New migration rule will open the floodgates to even more people in Australia – and could make it harder for young Aussies to buy a house

Young Australians could soon face even tougher competition to buy a house or apartment under new rules making it easier and faster for businesses to recruit skilled migrants on six-figure salaries.

A record 454,400 migrants moved to Australia, on a net basis, in the year to March, despite a severe housing shortage in the country.

This means Australia would need at least 181,760 new homes to accommodate the influx of skilled migrants and international students, based on an average household of 2.5 people.

Despite a rental and housing affordability crisis, the federal government shows no sign of wanting to slow the rapid pace of Australia’s population growth, which is on track to reach levels not seen since the post-war 1950s.

Home Secretary Clare O’Neil wants to streamline the process of recruiting companies from overseas to fill skills shortages, with the unemployment rate still low at 3.7 per cent.

Labor’s migration review is seriously considering changes so that skilled visas are processed within weeks rather than months.

Young Australians could soon face even tougher competition to buy a house or apartment under new rules making it easier and faster for businesses to recruit skilled migrants on six-figure salaries (pictured: A sale to auction in Sydney).

They might also be able to recruit highly skilled migrants with salaries of $120,000 or more, said the companies consulted on the potential changes. The Australian Financial Review.

The minister’s office declined to comment, with the final migration strategy expected at the end of 2023.

Australians with an average full-time salary of $95,581 are already unable to afford a median-priced apartment in Sydney worth $822,145 because banks are unable to lend to anyone more than six times their salary.

Sydney’s median house price is so high, at $1,359,936, that it is unattainable unless someone with a large 20 per cent deposit of $271,987 – borrowing almost 1, $1 million – earns no more than $180,000 a year to be among the top four percent of earners.

The situation is now so bad that AMP chief economist Shane Oliver is calling on the federal government to cut net overseas immigration in half, to 200,000 a year – from the current 400,000 – so that the housing supply can keep up with population growth.

“Current immigration levels far exceed the capacity of the housing sector to provide sufficient housing, exacerbating a severe housing shortage and low house prices,” he said.

“The role of high immigration levels cannot be ignored.

‘There has been much discussion about the low cost of housing in Australia for years, but debate about how immigration contributes to this problem is often absent.

“For a country with abundant land, it is ironic that housing affordability is so low.”

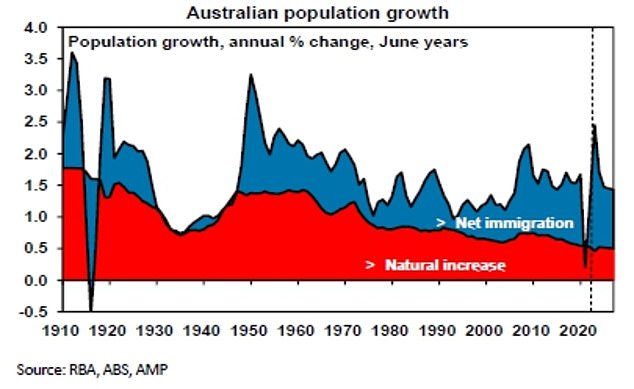

Australia’s population growth rate of 2.2 percent is already among the highest in the developed world, behind Canada and Singapore.

But Dr Oliver said Australia’s net level of overseas migration, covering permanent and long-term arrivals, was likely to exceed 500,000 and push the population growth rate up to 2.5 per cent .

“This would bring population growth to 2.5 percent in 2022-2023, the fastest growth since the 1950s,” he said.

Dr Oliver said the construction industry had been able to deliver 200,000 new homes per year, on average, in the five years to 2022, and argued that net annual overseas immigration should match closely at this level.

A record 454,400 migrants moved to Australia, on a net basis, in the year to March, despite a severe housing shortage in the country (pictured, Boxing Day crowds in the mall Pitt Street (Sydney)

Despite a rental and housing affordability crisis, the federal government shows no sign of wanting to slow Australia’s rapid rate of population growth, which is on track to reach levels not seen since post- war of the 1950s.

He predicted Australia’s housing deficit could reach 165,000 by mid-2024, but could further increase to 285,000 due to smaller household sizes since the pandemic.

The apartment building boom of the late 2010s had solved a severe housing shortage, but the reopening of Australia’s border to immigration in late 2021 has reignited the housing crisis.

Sydney’s median house price is more than 13 times the average salary, while in the US and UK “five” is a more common debt-to-income ratio, research from the American reflection on housing Demographia.