Property asking prices rise 1.3% in January as Rightmove reports a busy start to the year

According to Rightmove, asking property prices rose in January, following a busy start to the year for the housing market.

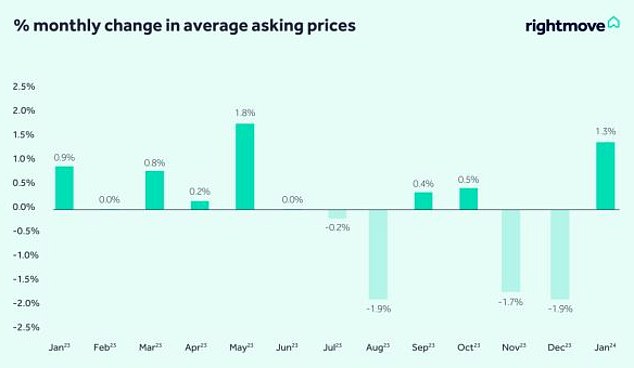

The price of new homes on the market rose by 1.3 per cent month-on-month, with the average house price approaching £360,000.

This was the biggest price increase from December to January since 2020, although average prices are still 0.7 percent lower than this time last year.

Rise: The average asking price for new sellers increased by 1.3% month-on-month, with the average property listing approaching £360,000

The online real estate portal also reported increased activity among home buyers and sellers.

It says the number of potential buyers contacting agents about homes for sale in the first week of 2024 is 5 percent higher than the same period last year.

The number of properties coming up for sale was also 15 per cent higher than at the start of last year, following a record number of sellers coming onto the market on Boxing Day.

The number of agreed sales at the beginning of this year is also 20 percent higher than in the same period last year.

No January blues: prices usually rise from a quiet December to a busier January, but this price increase is the biggest for January since 2020, according to Rightmove

Tim Bannister, director at Rightmove, said new sellers are confident about the prospects for the year ahead.

He said: ‘After a stop-start market in 2023, early signs point to a smoother year for movers in 2024.

‘Rightmove’s market-wide data allows us to see the very first signs of activity in the market, and the number of new listings, buyer inquiries to estate agents and agreed sales are encouraging early indicators.

‘Combined with our more recent mortgage data, the figures indicate that many are taking action to make their switch in 2024, including perhaps some who quit last year due to the more volatile mortgage market.

‘There are now more new sellers entering the market, and with more confidence in prices.’

The busy start to the year, reported by Rightmove, echoes a report from Realmoving, a comparison site used by around one in ten British movers.

It claims that new registrations for removal services, including conveyancing, surveying and removals, were 73 percent higher in the first week of January than the same period last year.

Rob Houghton, founder and CEO of Realmoving, said: “It is encouraging to see a burst of activity from moving companies at the start of this year.

‘People will only put their lives on hold for so long, and while the cost of borrowing is still a major issue, it appears many of those who put it off in 2023 are now making the decision to move on, encouraged by the resilience of prices and some downward movement in mortgage rates as lenders compete for business.”

It still takes time to find a buyer

Although Rightmove’s latest report shows that more buyers and sellers are keen to go ahead with their plans this year, it appears sellers continue to find it difficult to find a buyer.

On average, it took 71 days in December for a seller to find a buyer. This is a figure that has increased from an average of 55 days in July.

In December 2022, it took a seller 52 days to find a buyer – that’s 19 days less than Rightmove reported last month.

Difficult to sell: In December, it took an average of 71 days for a seller to find a buyer. This is a figure that has increased from an average of 55 days in July

Rightmove’s Tim Bannister added: ‘While the increased level of buyer activity we are also seeing may justify some of this increased price confidence from sellers, it is important that sellers keen to find a buyer do not get carried away with the new year . enthusiasm in setting their price expectations.

‘Increased mortgage rates and broader cost-of-living pressures continue to limit buyers’ purchasing power.

“Accurate and realistic pricing for their local area is the recipe for success for sellers looking to move in 2024, and overly optimistic pricing has been proven to make a move much less likely.”

What do brokers report?

