Nikkei last reached its highest level in 1989, when Japan shook off 34 years of stagnation

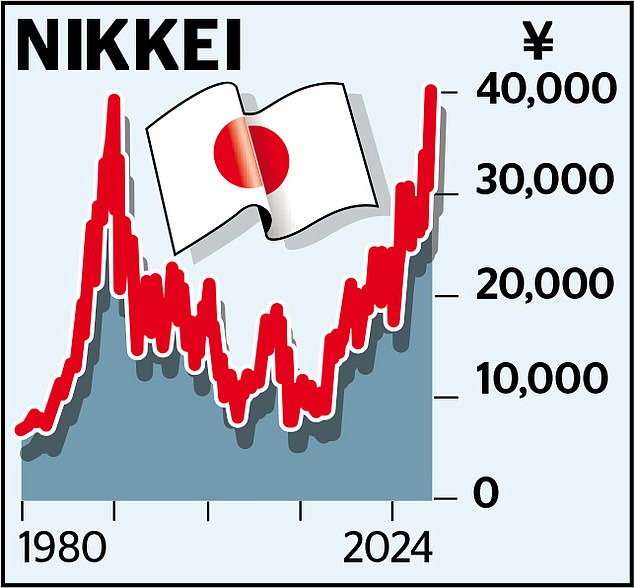

At the end of 1989, Japan’s Nikkei 225 index reached a record high of 38,915.87, amid great euphoria.

However, 34 years of crises, natural disasters, deflation – and a decline of almost 80 percent in the index – followed.

But last week, accompanied by much joy, the Nikkei finally reached 1989 levels, jumping to 39,239.

This recovery was driven by the global boom in semiconductor stocks, but also by a wide range of other more fundamental factors.

These include broker Nomura’s prediction that if America elects Donald Trump as president in November, there will be further disruption to US-China relations. The beneficiaries would be companies that sell more to America than to China, such as carmaker Subaru and noodle specialist Toyo Suisan. The ramen noodles are a favorite among Americans on a budget looking for something tasty.

Majestic: Accompanied by much joy, the Nikkei finally regained its 1989 level, jumping to 39,239

Does the Japanese market offer something similarly attractive for those looking for diversification? After all, according to one prediction, the Nikkei could go to 42,000. This prediction has raised eyebrows among those who have waited more than thirty years for the index to recover. But Joe Bauernfreund, manager of the AVI Japan Opportunity Trust, says there are reasons to believe “this time it’s different.”

He says: ‘The market is not driven by unsustainably high valuations. It’s the profits and the corporate reforms. I think we are in the early stages of the revival – and there are more benefits to come. There is tremendous opportunity in overlooked small-cap stocks.”

These major reforms include the ‘Abenomics’ stimulus initiatives, introduced by the late Prime Minister Shinzo Abe, and the new regulations on the Tokyo Stock Exchange, aimed at healing the hardened corporate culture.

Under the rules, which have been described by Goldman Sachs as “a game changer,” companies must use reserve cash for the benefit of shareholders. This should ensure that there are fewer companies whose stock market valuation is below the book value of their assets

These governance changes – which Goldman Sachs analysts say could mark a “transformational” year for the Japanese market – have been accompanied by shifts in attitudes.

Prime Minister Fumio Kishida is promoting “a new capitalism,” in which there is less aversion to takeovers and workers are expected to earn more regular raises. In June last year, as the Nikkei was on the rise, I overcame my reservations and invested in two Japanese funds: AVI Japan Opportunity and Vanguard Japan ETF (exchange traded fund).

Part of my inspiration for this came from Berkshire Hathaway boss Warren Buffett’s decision to put money into Itochu, Marubeni Mitsubishi, Mitsui and Sumitomo.

But even Buffett’s belief in Japan’s potential is almost muted compared to the optimism expressed by giants like BlackRock, the world’s largest fund manager.

Confidence has grown so much that international investors spent £10.5 billion on Japanese shares in January.

The country’s famously frugal citizens have also preferred cash to stocks, despite negative interest rates. This policy could finally end this month, as part of Japan’s normalization process. But Kishida hopes to lure these reluctant investors into the stock market with the new Nisa (Nippon Individual Savings Account), a system based on the British Isa.

If you think Japan deserves a place in your Isa, it’s worth doing some homework on the intricacies of the stock markets. For example, the Nikkei is possibly the most followed index. But its composition is based on the price of shares, not company size.

As a result of this bizarre arrangement, car giant Toyota, the country’s largest company, makes up 1.1 percent of the index. Number one is the much smaller Fast Retailing group, owner of the Uniqlo chain.

These and other complexities mean that I will not put my money directly into stocks, but into funds, especially those that focus on digitalization, such as Japan Jupiter Income, one of Bestinvest’s top picks. Other best buy funds include Baillie Gifford Shin Nippon, which focuses on smaller companies, and Man GLG Japan Core Alpha for the adventurous.

In 1989, Sony, founded in 1946 in Tokyo, was at the forefront of innovation.

In this century it was replaced by Apple, founded in 1976.

I bet Japan will make up for lost time.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.