‘Our Tesla insurance is DOUBLE what we pay for our gas car!’ Married couple is shocked to discover high cost of covering electric vehicles – so why DO insurers penalize eco-drivers?

When Brent Shreve and his wife Molly bought new cars in April, they each spent about $50,000 on a Tesla Model Y for him and a Volkswagen Atlas for her.

Despite the models being virtually identical in size and costing virtually the same price, the couple was shocked to discover that insurance premiums for the Tesla were double those for the Volkswagen. Insurer State Farm quoted the couple – in their mid-30s – $78 for the gas car and $140 for its electric equivalent.

Being young, inexperienced and driving an expensive car are surefire ways to increase your insurance premium, but opting for an electric car seems to have the same effect.

DailyMail.com analyzed data from an insurance comparison site The zebra and found that in several scenarios, the estimated cost of insuring an electric car was higher than that of the gasoline alternative.

Brent Shreve and his wife Molly (pictured) live in Fishers, Indiana

The Shreves bought two similarly priced cars in April. The 2023 Volkswagen Atlas (left) cost about $46,000. The Tesla Model Y (right) cost $53,000. State Farm quoted them almost double the amount to insure the Tesla

That was a shock to Shreve. The data consultant decided to invest in an electric car after Covid, when he had the option to work from home and didn’t need the longer range of a petrol vehicle.

In turn, he decided to upgrade his wife’s car to something larger so that their two children could handle longer trips.

Shreve said he bought the Tesla for $53,000, but received a $7,500 EV tax credit for it. The Volkswagen Atlas, with an internal combustion engine, cost $46,000.

After obtaining quotes from multiple providers and negotiating with a local insurance broker in their hometown of Fishers, Indiana, the couple discovered that the best quote came from State Farm, which had insured their old cars.

“I had read on a lot of Tesla forums that people were getting high quotes,” Shreve told DailyMail.com. “I assumed it would be higher, but not double.”

According to Lynne McChristian, director of the Office of Risk Management and Insurance Research at the University of Illinois at Urbana-Champaign, there are a handful of reasons why insurers would charge more to cover an electric car.

First, insurers lack the data to properly assess the risk.

“Insurance is a data-driven business,” she told DailyMail.com. ‘Insurers have had data on expected losses from auto insurance on gasoline-powered vehicles for decades. For electronic vehicles, the data is more limited because their history is not as long.”

“As we get more electronic vehicles on the road, it is highly expected that the cost of their coverage will decrease,” she added.

But there are other reasons why the cost of EV insurance may never come down, and they have to do with the way electric cars are made and the technology inside them.

“If they are damaged, the repair costs are higher,” she said. Because electric cars have fewer parts, replacement is more expensive if one breaks. This means that insurers may prefer to write off a car over repairing it.

Unlike in the past, when a windscreen could be replaced relatively easily, the sensors inside it now mean that traditionally simple repairs have become cumbersome and expensive. This also means that it can take some time, with the insurance company remaining responsible for renting a replacement car for the customer for even longer periods.

“If an electric vehicle is involved in a car accident, it is sometimes more likely to be declared totalitarian than a gasoline-powered vehicle because the cost of that battery can be half the price of the car,” said she. “That’s where the costs come in.”

According to data from The Zebra, the average insurance cost for a Tesla is $3,000 per year, well above the national average.

And for almost every vehicle class, the estimated average insurance cost for an electric car was more expensive than that of equally expensive and capable gasoline counterparts.

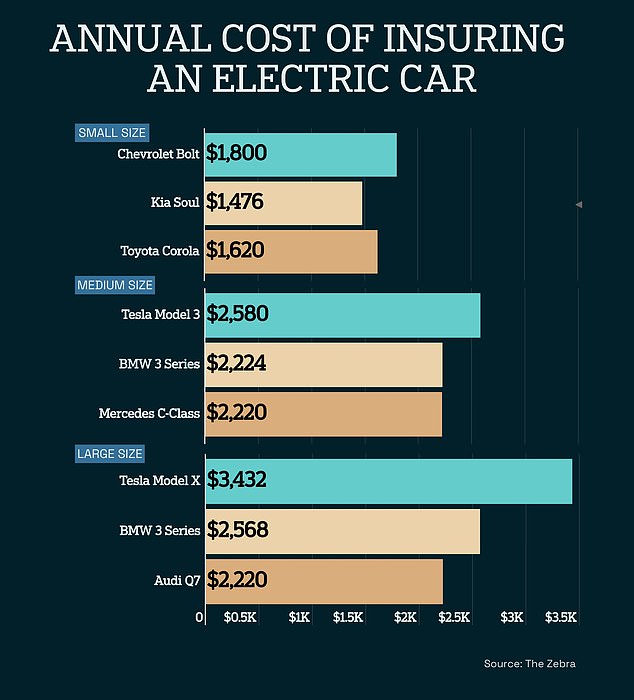

DailyMail.com analyzed data from insurance comparison site The Zebra and found that in several scenarios the estimated cost of insuring an electric car was higher than the petrol alternative

A 30-year-old single man would spend an average of $1,800 per year on full coverage to drive a Chevrolet Bolt EV. That same person would pay an average of $1,476 to insure a Kia Soul and $1,620 for a Toyota Corolla, according to The Zebra’s estimates.

A similar trend is observed for small sedans. At $2,580, a Tesla Model 3 is about 10 percent more expensive to insure than comparably priced BMW 3 Series cars and vehicles in the Mercedes C-Class range.

For larger vehicles in the small SUV class, a Tesla is again the most expensive to insure. That same 30-year-old would spend about $3,432 for full coverage to drive a Model X. For comparison, the same policy would cost $2,568 for a Mercedes GLS and $2,160 for an Audi Q7, all similarly priced vehicles.

Tesla has introduced its own insurance service, available in 12 states, and claims it has “unique visibility into vehicle, technology, safety and repair costs, eliminating the added costs of traditional insurers.”

But some owners who bought a Tesla policy complain that while they were initially offered well-priced premiums, the data collected by the car about how they drive was soon used against them.

Patrice says this data collection could be positive for all parties, as it reduces insurance costs and encourages more responsible driving behavior.

But Shreve said that even though Tesla insurance wasn’t available in his country, he wouldn’t have considered getting it on his Model Y no matter how much it cost.

“I have concerns about their data practices when it comes to privacy and everything they monitor in the car and how that could be used against you,” he said. “I would hesitate to do business with them on those grounds.”

Tesla insurance holders can be penalized for accelerating too quickly, passing too close to other vehicles and even driving after 10 p.m. Although the insurance service exists in California, state privacy laws prevent the collection of real-time driving data to determine premiums.

Shreve said that although Tesla insurance was not available in his country, he would not have considered getting it on his Model Y no matter how much it cost

While insurance costs may be significantly higher, many, including Shreve, would say the financial benefits of driving an electric car more than compensate.

The cost of electric car insurance can be partially offset by taking advantage of rebates at the local, state, and federal levels. Doing this can also save you money on gas.

This week, data from the U.S. Bureau of Labor Statistics indicated that auto insurance prices across the board rose 19 percent from last year — that’s the largest increase since 1976.

According to Patrice, this is due to the increasing frequency of expensive collisions and the cost of repairing modern cars – both electric and gas.

DailyMail.com wrote to Tesla and State Farm for comment on how it calculates insurance premiums, but did not hear back.