Reality check for home sellers as they’re forced to cut asking prices

Home sellers are facing a reality check, with more and more home sellers being forced to lower their asking price to get the property sold.

According to Rightmove, the average time it takes a seller to find a buyer has increased by three weeks, from 45 days this time last year to 66 days now.

Price cuts have also become more widespread in 2023, with 39 percent of properties now seeing their price reduced during marketing, compared to 29 percent last year.

Adjustment: Rightmove says 39% of properties have now had their price reduced during marketing, compared to 29% last year

Despite this gloomy outlook, Rightmove predicts that sellers will continue to price their homes optimistically, with the average asking price for a new listed property falling by just 1 percent by the end of 2024.

A year ago, Rightmove predicted that average asking prices for new sellers would fall by 2 percent by 2023, and according to the company they are currently 1.3 percent lower year-on-year.

But Tim Bannister, property expert at Rightmove, says the market has proven much more resilient than many expected given higher mortgage rates.

He said: 'This year has been better than many had predicted, with no significant signs of forced sellers, lower than expected price falls and good buyer demand for good quality properties.

“However, it has been a challenging mindset shift for some sellers to make the transition from the frenzied market of recent years.

'The agreed sales level is 10 per cent lower than currently seen in the more normal 2019 market, so sellers will need to price even more competitively next year to ensure they secure a buyer.'

How can sellers find a buyer in 2024?

Even as newly quoted asking prices remain relatively flat, it's the final sales price that really matters.

Sellers who price too high will likely have to wait a while to find a buyer and may find that they have to lower their asking price to do so – perhaps more than once.

Sellers may also be forced to seriously consider low offers.

Zoopla recently reported that one in four sales are agreed at 10 per cent or more below asking price, thanks to a rise in the number of properties on the market.

Motivated sellers are advised to price more competitively to secure a buyer in 2024, especially if there is an abundance of homes for sale in their area.

Rightmove says that pricing correctly from the start 'maximises the initial impact' with local buyers and gives new sellers a much greater chance of a successful sale.

Bannister adds: 'The housing market is made up of thousands of local markets, each with their own unique dynamics of supply and demand.

'In areas with more random sellers and fewer homes for sale, we may see asking prices for new sellers remain flat, or even rise very slightly compared to this year.

'In areas where sellers are struggling to attract buyers with limited affordability or need to sell quickly due to a change of circumstances, a new job or a strong desire for a lifestyle change, we are likely to see even more competitive pricing.'

Will 2024 be a buyer's market?

While interest rates are still high compared to recent historically low levels, the mortgage market is much calmer than it has been lately.

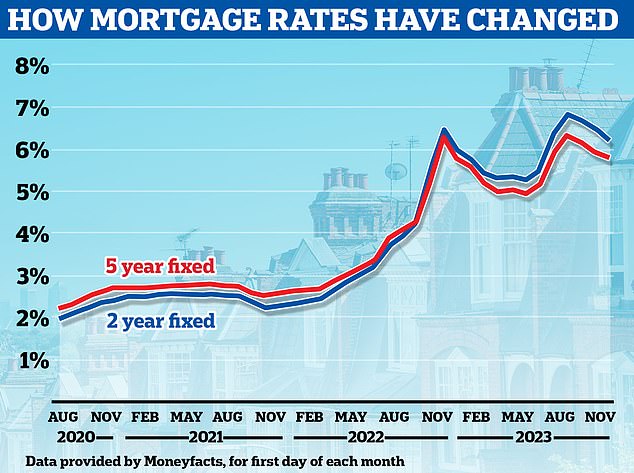

Mortgage rates have now fallen steadily since July, giving movers more stability and certainty about their potential monthly costs compared to the more volatile mortgage market this time last year.

According to Moneyfacts, the average five-year fixed rate is now 5.65 percent and the cheapest deals are now under 4.5 percent.

Those who have put off moving plans over the past year may decide that early 2024 is the right time to return, now that they can better plan for what they can afford.

Over the peak: Average fixed mortgage rates appear to be backtracking somewhat after a barrage of rate hikes in the first half of the year

Jeremy Leaf, a north London estate agent and former chairman of Rics, believes more optimism will return to the market early next year.

He says: 'Despite 15-year highs in key rates and persistent inflation, buyers are showing little chance of a correction, even as sales take longer and prices soften. Strong employment also supports the activity.

'We don't expect much change in the coming months, but there will be a gradual improvement as optimism always seems to become more apparent at the start of the year.'

Mark Harris, CEO of mortgage broker SPF Private Clients, believes mortgage rates are becoming more attractive, which should encourage more buyers to go ahead with their home buying or moving plans.

“The price of new mortgage rates has been trending downwards, with a number of lenders making cuts in the past week, bringing some early Christmas cheer to borrowers,” he said.

“With two- and five-year interest rates starting at less than 4.5 percent, we may be in a higher interest rate environment, but interest rates are becoming more palatable.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.