Ocado is worth almost three times its current share price, Morningstar says

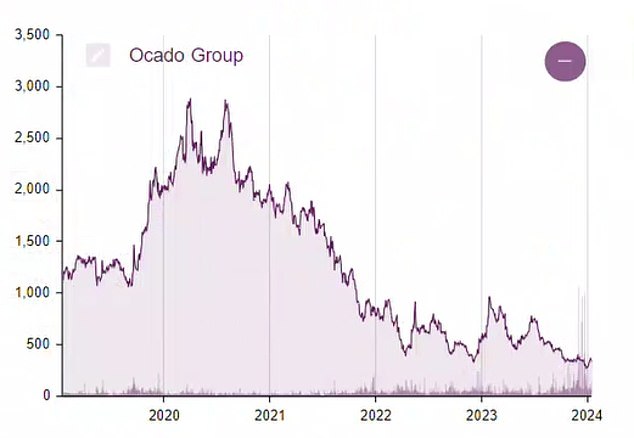

- Ocado shares have fallen almost 90% from their lockdown-induced peak

- Morningstar thinks markets are underestimating the potential growth of online grocery shopping

Morningstar analysts believe online supermarket Ocado is worth almost three times what its current share price suggests.

According to the company, the potential of the group’s technology is currently undervalued, as is the long-term growth of the online grocery market. Morningstar predicts that this growth will only increase over the next decade.

Ocado shares are down almost 90 per cent from a peak of 2,817p in September 2020, caused by the lockdown, amid concerns over its joint venture with Marks & Spencer and delays in the rollout of its warehouse robotics technology to third-party retailers globally.

Investors in Ocado received a boost on Wednesday after the company reported smaller losses

Shares rose double-digits this week after Ocado reported a narrower loss and raised its forecast for its robotic warehouse division. CEO Tim Steiner urged investors to remain confident in the company’s strategy.

Morningstar currently stands at 356.3p and has backed Steiner’s strategy with an Ocado price target of 920p.

Michael Field, European equity strategist at Morningstar, said: ‘Some investors might expect equities to rise after a nearly 15 percent rise, but we think there is much more to this story.’

The rating is a vote of confidence for Ocado, shortly after it lost the support of brokers Bernstein in what was seen as the “final rally” for the group’s shares.

The investment bank downgraded its rating to ‘underperform’ from ‘outperform’ and cut its price target to 260p from 1,000p.

“The story of tomorrow with jam is less jam now, more tomorrow,” the analysts said. They warned that the next three years could be tough for Ocado as online sales fail to recover after the pandemic, automated warehouses struggle to meet expectations and retailer partnerships prove tricky.

The company added: ‘We question whether the cultural fit of a successful technology company like Ocado sits well with slow, traditional supermarkets.’

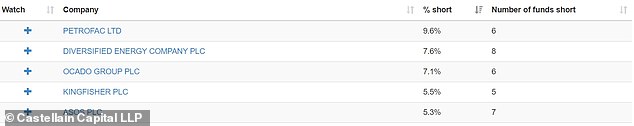

Ocado is one of the most shorted stocks on the UK market

Bernstein now questions whether the public market is the “right place for Ocado”. He said the best option was for Ocado to be acquired by US retailer Kroger.

Ocado is the third most shorted stock on the UK market, according to data from regulators, with investors owning 7.1 percent of the shares betting against the company.

However, Morningstar believes Ocado’s fair value is much higher, given the potential long-term growth of online sales as a percentage of the broader online grocery market, which Morningstar estimates will reach 25 percent by 2040.

According to research agency Mintel, online sales accounted for 13.1 percent of the total market share in the British supermarket sector last year.

According to Morningstar’s Field, this would “generate strong growth for both Ocado’s retail and technology solutions businesses”, with the group’s share of the online market growing to between 8 and 10 percent.

He told This is Money: ‘Most of the revenue and profit assumptions we’re talking about here are set in the distant future.

‘The market currently thinks that the technology solutions sector will grow by 15 to 20 percent (per year), depending on how optimistic analysts are. However, we think it is about 25 percent growth.

‘That doesn’t sound like much difference, but a 10 percent difference in growth… over such a long period of time, the picture changes completely.’

According to research agency Mintel, online sales accounted for 13.1 percent of the total market share in the British supermarket sector last year.

Field added that Ocado’s share peaks in 2020 and 2021 were driven by market estimates that online’s share of the grocery market would reach 80% and stay there. That seems “almost fanciful” compared to current estimates.

He added: ‘Some people think that the market share will be relatively minimal, even until 2040, but we don’t think that’s right either. It’s nonsense that no one will be online anymore and it’s also nonsense that 80 percent of people will be online.

‘But Ocado remains a leader in technology solutions. The company continues to develop technology that people need if they want to automate things like checkout and infrastructure. It remains a leader in that area too.

‘Ocado has generated significant revenues and significant sales growth in that sector in recent years.’

Ocado shares have fallen sharply since their peak and remain volatile

DIY INVESTMENT PLATFORMS

AJ-Bel

AJ-Bel

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive investor

interactive investor

Fixed investment costs from £4.99 per month

eToro

eToro

Stock Investing: 30+ Million Community

Trading 212

Trading 212

Free stock trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals are chosen by our editorial team because we think they are worth highlighting. This does not affect our editorial independence.