Pound falls as Chancellor sees growth slowdown

The pound fell yesterday after official figures showed a surprise slowdown in growth for Chancellor Rachel Reeves, raising fears of a recession.

Sterling fell half a cent against the dollar to just above $1.26, a two-week low, after the Office for National Statistics (ONS) said gross domestic product (GDP) fell by 0. 1 percent had shrunk.

The pound sterling fell by over half a cent against the euro to just over €1.20.

The decline in monthly GDP was the second in a row and the first time since the pandemic era in 2020 for two months in a row.

It raises the risk that the economy could contract in the current fourth quarter of the year, economists said.

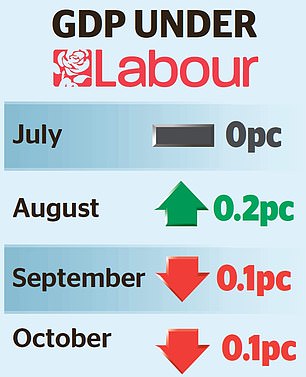

And with inflation expected to rise in coming months, fears have emerged that Britain is heading towards so-called ‘stagflation’ – a situation in which the economy stagnates while prices rise. The latest GDP figures mean the economy has grown in only one of the first four months since Labor took office – and GDP is 0.1 per cent smaller than when Reeves and Sir Keir Starmer entered Downing Street.

Battle: Latest GDP figures mean the economy has grown in only one of the first four months since Rachel Reeves and Sir Keir Starmer entered Downing Street

Still, hopes that the economy’s weakness will convince the Bank of England to implement a rate cut before Christmas at its latest policy meeting next week remain unlikely. Market expectations for a cut next Thursday have only increased marginally, from about 10 percent to 13 percent.

A survey by the Bank, which closely monitors the public’s inflation attitudes, shows that keeping inflation low remains a challenge.

The research shows that the public sees this percentage increasing to as much as 3 percent in the coming year.

That was higher than the expectation of 2.7 percent in the previous survey three months ago and the first time since August 2023.

The decline in GDP in October was widely attributed to uncertainty in the run-up to the budget, which took place at the end of that month.

But for many businesses, Reeves’ announced policies turned out to be worse than feared – especially her £25 billion raid on employers’ National Insurance.

Companies say this will likely result in fewer jobs, lower wages, higher prices and less investment. That could mean Britain deteriorates even further, experts say – as recent business surveys suggest.

Thomas Pugh, British economist at accountancy firm RSM, said: ‘With the economy now contracting for the second month in a row and inflation rising again towards 3 per cent, there is a risk that Britain is sliding into stagflation territory.’

Pugh said he expected the economy to “accelerate again in 2025” now that the budget has been passed. But Sanjay Raja, chief UK economist at Deutsche Bank, said: ‘There is likely more bad news on the horizon.

“The risk of negative quarterly growth has just increased.”

Paul Dales, chief Britain economist at Capital Economics, said the chances of a return to growth in November or December were “far from obvious”.

Isaac Stell, investment manager at Wealth Club, said: ‘As more and more companies declare they will cut back on hiring and investment to cope with rising budget-related costs, the question will be: where will the growth actually come from? ?’

DIY INVESTMENT PLATFORMS

A. J. Bell

A. J. Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund trading and investment ideas

interactive investor

interactive investor

Invest for a fixed amount from € 4.99 per month

Sax

Sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals have been chosen by our editors because we believe they are worth highlighting. This does not affect our editorial independence.