn Wharton Budget Model estimated last year that the SAVE plan would cost $475 billion over ten years.

When asked where the money would come from with the first round of $1.2 billion in forgiveness, senior administration officials argued that the Department of Education has the authority to administer student loan programs and does not need additional appropriations or an act of Congress like others programs do that.

The Biden administration launched the SAVE plan after the Supreme Court blocked the president’s original $400 billion student loan cancellation plan in June last year.

It is one of several alternative efforts the government is working on to cancel student loan debt.

But critics have raised concerns that the efforts have not solved the underlying problem of skyrocketing college costs.

The cost of a college education has nearly tripled since 1980.

Education Secretary Miguel Cardona stands next to President Biden at the White House after the Supreme Court blocked the president’s original $400 billion student loan forgiveness plan

Protesters gathered outside the Supreme Court when the court blocked President Biden’s previous student loan relief plan last June

The SAVE plan is an income-driven repayment plan for borrowers who have been making payments for at least ten years and originally withdrew $12,000 or less for college.

For every $1,000 borrowed above that, borrowers can receive forgiveness after an additional year of payments. All borrowers under the SAVE plan receive forgiveness after 20 or 25 years, depending on whether they have loans for graduate school.

Republicans in the House of Representatives tried to block the program’s implementation last year by passing a resolution, but the effort failed to gain support from the Democratic-controlled Senate.

To date, more than 7.5 million borrowers have enrolled in the SAVE plan, with more than 4.3 million having $0 in monthly payments. The Biden administration has touted it as the most affordable, income-driven repayment plan in history.

Borrowers approved for relief will receive emails from Biden on Wednesday informing them and letting them know they don’t need to take any further action.

“This is truly a lifeline for borrowers,” Education Secretary Miguel Cardona said of the latest round of student loan forgiveness. “The people receiving the debt relief announced today have sacrificed and saved for a decade or more to pay their student loans.”

Democrats and advocates have welcomed the announcement as a relief for Americans struggling under the burden of student loan repayments.

“Borrowers with low balances will finally get the relief they deserve. Student debt forgiveness results in relief from a financial burden that has burdened thousands of borrowers,” said Natalia Abrams, president of the Student Debt Crisis Center. “This is more evidence that student debt forgiveness is the way forward to restore an affordable higher education system in this country.”

The Biden administration has been working on several ways to cancel student loan debt after the Supreme Court blocked the previous plan, including launching the SAVE plan and going through the regulatory process.

For those approved, borrowers will see this reflected in their bills as student loan servicers begin processing debt forgiveness in the coming days.

Going forward, the Ministry of Education will continue to regularly identify and forgive student loan debt under the plan.

Starting next week, the department will also begin emailing borrowers who may qualify for forgiveness if they transition to the SAVE program.

Other steps the White House has taken to forgive student loan debt include changes to government loan forgiveness and income-driven repayment programs. They have also forgiven the debts of more than a million borrowers defrauded by their schools, and more than half a million borrowers with permanent disabilities.