New Yorkers with ‘middle class’ $5M homes in the Hamptons slash selling prices by as much as 28% to get rid of ‘unjustifiable’ luxury vacation homes

The Hamptons “middle class,” made up of New Yorkers with somewhat modest multimillion-dollar second homes in the East, have lowered their asking prices by nearly 30 percent in an effort to sell their homes.

Due to rising interest rates and the need to be in the city more often after the pandemic, many mid-sized Hamptons staycationers who own properties up to $5 million are trying to sell their homes at discounted prices.

In some cases, owners have lowered their asking prices in Sag Harbor and Amagansett by hundreds of thousands of dollars.

An officer told the police NYPost that prices for houses at the lower end of the spectrum are falling. They said, ‘We’re not talking about the ultra-rich here; these people are subject to economic norms.

The price of this Sag Harbor property, which is currently on the market for $2,395,000, has dropped a total of 28 percent since March 2023

‘When it comes to owning a holiday home, it’s just not that easy to justify the cost.’

The sudden uptick is believed to be linked to highs during the pandemic, when buyers paid double for homes in the east, which have now stabilized.

Without widespread work-from-home rules and people forced to return to the city office, many are struggling with their second home to justify keeping it.

The source said, “I know a lot of people who are turning their remote offices in the Hamptons back into bedrooms and putting them on the market.”

According to Zillow, the price of one property in Sag Harbor, currently for sale for $2,395,000, has dropped a total of 28 percent since March 2023.

Before that, the six-bedroom, six-bathroom Hamptons home with its own private pool was on the market for $2,750,000.

Located in picturesque Sag Harbor, the home is described as “a unique investment opportunity” for a buyer willing to give it “some tender loving care.”

There is a spacious 3,285-square-foot main house with five bedrooms and three and a half baths, as well as a private one-bedroom, one-bathroom entrance for visiting guests.

The entry on Zillow says, ‘On warm summer days, take a dip in the inviting flint pool, shoot some hoops, or enjoy the man-made docked beach that is the gateway to Long Beach and its breathtaking sunsets on Peconic Bay.

‘This is a golden opportunity. With a proven track record of generating income from both long and short term rentals, this complex offers incredible potential.”

Despite the significant cuts, the house is still on the market.

Similarly, in luxurious Amagansett, New York, the asking price of a three-bedroom home was reduced by 23 percent in the past month alone.

On October 1, the beautiful property was on the market for $1,795,000, but this was reduced to $1,395,000 on October 24.

This Sag Harbor property is currently for sale for $2,800,000, which is a 12.5 percent drop from the asking price since the summer

On August 18, this house was for sale for $5,700,000, but that was lowered a month later in September to $4,995,000, a drop of 12.4 percent

The beach cottage offers water views of Napeague Bay in Lazy Point, Amagansett’s hidden gem.

Buyers can enjoy “majestic sunsets and spectacular sunrises with views as far as the Connecticut coast from this charming home that exudes peace and tranquility from a bygone era.”

The mention adds, “The home is equipped with three bedrooms, a full house generator and central air conditioning and sits on a picturesque 0.38 acre double lot.”

Another home in Amagansett has significantly lowered its asking price in recent months in an effort to get off the market.

On August 18, it was listed at $5,700,000, but that was lowered to $4,995,000 a month later in September, a decline of 12.4 percent.

Located on a quiet private cul-de-sac, the five-bedroom, seven-bathroom property is just steps from the ocean beaches.

There is an 18′ cathedral ceiling in the living room and a double-sided gas fireplace shared with the dining room – set on a lush private property with a 20 x 40′ gunite pool.

In luxurious Amagansett, New York, the asking price of this three-bedroom home was reduced by 23 percent in the past month alone. On October 1, the beautiful property was listed at $1,795,000, but this was reduced to $1,395,000 on October 24

This waterfront property in Sag Harbor, the price fell 23.9 percent since October last year – and it’s still on the market

On September 7, another typical Sag Harbor home was listed for $3,200,000, but within six weeks the asking price dropped 12.5 percent to $2,800,000.

Zillow described it as having “classic charm and modern convenience,” including an open floor plan, high-end appliances and four bedrooms.

Outside, it has a ‘beautifully landscaped rear garden with a spacious terrace overlooking the heated swimming pool.’

This emerging trend comes after a former Oppenheimer analyst, dubbed the “Oracle of Wall Street,” predicted that home prices will fall for the first time in a decade.

Meredith Whitney is known for sending an accurate investigative report that raised the alarm about the risks Citigroup faced before the financial crisis.

But as warning bells sound again about the health of the US economy, Whitney told Insider she was not worried about another recession thanks to robust consumer spending, which was boosted by low unemployment rates.

Instead, she is focusing on U.S. home prices, which she expects will fall for the first time in more than a decade. It marks a stark reversal of a pandemic-inspired trend that has seen house prices rise 42 percent since March 2020, according to CoreLogic.

She predicts that Pennsylvania, Connecticut, New Jersey and Illinois are most at risk of falling prices due to migration trends.

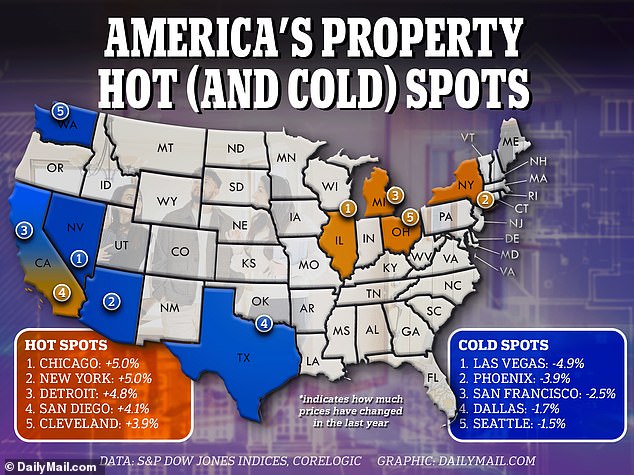

These are the five cities where home prices have risen the most, and the five where they’ve fallen the most, according to the S&P CoreLogic Case-Shiller US National Home Price Index

Texas could do much better, though — after a huge influx of California residents migrated there in search of a cheaper cost of living.

She said, “This is state specific. And so I expected this to happen. With over ten years – twelve years – of data, I can now look at it and know that it did indeed happen and it is still happening.”

But trends in the current climate have shown otherwise.

US home prices rose for the seventh straight month in August, reaching a record high, according to new data.

Prices rose 0.9 percent in August from the previous month, according to the S&P CoreLogic Case-Shiller US National Home Price Index – the main measure of US home prices.

It means properties are up 2.6 percent year-over-year, Case-Shiller data shows.

Mortgage rates are at their highest level in decades, with the average 30-year fixed rate hovering around 7.79 percent, according to government-backed lender Freddie Mac.

Rising mortgage rates and historically low inventories have continued to push up home prices in most of the nation’s 20 largest cities.

According to Case-Shiller’s 20-city composite, 12 cities saw average home prices increase in the year ending August 2023 compared to the year ending July 2023, while seven cities saw prices decrease and one remained unchanged.