Premium Bond prices are being cut AGAIN… and I can predict what will happen next to savers and what they should do now: SYLVIA MORRIS

National Savings & Investments has given its 22 million Premium Bond holders a Christmas gift they don’t want.

Yesterday, the company announced another reduction in its pricing rate.

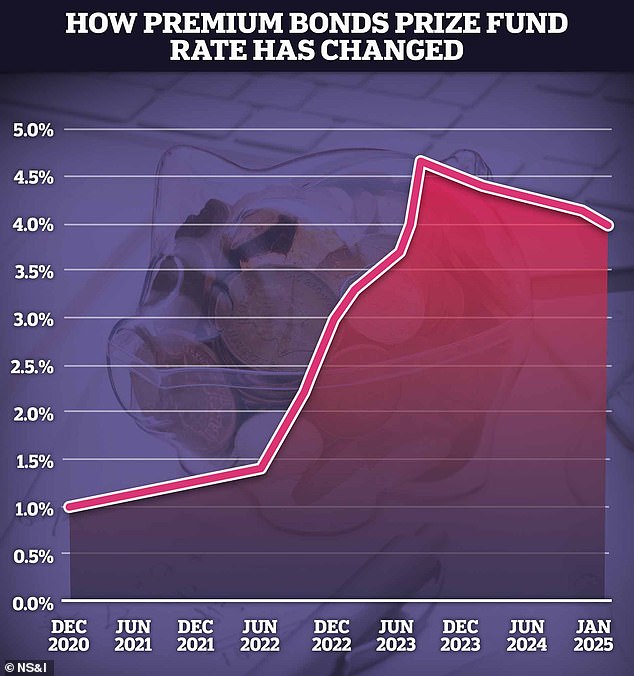

At next week’s draw (December 2), interest rates will already fall from 4.4 pct. to 4.15 pc. But from the January draw it will drop to 4pc. – the lowest level since August 2023. That is a total reduction of 0.4 percentage points in just two months.

It is also cutting rates on its easy-to-access Direct Saver and Income Bonds just five days before Christmas. These accounts are popular with retirees because they pay interest monthly.

The interest on the Direct Saver will decrease from 3.75 percent from 20 December. to 3.5 pc. Until last week he paid 4pc.

Cuts of the same magnitude await income bondholders, with interest rates falling to 3.44pc from December 20.

Andrew Westhead, retail director at NS&I, tells me the cuts follow those of other providers.

These are coming thick and fast from banks and building societies in response to the Bank of England’s two base rate cuts of 5.25pc. to 4.75 pc. since August.

These accounts are popular with retirees because they pay interest monthly

NS&I does not want to raise too much money by paying top rates for fear of not meeting the £9 billion target the government has asked for in the current financial year, which runs until the end of March next year. There is some headroom – it could be £4bn above or below the target – but without rate cuts it risks even exceeding its ceiling.

Further reductions in the base rate this year appear unlikely, which means that the NS&I rate will not fall further.

Last week we heard that the cost of living would rise to 2.3pc in the year to October. has risen, against 1.7 pc. in September. This is above the Bank of England’s target inflation target of 2 pc.

As a result, experts now believe that a further cut in the base rate (originally expected at the December 19 meeting) is unlikely. The next cut is therefore only scheduled for the meeting of the Monetary Policy Committee on February 6.

Of course, NS&I could reduce interest rates in the run-up to a new drop in the base rate, but only if NS&I notices that it is flooded with money. This could happen if other providers continue to lower their rates, making NS&I appear generous again.

Despite the cuts, Premium Bonds are still a good deal for some savers.

Their big advantage is that the prizes are tax-free, so they will appeal to savers who have used their £20,000 annual Isa allowance and their personal savings allowance, giving basic rate taxpayers their first £1,000 of interest on non-Isa accounts get without paying taxes. Higher payers will receive compensation of £500 per year, while additional payers will receive 45pc. get nothing.

Of course, they also appeal to those who enjoy having a chance to win prizes every month. The more you have, the better your chances of winning.

Down: The prize money for Premium Bonds has been cut again. From January 2025, the interest rate will be 4%, after being reduced to 4.15% last month

About two-thirds of Premium Bond holders – that’s more than 14 million savers – have never won a prize, according to a freedom of information request from financial website AJ Bell; and it is not surprising that those with smaller assets are the most likely to miss out.

The average holdings of the 5.3 million winners in the 12 months to May this year were £23,037, with four out of five winning more than once. The average holding for those who won nothing at the time was £175.

The odds of winning in the December draw increase from 21,000 to one to 22,000 to one. The odds for the January 2 draw remain 22,000 to one.

More than six million prizes were awarded this month. The number will drop to 5.726 million next month but is expected to rise to 5.89 million in January. This is because NS&I has tampered with the price levels.

There will still be two £1 million jackpots to be won, but the number of other big prizes will be reduced. Worst hit are £100 and £50, which will fall by 71,071 between December and January.

At the same time, NS&I has increased the number of smaller £25 prizes from 1,498,592 in November to 1,509,458 in December and again to 1,815,854 in January. That’s £306,396 extra prices in January compared to December.

The increase comes even as the country expects to pay out fewer prizes – £431,938,050 in January compared to £435,686,300 in December (both down from £463,982,050 this month, when prize money was 4.4pc).

Sy.morris@dailymail.co.uk

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.