Rents are rising by £3,240 annually compared to three years ago, with the number of properties available to let ‘scarce’

Tenants are paying £270 more every month than three years ago, according to new Zoopla figures.

The average annual rental cost is now £15,240, an increase of £3,240 compared to three years ago, the property portal revealed.

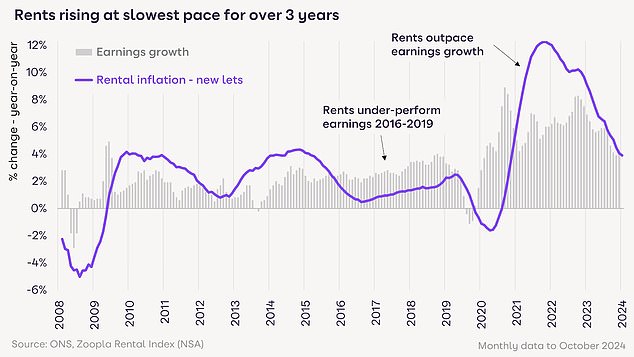

This means the average renter has seen a 27 percent increase in rental costs since November 2021, more than the 19 percent profit growth over the same period.

Richard Donnell, executive director of Zoopla, said: ‘Private tenants moving have seen rents rise faster than incomes over the past three years.

‘The number of rental properties has not grown since 2016, creating a shortage for renters at a time when demand has exploded amid a strong labor market and the rising costs of home ownership.

‘The ambitions to expand housing construction are important because the fastest way to relieve the pressure on tenants is to increase the supply of private and social rental housing.

‘Private landlords will continue to play an important role and should be encouraged to remain in the market.’

Slowing but still rising: Zoopla predicts rents will rise 4% by 2025, driven by faster rental growth in more affordable areas

Do rents reach a ceiling?

The annual rent increases recorded at almost double digits over the past three years appear to have reached somewhat of a ceiling.

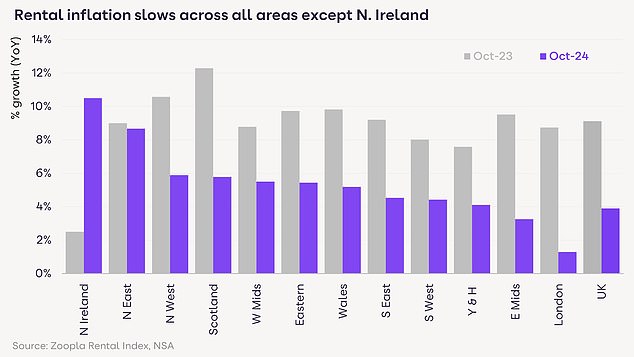

Average rents for new rentals are up 3.9 percent over the past year, the lowest growth rate since August 2021, and down from 9.1 percent a year ago.

The slowdown is partly due to a narrowing of the supply-demand imbalance over the course of 2024.

Tenant demand has fallen by almost a third compared to this time last year, while the number of rental properties on the market has risen by 12 percent.

The increasing pressure on the affordability of tenants in areas with high rents also causes prices to rise even further.

This is why London has recorded the biggest slowdown, with average rents up 1.3 percent over the past year, compared to a peak of 8.7 percent a year ago, according to Zoopla.

London also has the highest rental prices, with an average of £2,190 per month, which is 70 percent higher than the UK average.

Adam Jennings, head of lettings at Chestertons, says that as well as prices reaching record highs, they are seeing a rise in the number of people leaving the private rental sector and onto the property ladder.

‘In recent years, rents in London have risen to unprecedented levels as an increasing number of tenants have been unable to buy due to London’s high property prices and high mortgage rates.

‘With interest rates having fallen and stamp duty changes on the horizon, aspiring homeowners are feeling more motivated to take their first step on the property ladder.

‘As a result, the London rental market is recovering and more favorable conditions are being created for the remaining tenants.’

Where are rents still flying high?

In more affordable regions of Britain, rents have continued to rise dramatically.

Rents have risen 10.5 percent year-on-year in Northern Ireland and 8.7 percent in the North East of England.

These two areas have the lowest average rents of £801p/m and £732p/m respectively.

Outside London, rents are rising fastest in areas outside the major cities such as Rochdale (by 11.9 percent, Blackburn by 10 percent) and Birkenhead by 9 percent.

This largely reflects ‘catch-up’ rental growth as tenants look for better value for money areas in and around major cities.

In some locations it is all about supply meeting demand.

In Nottingham, for example, rental growth has come to a standstill. It is the only city where the supply of rental properties has increased in the past year, giving renters more choice.

As a result, rents have remained unchanged over the past year, after rising 10.4 percent the year before.

What next for the rental market in 2025?

Despite more homes available than a year ago, the number of homes available to rent remains below pre-pandemic levels in all regions except the East Midlands.

Zoopla says private landlords are continuing to sell rental properties at a steady pace despite tighter regulations and higher financing costs, despite significant increases in rental prices.

However, Zoopla believes that the peak of private landlord sell-offs is now over.

The question now is when market conditions look good for landlords to increase investments and expand rental supply. This is still a long way off and requires lower base rates and higher rental yields.

One bright spot is higher business investment in new-build rental properties, but even in these cases the pace of new construction has slowed due to higher financing costs and more regulation.

Zoopla expects a continued mismatch between supply and demand, with average rents for new rentals rising by four percent by 2025, bringing annual rental costs to £15,850.

Rent growth in London and the larger cities will lag behind the UK average due to increasing pressure on affordability and further modest growth in supply.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.