Oil price: UBS predicts Brent Crude will hit $110 a barrel in 2023

>

It’s been a volatile week for oil prices as investors weighed in on global growth concerns, but City forecasters say prices could soon return to levels not seen since mid-2022.

UBS analysts said on Thursday they expect Brent crude prices to recover from losses in the second half of last year to $110 a barrel by 2023 as the fallout from Ukraine’s war and ‘chronic’ underinvestment maintain capacity.

With Brent Crude oil prices hovering around $79.18/barrel at the time of writing, such an increase would be significant and likely raise concerns that energy market-driven inflationary pressures will persist for the foreseeable future.

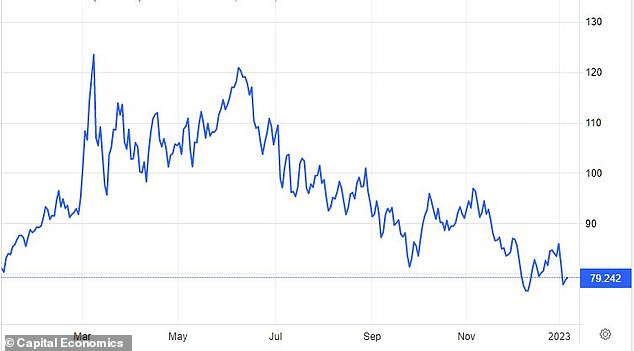

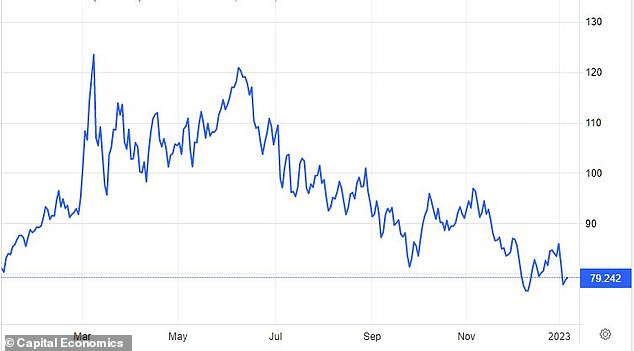

Volatile: Oil prices rose to $128 in the aftermath of Ukraine’s war, but fell rapidly in the second half of 2022

Oil prices initially came under pressure early in the week before staging a comeback as markets weighed a rapid rise in China’s Covid-19 infections with the potential for the country’s economy to fully reopen after the pandemic containment.

In a research note, UBS said it expects oil prices to continue rising through 2023.

“We continue to believe that the energy problems of 2022 – such as a diverted Russian supply and chronic underinvestment in upstream capacity – are likely to persist into 2023, and we expect crude oil prices to rise to $110/bbl this year,” it said. .

The Swiss banking giant predicts demand will be driven by Asia, with three-quarters of global demand growth coming from “emerging Asia,” which includes countries such as China, India, Indonesia and Korea.

UBS also stressed that OECD countries are replenishing their oil reserves while the EU ban on Russian imports remains in place, which will also boost demand.

UBS said: ‘This should result in strong year-over-year growth in demand, even though the near-term reopening is likely to be bumpy with occasional setbacks.’

The price of Brent Crude has fallen significantly since the March 2022 highs

Warren Patterson, Head of Commodities Strategy at ING, agrees that ‘the outlook for the oil market remains optimistic’, but he predicts a more conservative price target for Brent Crude of ‘just over $100/bbl in 2023’.

He said: ‘The change in Covid policies in China should support demand in the medium to long term, although admittedly rising Covid infections could weigh on demand in the short term.

For now, analysts seem inclined to believe oil and gas prices will fall in 2023 and 2024

Russia’s oil supply is still expected to fall due to the EU ban on Russian crude and refined products by sea. As a result, the oil market is expected to tighten from the second quarter onwards.’

However, AJ Bell’s director of investment, Russ Mold, explained that these views are not a market consensus and that “currently analysts seem inclined to believe that oil (and gas) prices will decline in 2023 and 2024.”

This is mainly because markets expect a one-third drop in operating profit for the seven oil companies in the West between 2022 and 2024, according to Mold, which equates to a drop of $120 billion (and that’s before any change in interest bills or taxes). ‘.

The projected fall in corporate profit is driven by expectations of declining demand due to a looming recession, the potential for peace in Ukraine, strong European storage levels and “the long-term trend toward renewables,” Mold said.

Brent crude oil prices rose in the first half of 2022 at the outbreak of war in Ukraine, reaching $128 a barrel in March.

