Pain at the pump as gas prices hit the HIGHEST seasonal level in a decade: Average price stands at $3.811 a gallon

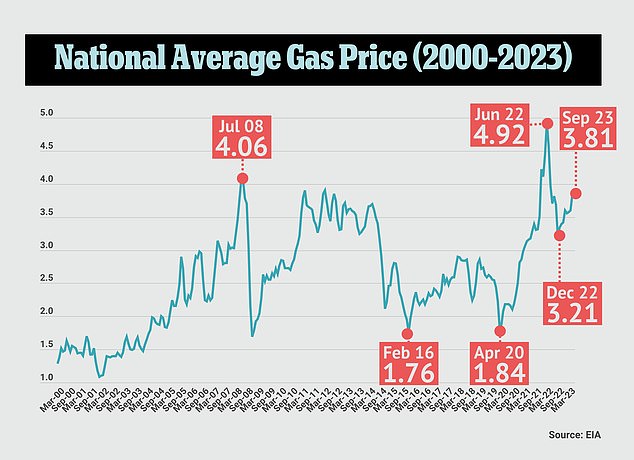

Gasoline prices are now at their highest seasonal level in more than a decade, following a surprising rally towards the end of the summer driving season.

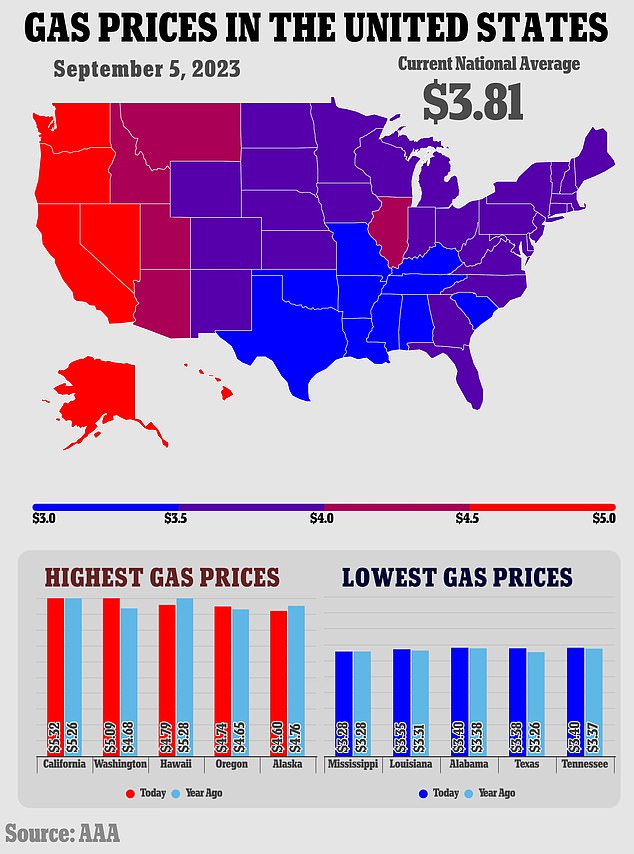

The national average for a gallon of gasoline on Sept. 5 is $3,811, according to data from the American Automobile Association, outpacing fuel costs by as much as three cents from last year around this time.

The price hasn’t been higher at this time of year since September 2012, when fuel at the pump was $3.84 a gallon amid concerns about supply disruptions from the Middle East.

This year’s seasonal high is significant because it comes at a time when gas prices generally fall as summer gives way to fall and people drive less. Plus, it comes on the heels of a surprisingly cheap summer, despite the 4th of July travel – which historically drives prices up.

An extension of production cuts by major producers Saudi Arabia and Russia on Tuesday added further pressure to already tighter global supply and appeared to have almost immediate effects.

Gas prices are now at their highest seasonal level in more than a decade, data shows – after a surprise rally towards the end of the summer driving season

A rebound in crude oil prices is believed to be one of the causes, as well as refinery problems that emerged earlier in the summer. At the same time, gasoline demand rose back to levels well above last summer, keeping national inventories largely below seasonal norms.

The decision was announced by both Riyadh and Moscow as a so-called “precautionary measure” to ensure the stability of the oil market. This week, 1.3 million barrels were withdrawn from the world market, resulting in abnormally high energy prices in the US.

Both countries are members of the Organization of the Petroleum Exporting Countries (OPEC+), which has been steadily reducing oil supplies since November.

Reasons given by Saudi coalition members for the cuts – now extended into next year – include that they are a precautionary measure aimed at “supporting the stability and balance of oil markets.”

The move almost immediately sent the price of Brent crude oil above $90 a barrel in trading on Tuesday afternoon – a price not seen since November, when the predominantly Eastern coalition’s budget cuts began.

