POLAR CAPITAL GLOBAL FINANCIALS TRUST: Make money from the big banks

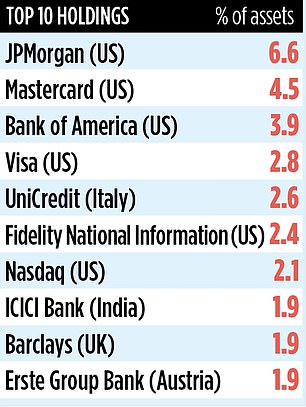

Investment confidence Polar Capital global financial services offers investors the chance to make money with some of the world’s leading financial brands – such as JPMorgan, Mastercard, Visa and Warren Buffett’s Berkshire Hathaway.

Although it is a specialist fund that should form only a small part of a diverse investment portfolio, its appeal is clear. With more than half of its assets in the US, it offers an alternative route to the country’s booming stock market.

Due to its financial focus, the company doesn’t hold any of the so-called ‘magnificent seven’ US growth stocks – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla – that have been largely responsible for pushing the US stock market ever higher.

According to the fund’s managers, the relative valuations of many US financial stocks remain attractive compared to the broader US stock market, despite a recent rally. In other words, they are relatively cheap and have the potential to increase in price.

In addition, Global Financials’ investment team believes that incoming US President Donald Trump will help create an economic and fiscal environment conducive to financially oriented companies (banks, consumer finance providers and alternative asset managers) that are doing well.

Lower corporate taxes, falling interest rates, looser banking regulation, modest inflation and an economy dodging a recession should all mean bigger revenues and profits for financial companies.

The trust, which has a market capitalization of just under £600 million, has more than half of its assets in the United States. It is run by a triumvirate of managers – Nick Brind, George Barrow and Tom Dorner – packed with experience running financial funds.

Brind says: “US equities are definitely in a good position. It now looks like the US economy will make a soft landing. If that is the case, and all the other pieces of Trump’s financial and economic puzzle come together, it will bode well for the financial sector.”

The UK listed trust has 60 equity positions plus a small exposure to fixed income equities (7 percent) and two holdings in UK unlisted companies, Atom Bank and Moneybox.

The financial shares are not homogeneous. Although the US bias dominates, the trust has a healthy collection of banks, both in Britain (such as Barclays and NatWest) and in Europe (Bank of Cyprus, Austrian bank Erste Group and acquisitive Italian UniCredit). The Indian bank ICICI is among the top 10 holding companies.

This diversity is complemented by key positions in different parts of the financial sector.

Alternative asset managers – such as US-based Ares Management (involved in private equity, credit and real estate markets) – and payment companies are microsectors that Brind and his team are positive about.

The trust’s recent performance figures are strong. Last year it generated a total return of 46 percent – higher than the average of its peer sector in financial services and financial innovation (28 percent).

However, things have not always gone smoothly. The trust suffered acutely when the pandemic brought the global economy to a near standstill in early 2020. Its size also shrank due to a plan that allowed investors to sell their shareholdings at a price close to the trust’s asset value.

A similar process will take place next June, although investor interest is unlikely to be as strong as the trust’s performance figures look better and the shares trade at just a 4 per cent discount.

The trust pays a dividend equal to 2.3 percent per annum and annual charges total 0.84 percent (source: Hargreaves Lansdown). The stock market identifier is B9XQT11 and its ticker is PCFT.

DIY INVESTMENT PLATFORMS

A. J. Bell

A. J. Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund trading and investment ideas

interactive investor

interactive investor

Invest for a fixed amount from € 4.99 per month

Sax

Sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals have been chosen by our editors because we believe they are worth highlighting. This does not affect our editorial independence.