But the 25 percent downward spiral of oil prices in the second half of 2022, when Brent Crude ended 2022 at about $82, has fostered optimism that inflationary pressures have peaked and will begin to normalize this year.

Last year’s energy price shocks were the main driver of global inflationary pressures and were themselves largely driven by the fallout from the war in Ukraine.

Therefore, interest rate hikes by central banks, which are designed to minimize inflation by depressing demand, are to some extent a blunt tool for addressing the underlying drivers of price increases.

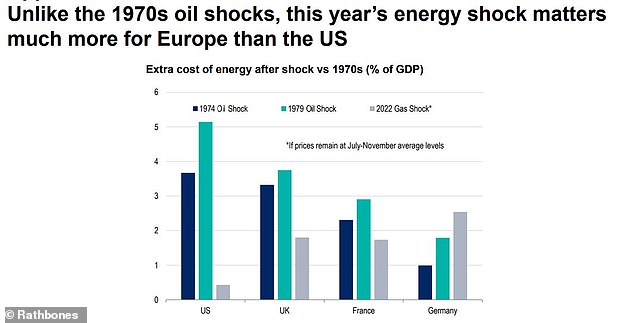

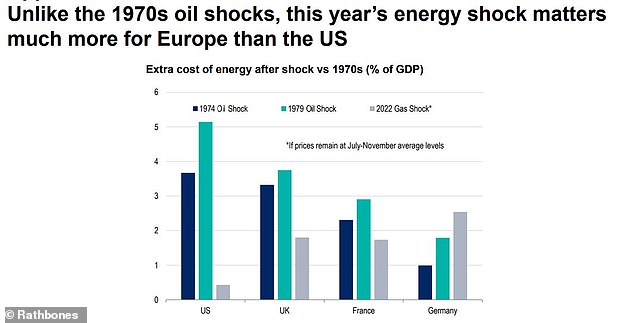

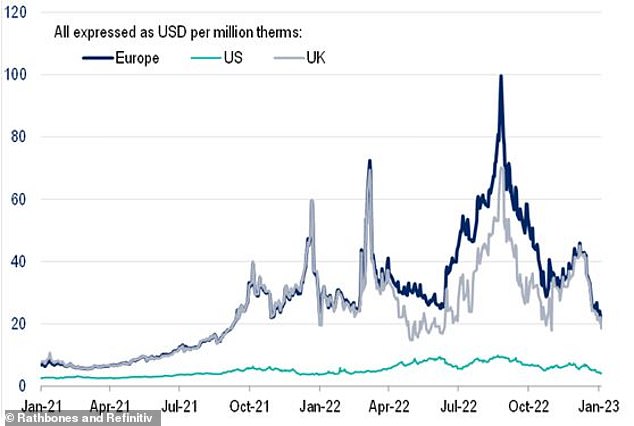

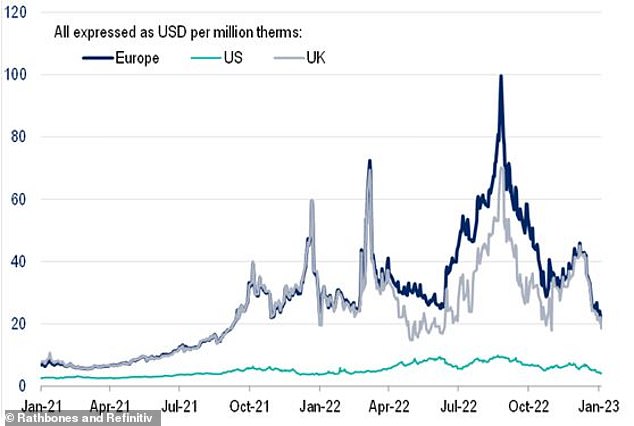

Rathbones’ data shows how the gas price shock was felt more strongly in Europe than in the US.

Extra energy costs: The US was hardest hit by oil shocks in the 1970s, but today European countries bear the brunt

A sharp increase in gas prices affects the UK and Europe more than the US

Ed Smith, co-chief investment officer, explains: “It’s not about usage intensity – about a third of Europe’s electricity generation relies on gas compared to more than half of US generation. It’s just a matter of pricing. At their peak last year, European gas prices had risen more than 14 times, while US gas prices had risen less than fourfold.

‘Because liquefaction and shipping are expensive processes, the global gas market is not fully integrated as other commodities often are. As a result, supply shocks are more regional than global.’

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and use it for free. We do not write articles to promote products. We do not allow any commercial relationship to compromise our editorial independence.