NOMURA INDIA EQUITY FUND: A crossing to India that can provide you with attractive returns for years to come

“Guess which equity markets will perform best over one, three, five, seven, 20 and 30 years?” asks Vipul Mehta, manager of Nomura India Equity Fund, expectantly.

Without an answer (do you know?), Mehta reveals: ‘The US and India. The two markets are taking turns being number one and number two. Yet India has not yet got the recognition it deserves.’

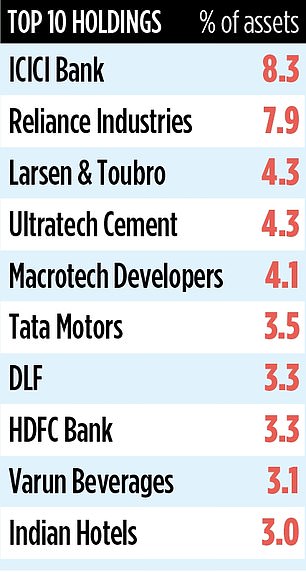

The Nomura fund has invested in a carefully selected portfolio of 25-35 Indian companies since its inception in 2017. These companies include Indian heavyweights ICICI Bank, Reliance Industries and Tata Motors.

The portfolio is selected across sectors and includes in-depth analysis and visits to Indian companies to assess their prospects.

By the end of May, assets under management had grown to around $1,876.9 million, with a £100 investment turning into £156 in three years, compared with £149 for the average Indian fund.

And while the Indian market has delivered 8 percent compound returns over the past 30 years, Mehta is confident in dollar terms that there is much more to come. “If everything goes well globally and locally, I think India will grow by 7 percent,” he says.

‘But if everything goes wrong, we will probably grow at 5 percent. But if we assume that growth is 6 percent a year for the next five years – and I see no reason why it wouldn’t – India will become the third largest economy by the end of 2027 – overtaking Germany and Japan.’

Mehta is aware that obstacles loom, but he says there are big factors that can further boost momentum.

The first is the young population. India has a population of 1.4 billion with an average age of 30. That continues to drive growth in productivity, consumption and all activity.

However, Mehta adds that the risk is the six to seven million people who enter the labour market every year and that it is necessary to create jobs for them. “If that does not happen, it results in social insecurity or disruption,” he says.

The second driver is the amount of money spent on infrastructure. “There are now 160 airports and many cities are building metros,” says Mehta.

And thirdly, there is a strong emphasis on production and export.

Mehta points to a recent Made in India campaign. Defence and trains are made in India, with some production moving from China to the country.

The combination of recent growth and further potential is making domestic and international investors aware of the opportunities to invest in India.

Still, Mehta sees opportunities. “Valuations are expensive, but they are not in bubble territory and I don’t see any reason for a collapse,” he says.

Even the results of the Indian elections could not dampen Mehta’s optimism, with Narendra Modi of the BJP party returning for a third term as prime minister.

However, his previous majority shrank and his party formed a coalition with two allies.

The Indian stock market fell 7 percent on the news, but recovered most of its losses as the coalition was formed. “Markets fell because there was an overwhelming expectation,” Mehta said.

“There doesn’t appear to be any threat to the government’s survival over the next five years and to Modi as prime minister – unless he hands over the baton.” The fund has a running fee of 0.93 percent.

DIY INVESTMENT PLATFORMS

AJ-Bel

AJ-Bel

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive investor

interactive investor

Fixed investment costs from £4.99 per month

eToro

eToro

Stock Investing: 30+ Million Community

Trading 212

Trading 212

Free stock trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals are chosen by our editorial team because we think they are worth highlighting. This does not affect our editorial independence.