Recession watch: Why the IMF has begun to strike a more positive tone

>

The International Monetary Fund has suggested that 2023 could turn out to be a better-than-expected year for the global economy as positive data begins to ease expectations of a global recession.

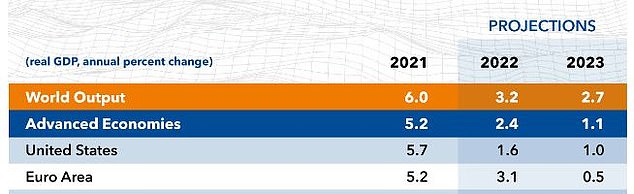

While deputy general manager Gita Gopinath confirmed the IMF’s forecast of 2.7 percent global growth in 2023, a slowdown from 3.2 percent in 2023, she told the World Economic Forum in Davos on Tuesday to expect “improvement” in the second half of the year. and until 2024.

She said that while the war in Ukraine, the lingering impact of the pandemic and high inflation meant a “tough year” ahead, “there are signs of resilience” in the global economy.

IMF Deputy Managing Director Gita Gopinath tentatively suggested 2023 could herald a better-than-expected year for the global economy

The latest IMF forecasts in November – new data will be released later this month

In particular, Gopinath emphasized a strong labor market and “maintaining” consumption in many markets.

She said: “We expect global growth to bottom out this year, but to improve by the second half of this year and into 2024.”

The IMF’s updated forecasts for the global economy will be released on January 31.

While the final months of 2022 have been dominated by gloomy forecasts for the global economy, data from the US and Europe in recent weeks has allayed some concerns.

In the US, inflation is falling faster than expected, while the Commerce Department said in December that third-quarter GDP growth was stronger than previously thought at 3.2 percent. There will be an update on the fourth quarter of the US economy later this month.

A similar picture can be seen in the Eurozone, where annual inflation fell from 10.1 percent to 9.2 percent in December 2022 and GDP grew by 0.2 percent in the third quarter.

Germany’s chancellor, Olaf Scholz, added to the optimism on Tuesday when he told Bloomberg that Europe’s largest economy would completely avoid a recession.

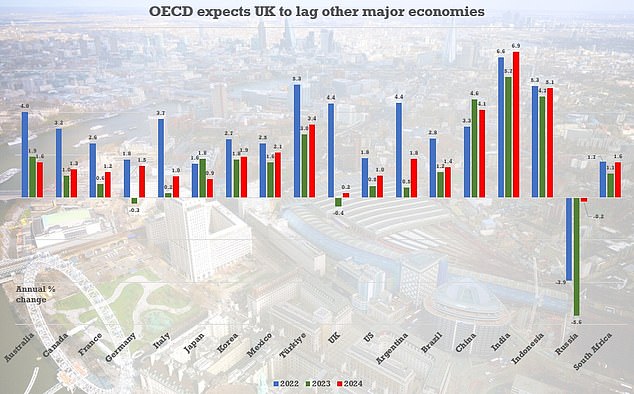

The OECD has previously predicted that the UK economy will lag all G20 countries, with the exception of Russia

ING analysts said on Wednesday: ‘Markets [are] no longer a disastrous recession for the eurozone.

This is reflected in a greater appetite for riskier investments and has accelerated the outperformance of riskier bonds relative to safer bonds. In a word, spreads tightened. However, the two developments could turn out to be contradictory, as better growth could slow down inflation.’

CEO of Witan Investment Trust Andrew Bell added: “Falling inflation in many economies has reduced the risk of overzealous monetary tightening and increased the likelihood of a soft landing for the global economy or a period of relatively mild recession.

Bell also highlighted “non-cyclical factors boosted by recent events” that could boost growth prospects, such as strengthened investments in supply chain resilience, higher global defense spending and “greater infrastructure investment in renewable energy sources.”

The global economy is also poised for a bull’s eye from the second largest contributor, China, which is now lifting its extreme Covid-19 restrictions.

Ewan Thompson, fund manager of the Liontrust Emerging Markets fund, said: “Given the recession fears plaguing developed economies this year, the global economy will receive welcome support from China, where growth will accelerate rapidly at a time of significant uncertainty elsewhere. .’

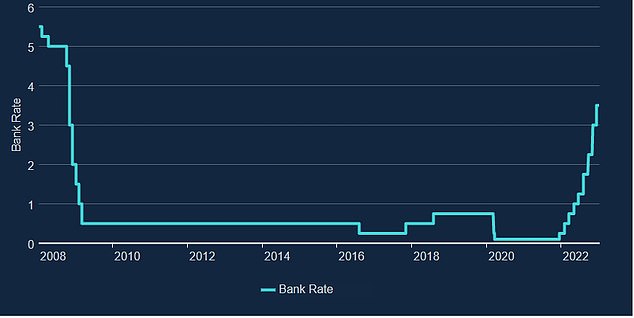

The Bank of England continued to raise interest rates in 2022

Tougher outlook for the UK economy

However, the outlook for the UK economy remains relatively weak, even as inflation begins to ease and after the ONS lifted its November growth reading.

Britain is expected to have the weakest growth of any G20 economy by 2023, with the exception of Russia.

Oliver Rust, head of product at the independent inflation data aggregator, Truflation said: “There is no sugarcoating: it looks like it’s going to be another tough year for the UK economy. Inflation appears to remain high and unlikely to return to the BoE’s target of 2 percent any time soon.

This, coupled with high interest rates, falling wages and rising unemployment, means the UK is likely heading into a recession – if not one already.

‘We are [also] to understand the full impact of Brexit on the UK economy, although we know it is already hurting small and medium sized businesses struggling to export their goods to Europe. This may be the biggest known-unknown of 2023 that could play a big role in how the UK economy performs.”

While UK inflation is falling, it remains stubbornly high, and analysts expect the BoE to continue its rate hikes – starting with a 50 basis point jump to 4% in early February.

The growth cycle will further depress growth in a more conservative credit environment, even if the UK economy exceeds expectations in the coming year.

Marcus Brookes, chief investment officer at Quilter Investors, said: ‘Although a recession is forecast, the UK economy surprised with a positive GDP reading in November.

So it could be that the economy is not as bad as previously feared and that the BoE will keep its foot on the gas.

“If inflation doesn’t start to come down a little faster than it is, any chance of a reversal in monetary policy is getting less likely by the day.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and use it for free. We do not write articles to promote products. We do not allow any commercial relationship to compromise our editorial independence.