Real estate expert reveals ‘one of the greatest crises people will see’ in the coming years

A real estate expert is warning prospective homeowners of the “biggest crisis they will face” in the wake of Hurricane Helene ravaging Florida and North Carolina.

Ryan Serhant, who currently stars in Netflix’s Owning Manhattan, claims that there is an emerging “cost of home insurance” crisis due to the numerous natural disasters occurring across the country.

The seasoned professional explained that buyers are facing higher insurance rates than ever in states that are regularly hit by disasters – especially in states where properties are often in ruins.

‘It’s about $34 billion in bad amounts. It’s one of the biggest insurance crises I think we’ll see in a very, very long time.

“What’s even more frightening to me is that only two to four percent of homeowners actually have flood insurance.

The seasoned professional explained that buyers are facing higher insurance rates than ever in states that are regularly hit by disasters – especially those where properties are often in ruins.

Ryan Serhant, who currently stars in Netflix’s Owning Manhattan, claims there is an emerging ‘cost of home insurance’ crisis due to the numerous natural disasters occurring across the country

“If you get it through the National Flood Insurance Program, it costs $1,000 a year, on top of all your other costs. So it is a mockery,” he said on the talk show Varney & Co.

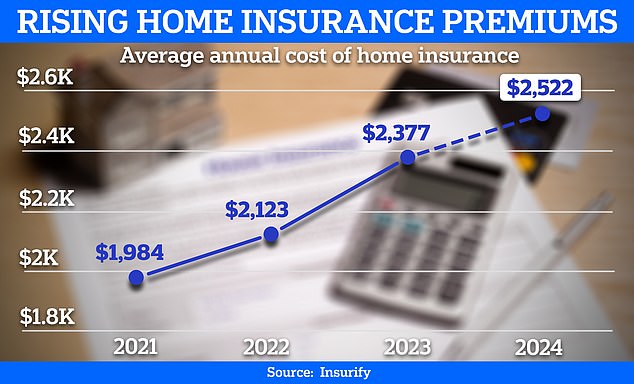

This is evident from recent data from the insurance comparison platform Insurethe typical annual premium will rise to $2,522 by the end of 2024 – a staggering six percent increase over last year.

This expected increase for 2024 follows a 20 percent increase in the past two years.

This is largely due to escalating natural disasters, insurers pulling out of certain areas – reducing competition – and higher home repair costs.

Debris lies on the ground in Asheville’s River Arts District, following a flash flood caused by Hurricane Helene, in Asheville, North Carolina, October 3

According to predictions from insurance comparison platform Insurify, the typical annual premium will rise to $2,522 by the end of 2024

Hundreds of people are still missing and almost a week after Helelne made landfall, 780,000 homes were without power

Rising costs are making home insurance increasingly unaffordable for many Americans, with some choosing to forego coverage altogether as a result.

Florida homeowners are already paying the highest premiums for coverage in the U.S., averaging $10,996 per year by 2023.

But Insurify projects that will rise another 7 percent this year, pushing the typical premium in the state to a whopping $11,759.

Meanwhile, those living in Louisiana currently face the second-highest home insurance rates in the country – $6,354 per year – nearly three times the national average.

A flood-damaged pottery tools business in the aftermath of Hurricane Helene on October 3 in Bat Cave, North Carolina

At least 200 people have died in six states in the aftermath of the powerful Category 4 hurricane.

Insurify predicts the state will see the largest premium increase in 2024, with a 23 percent increase to an average of $7,809.

But many predict the numbers could worsen due to the devastation caused by Hurricane Helene.

The death toll from the disaster has now surpassed 200 as rescuers continue to search for survivors of the storm – the deadliest since Katrina in 2005, which killed more than 1,800 people – which has ravaged the south-east.

Hundreds of people are still missing and 780,000 homes were left without power almost a week after Helene made landfall last week as a Category 4. Many are left wondering if more could have been done to raise the alarm about the massive storm before it hit.

Debris is scattered across the lake in the aftermath of Hurricane Helene, Wednesday, Oct. 2, in Lake Lure

A mobile home and car along the Swannanoa River in the aftermath of catastrophic flooding caused by Tropical Storm Helene in Swannanoa, North Carolina, October 3

After making landfall in Florida, Helene quickly passed through Georgia before drenching the Carolinas and Tennessee with heavy rain.

A small mountain town in North Carolina lies in ruins. Locals describe the community of Swannanoa as ‘completely obliterated’.

Over the weekend, estimates of damage caused by the hurricane ranged from $15 billion to more than $100 billion.