Nightmare before Christmas! Ohio woman reveals how scammers drained her bank account of $5,000 in cruel ‘check washing’ con just days before the holidays

An Ohio woman has revealed how a cruel scammer stole a check she had put in the mail and then used it empty her account a few days earlier Christmas.

Carole Wesolowski had $5,000 withdrawn from her checking account after a woman tricked bank branch staff into cashing the check with a fake ID that had Carole's name on it but the crook's photo.

The astonishing moment was even captured by the company's security camera. Although the suspect is clearly visible in the images, she has yet to be caught.

Wesolowski and her husband, from Maumee, Ohio, had mailed a check earlier this month, which they believe was then stolen by the thief.

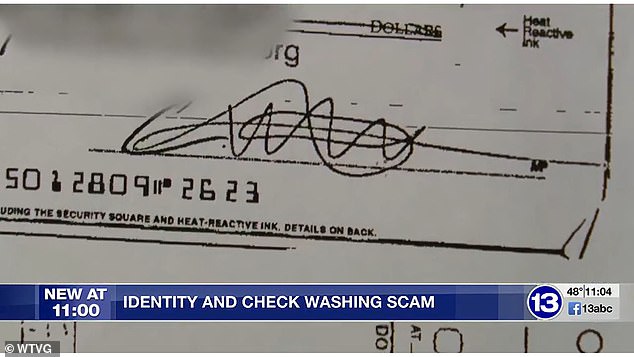

The woman then allegedly adjusted the check to a larger amount – as part of a scam known as 'check washing'.

Carole Wesolowski had $5,000 taken from her on December 20 after a woman managed to steal her identity and trick bank branch staff into giving her access to the account

Wesolowski and her husband, from Maumee, Ohio, had sent a check through a driveway mailbox earlier this month – which they believe was then stolen by the thief.

The suspect, pictured, then allegedly forged the check – as part of a scam known as 'check washing' – and used the details to create a fake ID and withdraw money from the account her victim at the bank.

The criminal then cashed the altered check and took money from her victim's account at the bank. Although checks can be deposited into bank accounts, it is also possible for the person cashing them to simply withdraw the amount in bank notes – as the criminal did in this case.

Wesolowski was not informed of what had happened until she received a letter from her bank about the check on December 20. After a fight she got the money back.

She said WTVG: 'They have her on camera cashing this check, she also has a fake ID with my information on it, but her photo. She withdrew $5,000 from our checking account.

“Once they receive your check, they'll have your name, your address, and then your checking account information at the bottom. And they can get so much more information about you.”

She added that the incident had left her 'violent'.

Fortunately, Wesolowski's daughter works at the bank who was able to view the security footage.

She had recently watched a WTVG report on serial identity fraud and told her stepmother that she believed it was the same woman who had stolen her identity.

Wesolowski then reported the incident to the police and was able to get her money back – although the suspect has still not been caught.

Americans are urged to be on high alert for cases of check fraud. Earlier this year, the government's Financial Crimes Enforcement Network (FinCEN) warned that check fraud cases nearly doubled from 350,000 to 680,000 between 2021 and 2022.

Officials said there have been reports of thieves attacking postal workers or stealing their dart keys, which are the master keys used to open boxes.

Scammers then engage in the “check washing” scam, where they scrub away some details using simple tools like nail polish remover, but leave the signature untouched.

They can then add their own details to the cheque, change the amount and deposit it. Some of these controls are even shared between scammers on the dark web.

John Ravita, director of business development at SQN Banking Systems, recently told the New York Times: 'You can buy checks on the Internet for $45, with an excellent signature.

'There is one website that offers a money-back guarantee. It's like Nordstrom.'

The suspect, pictured, bears a resemblance to a scammer who Oregon police say targeted at least five banks using a fake passport and stolen Social Security numbers.

The suspect, pictured, bears a resemblance to a scammer who Oregon police say targeted at least five banks using a fake passport and stolen Social Security numbers.

Americans are urged to be on high alert for cases of check fraud. Earlier this year, the government's Financial Crimes Enforcement Network (FinCEN) warned that the number of check fraud cases has almost doubled from 350,000 to 680,000 between 2021 and 2022

Wesolowski and her husband say they now take better precautions when sending checks — such as writing on them with a sharp pen because they become more difficult to wash.

They also hand the check to postal workers at the post office instead of using a drive-by box and just putting their name on it – instead of the entire address.

It comes after Oregon police raised the alarm over an apparent identity theft that bears a striking resemblance to Wesolowski's attacker.

The woman is said to have attacked at least five banks with a fake passport and stolen social security numbers.

Investigators said she may not have been working alone and that she got into the passenger side of a black Honda Civic.

Anyone who believes they know the suspect is asked to contact them Oregon Police.