Due to rising tensions between the Kremlin and Washington — and as countries not as connected to the West continue to push for greater autonomy — the strategy has since tightened global supply, although prices have been somewhat stagnant so far.

In July, major producer Russia — which rocked markets when it invaded neighboring Ukraine nearly two years ago — pledged to buy 500,000 barrels a day of its exports.

At a time when U.S. officials are still trying to make up for the more than 1 million barrels of fuel production per day lost during the pandemic, the loss is significant and seems to be finally making itself felt.

Another contributing factor to the higher prices is a lack of refining capacity on the US side, after production from US gasoline makers was limited over the summer.

This step is important because it comes at a time when gasoline prices are generally believed to be falling, when summer gives way to fall and driving tends to become less. A rebound in crude oil prices is believed to be one of the causes, as were refinery problems earlier this summer

The development follows a surprisingly cheap summer, despite the 4th of July and Labor Day trips – which have historically given way to higher gas prices and a more seasonal price increase. Pictured is a Mobil in LA ahead of the well-traveled Labor Day weekend

Record heat in fuel-producing hubs like Texas and Louisiana further impacted supplies after several refiners pledged to run their plants at up to 95 percent capacity in an effort to pump out more fuels despite the heat.

For an industry that had been operating at about 90 percent for more than a year, the challenge was a major one—and companies like Marathon Petroleum, the largest U.S. refinery, and the second-largest Valero Energy, eventually went under with their high bids. .

At the same time, gasoline demand rose back to levels well above last summer, keeping national inventories largely below seasonal norms since mid-July.

A higher-than-normal number of exports that month to places like Mexico — where a series of problems with its refineries and crude oil production increased the country’s need for imports — further paved the way for the rise in pump prices, which, although unusual, are still high. significantly lower than the peak average of $5 in June 2022.

Gas prices have risen steadily since then, reaching a national average of $3.86 per gallon last month.

Researchers on US gas price history probably expected some respite leading up to September, but the recent expansion from Rihyad and Moscow seemed to dash all those hopes almost immediately.

There was no immediate reaction to the decision in Washington on Tuesday, although US lawmakers have historically criticized OPEC, Saudi Arabia and Russia for their increasingly aggressive production decisions.

President Joe Biden warned the kingdom last year that there would be unspecified ‘consequences’ if it cooperated with Russia on austerity measures as the country’s invasion of Ukraine continues to rage.

That said, the White House has little control over the cost of crude oil or gasoline, and Biden, in turn, has accused the oil companies of “making a profit” during past price spikes rather than more ambitious drilling.

With gas demand at its highest level since 2020, it seems increasingly unlikely that supplies will be replenished in time for the fall – when many refiners enter the fall maintenance season – potentially paving the way for a historically costly fall as the it’s about driving.

Shrinking refinery capacity is also still a concern as more money is channeled into greener forms of fuel and transportation, such as electric vehicles.

The national average for a gallon of gasoline is $3,811, surpassing fuel costs by three cents this time last year

A series of output cuts over the past year, meanwhile, have failed to raise prices substantially amid weakened demand from China and a tighter monetary policy aimed at fighting inflation.

However, with international travel returning close to pre-pandemic levels, demand for oil is likely to continue to rise.

Above all, the Saudis want to raise oil prices to fund Vision 2030, an ambitious plan to overhaul the kingdom’s economy, reduce dependence on oil and create jobs for a young population.

The plan includes several massive infrastructure projects, including the construction of a $500 billion futuristic city called Neom.

But Saudi Arabia also needs to manage its relationship with Washington. Biden campaigned on a pledge to make powerful Crown Prince Mohammed bin Salman a “pariah” over the 2018 murder of Washington Post columnist Jamal Khashoggi.

Tensions eased somewhat in recent months as the Biden administration sought an agreement with Riyadh to diplomatically recognize Israel.

But those talks include Saudi Arabia pushing for a nuclear cooperation deal that would allow America to enrich uranium in the kingdom – something that worries nonproliferation experts as spinning centrifuges open the door to a possible weapons program.

Prince Mohammed has already said the kingdom would pursue a nuclear bomb if Iran had one, potentially sparking a nuclear arms race in the region as Tehran’s program moves ever closer to weapons-grade levels.

Saudi Arabia and Iran have eased in recent months, though the region remains tense amid wider tensions between Iran and the US.

Higher oil prices would also help Russian President Vladimir Putin finance his war against Ukraine. Western countries have used a price cap to try and limit Moscow’s revenue.

The measures taken by these countries are likely to increase costs for motorists at gas stations and put new strains on Saudi Arabia’s relationship with the United States.

Benchmark Brent crude was trading at $90 a barrel on Tuesday immediately after the announcement. Brent has largely fluctuated between $75 and $85 a barrel since October last year.