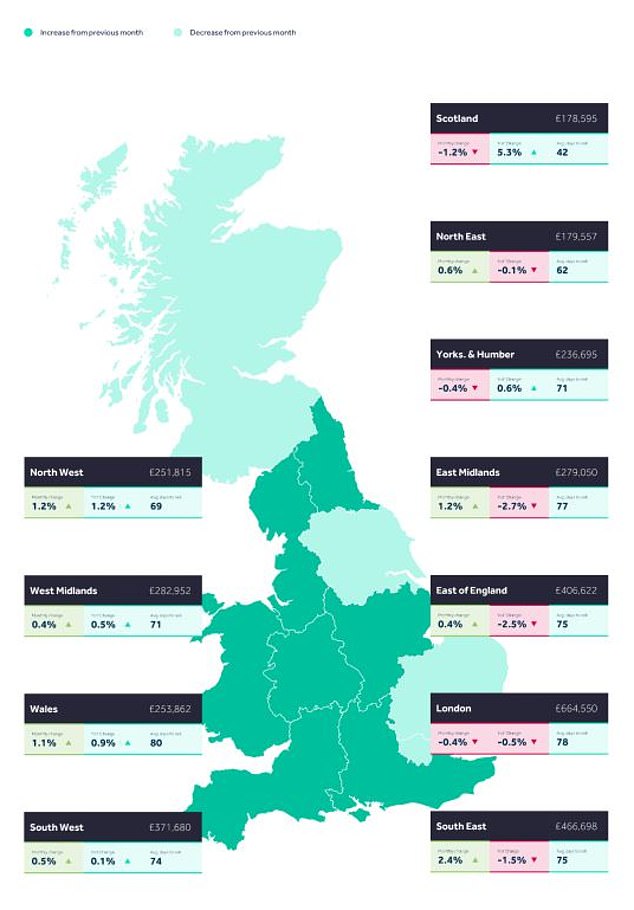

Ultimately, the real estate market consists of thousands of micro markets that will all behave differently from each other.

What happens to asking prices or sales prices in one local region may be very different from what happens in another location.

Rightmove found that prices in the south-east of England rose by 2.4 per cent in January, for example, while in Scotland they fell by 1.2 per cent.

Lower mortgage costs are causing more buyers to return to the market, according to London real estate agent Chestertons.

It says 20 percent more people started their property search in December, compared to December 2022, and 24 percent more property offers were submitted.

David Rees, research analyst at Chestertons, added: ‘Housing hunters often take advantage of the festive season to really focus on their property search and falling interest rates seemed to give buyers more confidence entering the market in December.

‘This is good news for the market, but it is important to remember that despite this rise there are still far fewer buyers than before the Bank of England started raising rates.’

Chestertons also noted that more and more homeowners are looking to sell, with the agency carrying out 15 per cent more property valuations in December than in the previous year.

Rightmove found that prices in the south-east of England rose by 2.4% in January, while in Scotland they fell by 1.2%

Chris Rowson, managing director at Sharman Quinney in Cambridgeshire, says business is going well around him.

“It’s certainly cold this time of year, but the housing market is heating up,” Rowson said. ‘We have had a promising start to the year, with some very positive signs.

‘Prospective sellers are getting their valuation appointments booked, prospective buyers are inquiring and getting their viewings booked and we are also seeing very high demand for mortgage appointments as movers try to understand their affordability and position at the start of the year.

“The most important thing is that we see offers being made, and that is a high number. It’s still early and not the time to get carried away, but we’ve had a good start.’

Paul Bayliss, director of The Square Room estate agents on the Fylde Coast in Lancashire, also says buyer confidence is improving where he is now.

‘It’s been a busy January so far, which actually follows a busy end to 2023 for us, even more so than during the summer.

‘The most important thing is mortgage rates, and with rates falling from July to early 2024, we see that buyers have become more confident.

‘We’ve seen a lot of activity from first-time buyers in the market, who are now ready to make their move early this year, and now that mortgage rates are more stable, we’re also seeing upsizers returning who are now more confident. take out a larger mortgage for a larger home.

“The market is just getting started, but we are optimistic about what 2024 can bring.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.