Nifty Midcap 150 rises as profits and market cap double in 5 years

Illustration: Binay Sinha

According to a study by Mirae Asset, the mid- and small-cap segments have been outstanding over the past five years, consistently outperforming the large-cap index. They have delivered impressive returns of 30% and 31% respectively, compared to a compound annual growth rate (CAGR) of 18% for large-caps.

“The Nifty Midcap 150 index has seen a substantial 207% post-tax growth in earnings to Rs 2.05 lakh crore from June 2019 to June 2024, while its market capitalisation has grown 360% to Rs 82.5 lakh crore. This period has also seen significant diversification with over 240 significant IPOs, collectively accounting for over $1 billion in market capitalisation,” Mirae Asset noted.

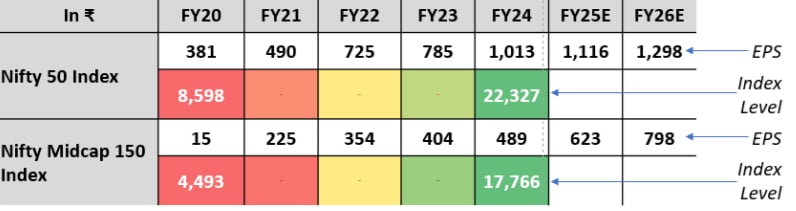

The mid-cap segment has shown exceptional earnings growth, outperforming the large-cap index.

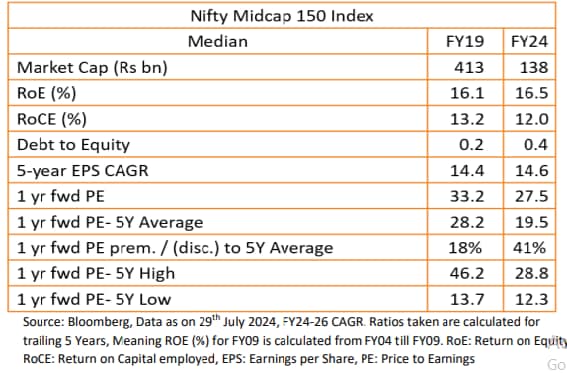

The Nifty Midcap 150 Index has also reported a massive 138% rise in earnings per share (EPS) over the last four years, from Rs 15 in FY20 to Rs 489 in FY24. This growth is expected to continue, with an estimated EPS growth of 28% projected for FY24 to FY26. In contrast, the Nifty 50 Index is expected to grow at a slower pace of 13% over the same period.

This disparity in earnings growth highlights the superior performance of mid-cap companies and their potential for further value creation. While valuations have risen in the mid-cap space, underlying earnings strength provides a cushion and suggests opportunities for long-term investors, according to Mirae Asset.

This growth is attributed to several factors:

IPO boom: More than 240 new mid-cap companies have entered the market through IPOs, increasing market depth and diversity.

Improved macroeconomic environment: Strong economic growth, combined with supportive government policies, has created a favorable environment for mid-cap companies.

Improvements in corporate governance: IImproved corporate practices and balance sheets have increased investor confidence.

These factors have collectively led to a significant revaluation of mid-cap valuations, making it an attractive investment proposition. However, it is essential to note that while valuations have increased, underlying earnings growth also justifies some of this increase.

From trading at a discount to large caps, mid caps now command a premium. While some of this valuation increase has been justified by strong earnings growth, factors such as liquidity and investor sentiment have also played a role.

Key factors driving valuation expansion:

- Improved profitMid-cap companies have shown robust earnings growth, outperforming large-cap companies.

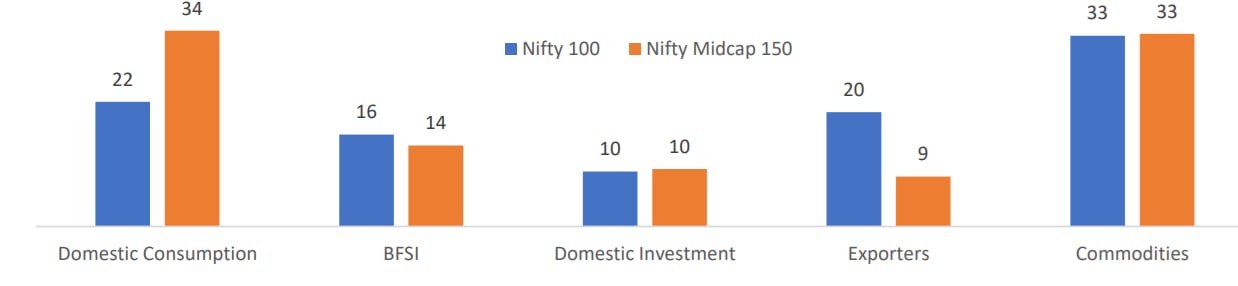

- Domestic focus: Midcaps tend to be more exposed to the domestic economy and thus benefit from India’s growth.

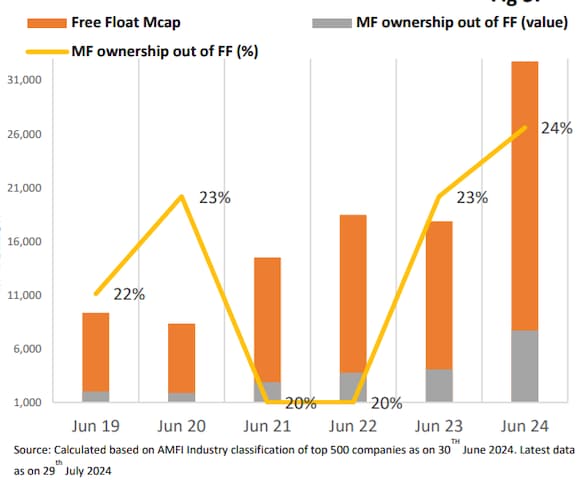

- Growing interest from investors:The growing investment in mutual funds and the increased market capitalization of freely tradable shares reflect the increased confidence of investors.

As you can see in the chart below, mid-caps tend to derive a higher portion of their revenue from domestic demand factors (~58% for midcaps vs. 47% for largecaps). This means that midcap names are more domestically oriented, while largecap names are more internationally oriented.

Income composition for FY24 (in %)

Another measure of market capitalization is the Free float (FF) market capitalization, which indicates the value of listed stocks. It has quadrupled from June 2019 to June 2024. Moreover, the Mutual Fund’s share of the FF market capitalization has increased from 22% to 24% during the same period.

“The overall earnings outlook remains resilient, led by favorable macros coupled with improving micros across sectors. The good part is that earnings growth is broad-based rather than being driven by specific sectors as was the case in the past. In that context, while valuations are still high relative to the past, there are ample opportunities available in consumer discretionary, healthcare, financials, real estate and industrial consumables sectors,” the study said.

The Nifty Midcap 150 Index has grown 138% in earnings over the last 4 years (₹15 in FY20 to ₹489 in FY24). It is expected to grow 28% (FY24 to FY26e), during the same period the Nifty 50 Index is expected to grow 13%.

Despite high valuations, the mid-cap space offers growth opportunities across sectors such as consumer discretionary, healthcare, financials and industrials. While caution is warranted, the long-term growth potential of the Indian economy supports a positive outlook for mid-caps.

However, it is crucial to take a selective approach and focus on quality companies with strong fundamentals.

First publication: Aug 13, 2024 | 08:08 AM IST