Property asking prices rise AGAIN during spring sales peak, says Rightmove, but buyers are being squeezed

According to Rightmove, asking prices for houses have risen in the past month as buyers and sellers ramp up their activity during the busiest period in the house selling calendar.

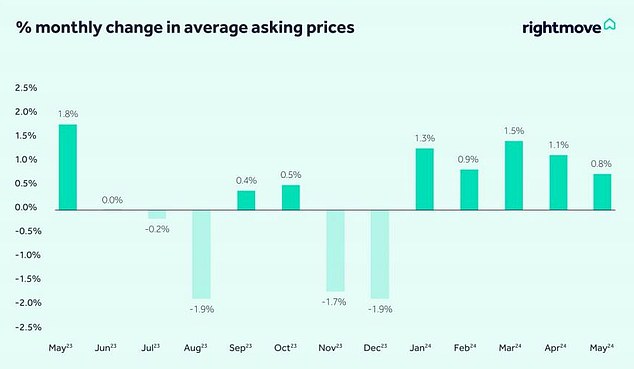

The property website reported an increase of 0.8 per cent in May, meaning the typical asking price is now £375,131.

That’s a new record and £2,807 more than in April. It is the fifth month in a row in which asking prices have risen, according to the Rightmove index.

Growth spurts: asking prices have risen slightly, although experts say the housing market won’t be in full bloom until mortgage rates start to fall

However, prices are still only 0.6 percent higher than this time a year ago, thanks to a series of asking price drops in late 2023 and early 2024, from which the market has only just recovered.

Many potential buyers put their plans on hold last year due to the rise in mortgage rates, and Rightmove said they were now returning to the market, which had helped drive up prices.

Agreed turnover has also increased by 17 percent in the first four full months of this year compared to the previous month, partly due to this effect.

However, mortgage rates remain high and Tim Bannister, Rightmove’s property director, commented: ‘The market remains price sensitive, and with prices reaching new records in most regions and mortgage rates remaining high, affordability is increasing for many homebuyers. is still stretched.’

However, lenders Barclays and HSBC both cut some of their mortgage rates this week, leading some brokers to predict the tide could be turning.

> See the latest rates you can get with our mortgage finder

Ups and downs: Average asking prices have moved in both directions over the past year

Fifth in a row: asking prices have risen since the start of this year, says Rightmove

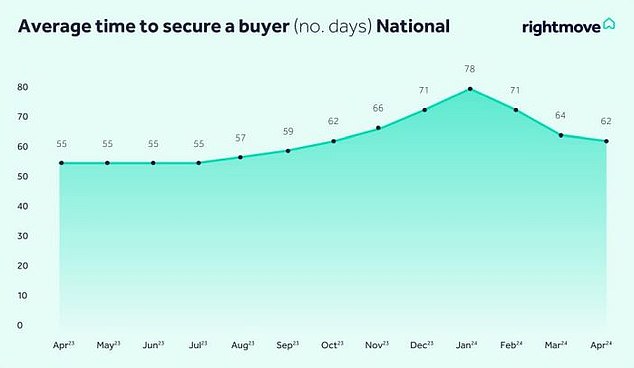

Increased activity also means that the time it takes to complete a sale increases. Rightmove recorded a ‘painful’ average of 154 days between reaching a sales agreement and legal completion.

As it takes an average of 62 days to find a buyer before the legal process begins, the real estate portal advised potential sellers hoping to have a new home by Christmas to take action now.

Nathan Emerson, managing director of property broker Propertymark, said: ‘Spring, heading into summer, is traditionally a busy time for the housing market and these latest figures could be ideal inspiration for sellers to use this as an opportunity to sell their property. to market. market.

“Buyers and sellers are adjusting to current inflation levels and higher interest rates, but the more these two factors move downward, the more likely there will be further stimulus to housing market growth.”

Slow: It takes 62 days to find a buyer, and a total of 154 days to complete the entire sales process from start to finish, according to real estate portal data

There is a lot of demand for family homes in the North East

Large family homes at the top of the ladder outperformed the market when it came to asking prices, rising 1.6 per cent to £682,661 last month.

This is compared with homes for second-movers, which rose 0.2 per cent to £343,268, and first-time buyers who saw their asking price rise 0.4 per cent to £228,003.

Rightmove defines the top of the ladder as all houses with five beds or more, as well as four-bedroom detached houses.

Second-step homes cover all three- and four-person homes that are not detached, while starter homes are homes with two beds or fewer.

In the past year, houses on the top ladder increased by 1.3 percent, second-step homes by 0.5 percent and starter homes by 0.7 percent.

Nick Leeming, chairman of broker Jackson-Stops, said: Seasonal demand and a surge in listings have helped drive spring transactions, although some may still be waiting in the wings for an elusive rate cut to ease affordability constraints.

‘Demand for detached homes and prime landed properties in particular is attracting the greatest competition from buyers, as beautiful places come into their own, the sun finally shines and people aim to move by the end of the year.’

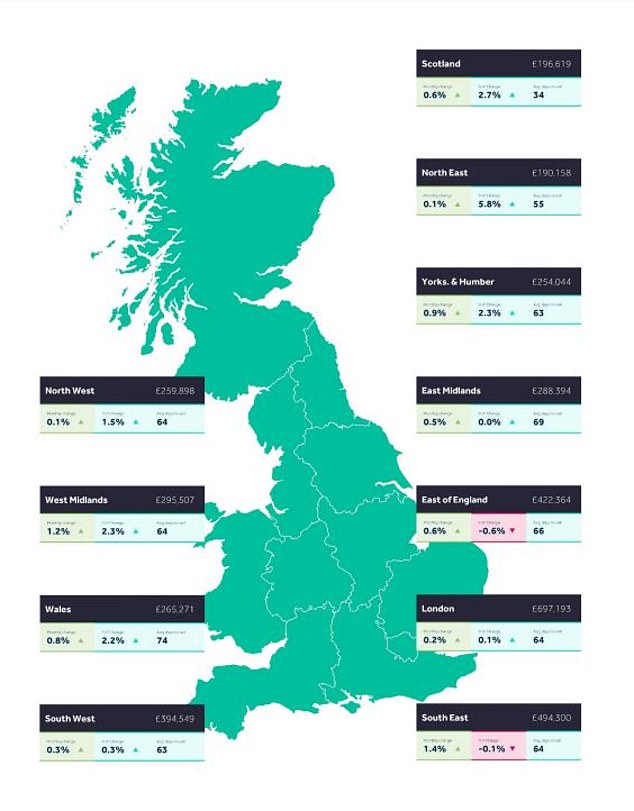

Geographically, the South East saw the biggest increase in asking prices during the month, up 1.4 percent, although it was still down 0.1 percent year-on-year.

The North East has seen the biggest annual increase, with asking prices rising by a whopping 5.8 per cent – far more than any other region. However, it still has the cheapest average prices in the UK at £190,158.

Hot in the North: The Northeast has seen the biggest jump in asking prices over the past year

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.